PHOTO

Abu Dhabi, United Arab Emirates: Burjeel Holdings PLC (“Burjeel” or “the Group”), a leading super-specialty healthcare services provider in MENA listed on the Abu Dhabi Securities Exchange (“ADX”) (SYMBOL: BURJEEL; ISIN: AEE01119B224), today announced its financial results in accordance with International Financial Reporting Standards (IFRS) for the three-month period ended 31 March 2024.

Progress on Strategic Priorities

Burjeel Holdings saw continued progress on its strategic ambitions to ramp up the Group’s high-growth assets, expand its healthcare infrastructure and drive patient yields through the provision of highly specialized complex care.

The Group continued to execute on geographic expansion, with the opening of 13 new PhysioTherabia centers in the Kingdom of Saudi Arabia by May ‘24. This brings the total number of PhysioTherabia centers to 17 across Riyadh, Madina, Jeddah, Dammam, Al Khobar and Yanbu, meaning the Group is well on track to reach its target of 60 centers by the end of 2025. It also expanded insurance partnerships with leading providers in the KSA like Tawuniya and Al Arabia Takaful.

Burjeel’s super-specialty medicine practice passed important strategic milestones with the launch of the Thyroid Parathyroid Center at Burjeel Medical City (“BMC”) in cooperation with the University of Kansas Medical Center. BMC successfully performed its first two liver transplants during Ramadan. Finally, Burjeel launched OncoHelix-CoLab in May ’24, expanding its omics and precision medicine capabilities with the first lab in the UAE to offer comprehensive capabilities in molecular and cellular immunology as well as transplant diagnostics.

John Sunil, Chief Executive Officer of Burjeel Holdings, said:

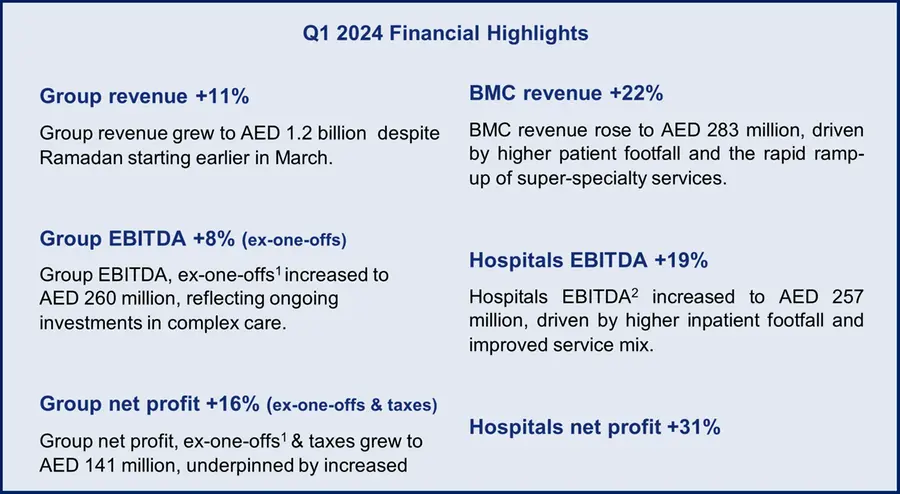

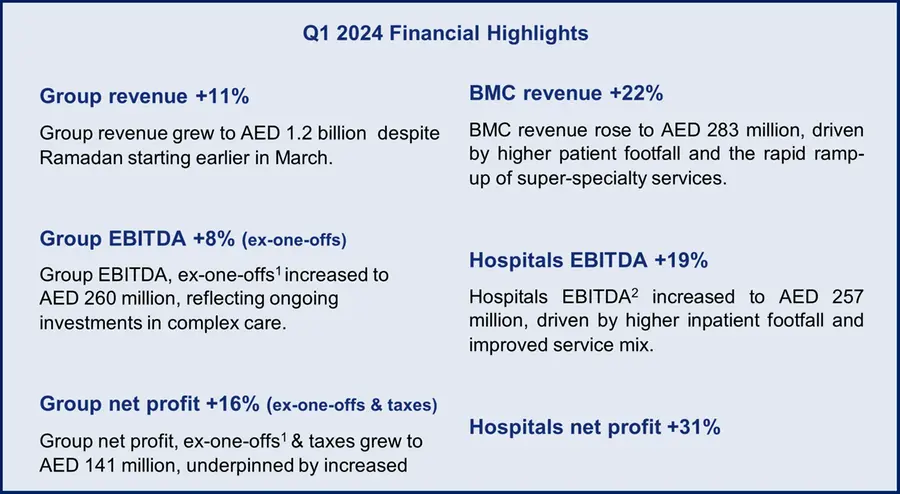

“Building on our impressive performance in 2023, Burjeel Holdings delivered another quarter of double-digit revenue growth despite the impact of an earlier start to Ramadan this March. At the same time, outstanding performance across our core business segments drove accelerated revenue and patient footfall results in the pre-Ramadan period, which aligns with our full-year 2024 guidance. First-quarter adjusted EBITDA grew by 7.7%, reflecting ongoing investments in complex care to unlock additional higher yield inpatient footfall. Adjusted net profit was up by 16.3%, driven by robust revenue growth, increased operational efficiencies and lower finance costs.

“Expanding the footprint of PhysioTherabia centers in Saudi Arabia continues to be our key high-potential growth area. Since inception, we have already rolled out 17 of the 30 centers due to be operational this year, putting us well ahead of schedule. Moreover, PhysioTherabia has gained access to a broader clientele through strategic partnerships with leading insurance providers, accelerating the Kingdom's penetration and solidifying its position as a key player in the sector.

“Burjeel Holdings has also passed further important milestones towards the strategic goal of cementing our position as a leading hub for complex and advanced care. BMC recently completed its first two liver transplants, marking a significant leap in our multi-organ transplant program. With OncoHelix-CoLab, a first-of-its-kind facility in the UAE, we aim to revolutionize the diagnostic landscape and strengthen the healthcare ecosystem in the region.

“Based on our robust first-quarter performance, especially in the pre-Ramadan period, and supported by strong macro tailwinds, we reiterate our 2024 guidance of delivering mid-teens revenue growth and improving EBITDA margin. On top of that, we continue to evaluate various CAPEX-light opportunities in the Gulf, where we anticipate introducing new value-based products in KSA and additional advanced healthcare service lines in the UAE.”

Robust Business Growth Continues

Burjeel Holdings delivered revenue growth of 11.1% to AED 1.2 billion in Q1 ’24, despite the impact of the longer Ramadan period on elective surgeries and outpatient visits, which started on 10 March 2024, compared to 22 March 2023. Group revenue growth in the pre-Ramadan period accelerated compared to Q4 ‘23 performance and was in line with FY ‘24 guidance, driven by strong patient footfall growth and improvement in patient yield.

The Hospitals segment continued to be the core driver of the Group’s performance, delivering 90% of total revenue in Q1 ’24, including robust top-line growth at the Group’s flagship hospital, BMC, and other high-growth assets. Group bed occupancy rose to 64% in Q1 ’24, meaning Burjeel still has room within the invested infrastructure to grow organically without any further investment.

The Group achieved robust inpatient footfall growth of 11.0% in Q1 ‘24. Inpatient volume in the pre-Ramadan period accounted for 88% of total incremental growth for Q1 ‘24, supported by the continued ramp-up of growth assets and strong demand for super-specialty services. Growth in inpatient footfall was further driven by BMC, Burjeel Hospital Abu Dhabi, Medeor Hospital Dubai and Burjeel Royal Hospital Al Ain.

Group outpatient footfall and utilization rate in Q1 ’24 were substantially impacted by the postponement of visits falling during Ramadan until after Eid. As a result, outpatient volume increased only marginally by 1.6%. Outpatient volume growth accelerated in the pre-Ramadan period compared to Q4 ’23 due to the introduction and rapid ramp-up of new services and effective cross-group referral capabilities. Growth in outpatient footfall was further driven by BMC, LLH Salalah, Burjeel Day Surgery Center Al Reem and Burjeel Royal Hospital Al Ain.

Group EBITDA ex-one-offs grew by 7.7% to AED 260 million in Q1 ’24 despite the Ramadan impact and ongoing investments in complex care. Including one-off items like movement in the fair value of investments in tradable financial securities and performance-based employee bonuses for the strong financial results achieved in FY ’23 (paid in Q1 ’24), reported EBITDA decreased by 2.9% to AED 234 million.

Group net profit ex-one-offs & taxes rose by 16.3% to AED 141 million, underpinned by revenue growth, increased operational efficiencies and lower finance costs. As previously indicated, the continued ramp-up of Burjeel’s growth assets will support incremental revenue growth with marginal impact on cost, which is expected to translate into meaningful bottom-line growth. Including one-off items and taxes, reported net profit declined by 14.0% to AED 104 million.

Strong Performance Across Core Business Segments

Hospitals revenue and EBITDA[3] increased by 13.5% and 18.9%, respectively, in Q1 ’24, driven by higher inpatient footfall and the Group’s continued focus on advanced specialty services, including oncology, bone marrow and organ transplantations, fetal medicine, pediatric sub-specialties and orthopedics. Hospitals EBITDA margin expanded to 23.6% in Q1 ’24, compared to 22.5% in Q1 ’23.

The Medical Centers segment's performance in Q1 '24 was impacted by the transformation of Burjeel Medical Center Al Shahama ("Al Shahama") into Advanced Day Surgery Center (the Hospitals segment) in Dec '23. The Medical Centers segment including Al Shahama delivered robust revenue growth of 12.5%, totaling AED 120 million in Q1 '24, on the back of an improved service mix towards high-yield specialties. Medical Centers EBITDA including Al Shahama grew by 8.1% to AED 33 million despite the impact of the ramp-up of PhysioTherabia centers (losses of AED 3 million).

Strong Demand for Super-Specialty Care Even in Ramadan

Burjeel's flagship hospital asset, BMC, once again delivered outstanding performance. Revenue grew 21.8% to AED 283 million in Q1 '24, while EBITDA3 was up 32.3% to AED 44 million. Notably, BMC's EBITDA margin increased by 1.2 p.p. to 15.7% in Q1 '24 despite ongoing investments in physician headcount (+30% YoY).

BMC’s strong growth was driven by a robust increase in inpatient and outpatient footfall and the introduction and rapid ramp-up of new services. Total patient footfall grew by 23.5% in Q1 ’24, with bed occupancy reaching 55% in Q1 ’24, compared to 41% in Q1 ’23.

BMC is a key driver of our wider ambition and of our ability to deliver increasingly complex care and high-value services. BMC contributed 26% to total Hospitals segment revenue in Q1 ’24. The segment still has significant utilization headroom, highlighting its continued potential to contribute to our long-term value-creation plans.

Maintaining a Robust Balance Sheet

The Group's net debt / pre-IFRS 16 LTM EBITDA[4] remained at 1.1x as of 31 March 2024. The strength of the Group’s balance sheet provides adequate financial flexibility to pursue growth opportunities going forward. It is the Group’s intention for debt maturing in 2024 and 2025 to be partially paid down and optimized to reduce financing costs and extend tenures, using a variety of available instruments.

Cash flow from operating activities remained almost stable despite the substantial impact from Ramadan and other one-offs on EBITDA growth, as well as changes in working capital in Q1 '24. FCF cash conversion[5] improved to 40%, with an 18% ROCE in Q1 '24.

Dividends

Burjeel is committed to delivering value to its stakeholders and has an asset-light cash-generative model that underpins significant dividend-paying capacity. The Group’s dividend policy envisages payment of cash dividends from 2024 onwards, with an expected payout ratio of 40% to 70% of net profit, depending on investments required for additional growth plans. In May 2024, the Group paid out AED 65 million as a final dividend for H2 ’23. Total dividends for FY ’23, including the AED 95 million interim dividend already paid, amounted to AED 160 million.

Positive Outlook Maintained

Burjeel Holdings management maintains a positive outlook for its mid- and long-term growth thanks to the favorable macro tailwinds in the United Arab Emirates and the Kingdom of Saudi Arabia, with strong predicted mid-term GDP growth, rapid population growth and increasing demand for added healthcare capacity. The regional aspiration to expand the non-oil-based economy will boost demand with limited supply in a regulated environment, driving the Group's performance.

Burjeel Holdings continues to see strong demand for its differentiated specialty healthcare offering. With state-of-the-art infrastructure consisting of several high-growth assets and an expansive referral network, Burjeel remains in a solid position to deliver on its value-creation strategy of increasing patient yield and utilization while unlocking strategic expansion opportunities. The Group continues to invest in deploying technology to provide a seamless patient journey and drive clinical efficiency.

Guidance Reiterated

2024

| Group revenue expected to grow in the mid-teens BMC revenue expected to grow more than 30% | EBITDA margin expected to improve to 23.5% vs. 22.8% in 2023 BMC EBITDA margin expected to improve to the high-teens | Maintenance CAPEX expected to be up to 2.5% of revenue Growth CAPEX of ~AED 455m for UAE & KSA expansion and digital transformation | Net debt/pre-IFRS 16 EBITDA of less than 2.5x to be maintained | ||

| Mid-Term (2025-2027) | |||||

| Group revenue growth expected to normalize gradually from the mid-teens to low double-digits BMC to continue to ramp up to reach beyond AED 2bn revenue p.a. KSA expansion projects to reach beyond AED 1bn revenue p.a. | Group EBITDA margin to gradually expand to high-20s Driven by ramp-up of growth assets, asset-light international expansion, as well as focus on increasing patient yield and operational excellence |

Accumulated Growth CAPEX of ~AED 450m for UAE & KSA expansion and digital transformation | Net debt/pre-IFRS 16 EBITDA of less than 2.5x to be maintained |

| Financial Review (Q1 ’24 = Three-month period to 31 March 2024) | |||

| AED millions | Q1 ’24 | Q1 ’23 | Change |

| Revenue | 1,205 | 1,085 | +11.1% |

| OPEX[6] | (949) | (848) | +11.8% |

| Share of profit from associates | 4 | 5 | (19.6%) |

| EBITDA ex-one-offs[7] | 260 | 242 | +7.7% |

| Change in fair value of financial assets carried at fair value through profit and loss | (12) | — | — |

| Annual employee bonuses | (14) | — | — |

| EBITDA | 234 | 242 | (2.9%) |

| Finance costs | (33) | (35) | (6.4%) |

| Depreciation & amortization | (86) | (85) | +1.4% |

| Provision for taxes[8] | (11) | — | — |

| Net profit | 104 | 121 | (14.0%) |

| Net profit ex-one-offs & taxes7 | 141 | 121 | +16.3% |

-Ends-

Conference Call Information

Date: Wednesday, 8 May 2024

Time: 4:00 pm Gulf Standard Time (GST)

Please find the details of the conference call below.

Webcast Link

United Arab Emirates: 800 0320690

United Kingdom: +44 203 984 9844

United States: +1 718 866 4614

Global Dial-In Numbers

Access Code: 305568

About Burjeel Holdings

Founded in 2007, Burjeel Holdings is one of the leading private providers of world-class healthcare services in the UAE and Oman, and it operates a growing specialized healthcare segment in Saudi Arabia. With a network of 82 assets, including 17 hospitals and 42 medical centers, as well as 15 pharmacies and other allied services, the Group collectively provides a premier offering in the Gulf region. Burjeel Holdings’ brands include Burjeel, Medeor, LLH, Lifecare, PhysioTherabia and Tajmeel. It has 13 JCI-accredited facilities, with a total of 1,708 patient beds across its operations in the UAE and Oman and holds a leading position in the UAE.

Contacts

| Investor Relations: | Media: |

([3]) Based on reported EBITDA.

([4]) Net debt / pre-IFRS 16 EBITDA is calculated as reported EBITDA less annual lease rental payments, and net debt is calculated as bank debt less cash and bank balances.

([5]) FCF = reported EBITDA – maintenance capex – change in working capital. Working capital = inventory + receivables – payables (including accruals). Change in working capital is calculated as working capital balance in prior period less working capital balance in current period. FCF conversion = free cash flow / reported EBITDA.

([6]) OPEX refers to total operating expenses excluding all depreciation & amortization expenses and one-offs: performance-based employee bonuses for FY ’23 financial results (paid in Q1 ’24).

([7]) EBITDA and net profit ex-one-offs exclude performance-based employee bonuses for FY ’23 financial results (paid in Q1 ’24) and movement from the change in fair value of investments in tradable financial securities. Net profit ex-one-offs & taxes also excludes tax provisions.

([8]) The Group should be subject to the provisions of the UAE CT Law with effect from 1 January 2024 and current taxes shall be accounted for as appropriate in the consolidated financial statements for the period beginning 1 January 2024.