PHOTO

Manama, Kingdom of Bahrain – The Central Bank of Bahrain’s (CBB) Board of Directors held its first meeting for the year 2023, chaired by Mr. Hassan Khalifa Al Jalahma on Sunday, 19 March 2023.

The Board reviewed the topics on the agenda and approved the CBB’s annual report and audited financial statements for the year 2022, in addition to reviewing the CBB’s activities for 2022.

In addition, the board reviewed the main economic indicators for the year 2022 and noted the real economic growth during the third quarter of 2022 which reached 4.2% compared with the same period of the year 2021. Furthermore, consumer price index registered and increase of 3.6% in 2022 compared with 2021. As for the balance of payments, current account surplus increased remarkably from BD 978.5 million in 2021 to BD 2571.3 million in 2022.

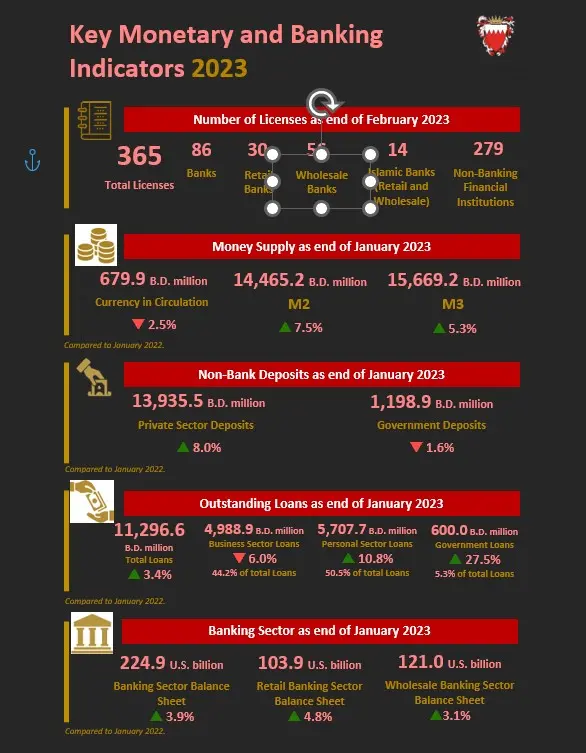

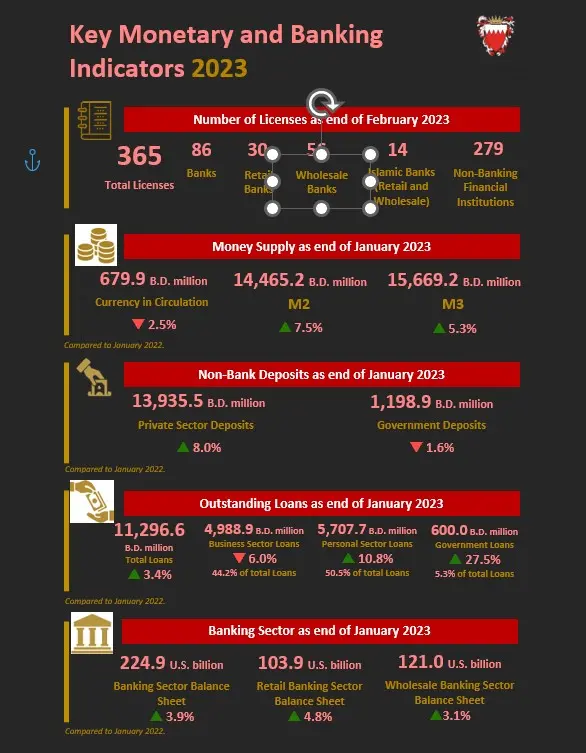

The Board also reviewed key monetary and banking indicators for the year including the money supply, which increased to BD 15.1 billion at the end of 2022, an increase of 1.7% compared to the end of 2021. As for retail banks, total private deposits increased to BD13.5 billion at the end of 2022, an increase of 4.4% compared to the end of 2021. The outstanding balance of total loans and credit facilities extended to resident economic sectors increased to BD11.3 billion at the end of 2022, an increase of 3.6% compared to the end of 2021, with the Business Sector accounting for 43.8% and the Personal Sector at 50.6% of total loans and credit facilities. The balance sheet of the banking system (retail banks and wholesale sector banks) increased to $224.1 billion at the end of 2022, an increase of 3.0% compared to the end of 2021.

As for the first month of 2023, the money supply increased to reach BD 15.7 billion at the end of January 2023, an increase of 5.3% compared to the end of January 2022. As for retail banks, total private deposits increased to BD13.9 billion at the end of January 2023, an increase of 8.0% compared to the end of January 2022. The outstanding balance of total loans and credit facilities extended to resident economic sectors increased to BD11.3 billion at the end of January 2023, an increase of 3.4% compared to the end of January 2022, with the Business Sector accounting for 44.2% and the Personal Sector at 50.5% of total loans and credit facilities. The balance sheet of the banking system (retail banks and wholesale sector banks) increased to $224.9 billion at the end of January 2023, an increase of 3.9% compared to the end of January 2022.

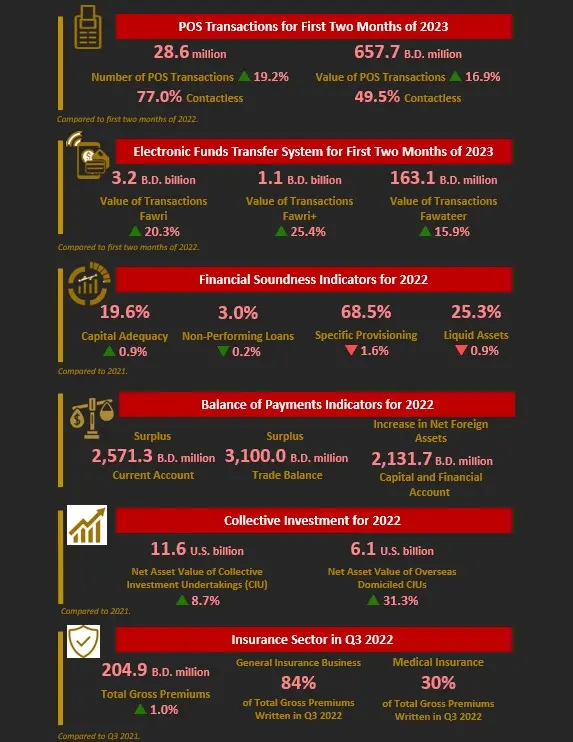

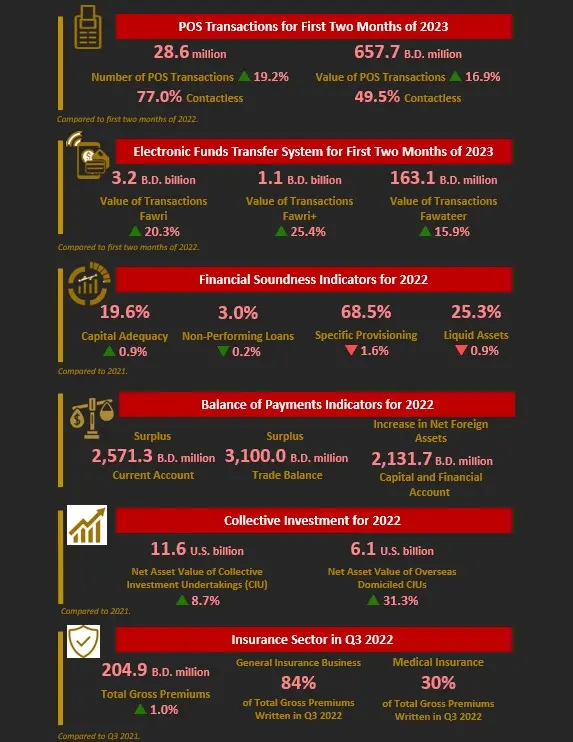

Point of Sales (POS) data for the year 2022 totaled 162.8 million transactions (74.5% of which were contactless), an increase of 29.7% compared to 2021. The total value of POS transactions for the year 2022 totaled BD 3.8 billion (46.7% of which were contactless), an increase of 22.0% compared to 2021. As for the figures of the first two months of 2023, POS data totaled 28.6 million transactions (77.0% of which were contactless), an increase of 19.2% compared to the first two months of 2022. The total value of POS transactions for the first two months of 2023 totaled BD 657.7 million (49.5% of which were contactless), an increase of 16.9% compared to the first two months of 2022.

The banking sector maintained a high level of capital adequacy and liquidity, as the capital adequacy ratio of the banking sector reached 19.6% in Q4 2022 compared with 18.7% in Q4 2021. The capital adequacy ratio for the various banking sectors was 21.5% for conventional retail banks, 17.6% for conventional wholesale banks, 21.8% for Islamic retail banks, and 17.0% for Islamic wholesale banks in Q4 2022.

The total number of registered Collective Investment Undertakings (CIUs) as of the end of 2022 stood at 1745 CIUs, of which 211 new CIUs were registered during 2022, an increase of 63.6% compared to 2021. The net asset value (NAV) of the CIUs increased from US$ 10.6 billion in 2021 to US$ 11.6 billion in 2022, reflecting an increase of 8.7%. Moreover, the NAV of overseas domiciled CIUs increased from US$ 4.7 billion in 2021 to US$ 6.1 billion in 2022, an increase of 31.3%.

-Ends-