PHOTO

Abu Dhabi, United Arab Emirates: Burjeel Holdings PLC (“Burjeel” or “the Group”), a leading super-specialty healthcare services provider in MENA listed on the Abu Dhabi Securities Exchange (SYMBOL: BURJEEL; ISIN: AEE01119B224), today announced its financial results in accordance with International Financial Reporting Standards (IFRS) for the three-month and six-month periods ended 30 June 2024.

Continued progress on strategic priorities

Burjeel Holdings achieved several key milestones as it continued to execute on its strategic priorities to ramp up the Group’s high-growth assets, expand its healthcare infrastructure and service range, and drive patient yield through the provision of highly specialized complex care.

Burjeel Holdings launched IMed Technologies, in line with our ambition to be a leading player in health tech. The venture will create innovative AI-based solutions and foster collaboration with global healthcare stakeholders. The platform will leverage our clinical expertise, regional footprint, and extensive data assets to enhance patient care decision-making and operational efficiency, resulting in further improvements in patient experience, provider satisfaction, and financial performance.

The Group further expanded its presence in the UAE, opening two specialized Day Surgery Centers in Al Ain’s Al Dhahir and Al Dhafra’s Madinat Zayed areas. Equipped with advanced diagnostic and treatment technologies, community-based Day Surgery Centers are designed to deliver top-tier, accessible, and efficient healthcare, ensuring residents receive exceptional treatment close to home.

Burjeel Holdings strengthened its cancer care services with the opening of the Burjeel Cancer Institute (BCI). Strategically located within Burjeel Medical City, BCI consolidates one of the largest cancer care networks in the UAE. It’s comprehensive scope of specialized services includes chemotherapy, immunotherapy, surgical oncology, stereotactic radiosurgery, and stereotactic body radiotherapy to offer a seamless experience for patients. The institute is also equipped to conduct high-quality clinical trials and translational research and serves as an advanced patient-centric cancer care hub in the region.

The Kingdom of Saudi Arabia continues to be a key growth priority. The Group made a first step towards unlocking the Kingdom’s primary healthcare potential through the formation of a joint venture with Keralty, a Colombian multinational healthcare provider. Together with Keralty, the Group will launch a unique value-based healthcare model with specialized primary care centers across KSA, leveraging growing demand for affordable and high-quality healthcare. The Group also completed the commission of five new PhysioTherabia centers in July, bringing the total to 22 branches, and signed new collaboration agreements with the Saudi Athletics Federation and Malath Insurance Company.

John Sunil, Chief Executive Officer of Burjeel Holdings, said:

“In the first half of 2024, Burjeel Holdings delivered robust top-line growth, acceleration in patient footfall and continued market penetration. We also made significant progress against key strategic and operational milestones, with continued investments in super-specialty areas such as oncology and organ transplantation and expansion of our regional network. This has enabled the Group to meet robust domestic and international demand, which will translate into higher asset utilization and patient yields.

“Cancer care is one of our key focus areas, with significant growth potential. Burjeel is at the forefront of oncology treatment in the UAE, with ambitions to become a world leader in advanced cancer care. Our recently launched advanced patient-centric cancer hub and first-of-its-kind advanced molecular diagnostics laboratory, as well as expanded partnerships in immunotherapy solutions, are just some examples of our innovative progress as we seek to transform cancer treatment and significantly improve patient outcomes.

“Our multi-organ and bone marrow transplant programs are gaining momentum, demonstrating Burjeel’s strong and unique capabilities, as well as considerable demand for complex care. Since our inaugural liver transplant in April 2024, Burjeel Medical City has successfully performed a total of 10 such procedures. This includes the UAE’s first pediatric liver transplant and the first combined liver and kidney transplant, underscoring our capabilities in offering a full range of pediatric and adult multi-organ transplant services. Moreover, we are ramping up our bone marrow transplant program, having completed more than 141 procedures, 52 of which were pediatric.

“Unlocking the Kingdom of Saudi Arabia’s primary healthcare potential is a key focus of our long-term growth strategy. With the right mix of prominent partners, we aim to provide cost-efficient and unique healthcare solutions based on prevention, detection, and health risk management through a clinically integrated network in highly populated regions. This, combined with our upcoming day surgery units and fast-growing PhysioTherabia network, will solidify our position as a key player in the Saudi healthcare market.

“Burjeel is well-positioned to achieve strong growth and profitability, in line with our guidance. We believe that performance in the second half of 2024 will be driven by the rapid ramp-up of high-growth assets and high-yield services, as well as fast growth in international and domestic patient footfall.”

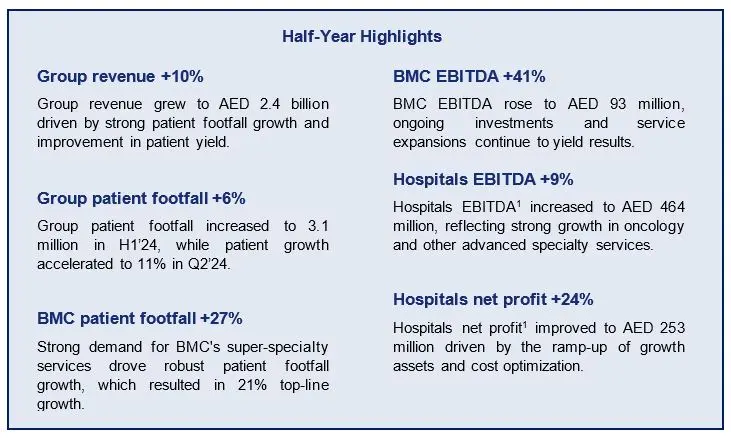

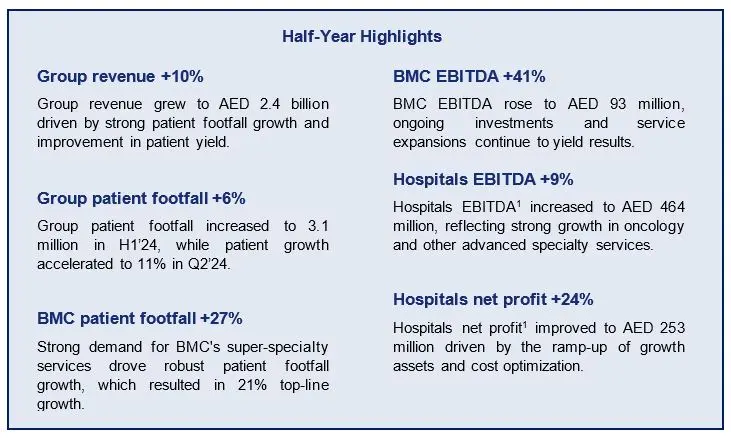

Sustainable revenue growth along with investments in future patient growth

Burjeel Holdings delivered revenue growth of 10.4% to AED 2.4 billion in H1’24, driven by solid patient footfall (+6.2% YoY), a rising volume of complex medical procedures, and improvement in patient yield. Outpatient and inpatient revenue increased by AED 137 million (+10.3% YoY) and AED 82 million (+11.0% YoY), respectively. Group revenue growth primarily resulted from a hike in medical oncology in the service mix (+64.1% YoY), contributing around 30% of its incremental growth.

The Group’s performance was supported by robust inpatient footfall growth of 13.6% in H1’24 from strong demand for Burjeel’s advanced care service offerings. On the back of growing demand for complex oncology care, the Group delivered 7,100 medical and surgical oncology procedures (+41.3% YoY) and 4,200 radiation oncology sessions (+42.7% YoY). Growth in inpatient footfall was driven by Burjeel Medical City, Burjeel Specialty Hospital Sharjah, Medeor Hospital Dubai, and Burjeel Royal Hospital Al Ain.

Burjeel Holdings accelerated outpatient footfall by increasing the range and capacity of medical services offered. Growth in outpatient footfall was driven by Burjeel Medical City, LLH Salalah, Burjeel Day Surgery Center Al Reem and Burjeel Royal Hospital Al Ain.

Group EBITDA ex-one-offs[1] grew by 2.2% to AED 477 million despite a rise in direct costs from ongoing investments in medical oncology to unlock future higher-yield patient footfall. Group EBITDA growth also reflected the impact of the ramp-up of new assets and higher overhead costs due to investments in medical tourism development and regional expansion.

Group net profit ex-one-offs & taxes2 rose by 5.9% to AED 238 million, on the back of revenue growth and lower finance and depreciation costs.

Robust segmental performance

The Hospitals segment remains the Group’s primary driver of revenue and contributed 88% of total Group revenue in H1’24, consistent with previous periods. Group bed occupancy rose to 64% in H1’24, indicating there is room for further ramp-up within the existing infrastructure.

Hospitals revenue and EBITDA increased by 9.2% and 8.6%, respectively, in H1’24, mainly driven by higher inpatient and outpatient footfall resulting from the growth in medical oncology, as well as other advanced specialty services, including organ transplants, fetal medicine, pediatric sub-specialties and orthopedics.

The Medical Centers segment, which plays a significant role as the Group’s key referral source, delivered robust revenue growth of 13.3% in H1’24. Within the Medical Centers segment, specialty care departments such as obstetrics, gynecology, pediatrics, orthopedics, and cardiology, rapidly ramped up. Medical Centers EBITDA, excluding PhysioTherabia performance, increased by 12.9% to AED 66 million.

Burjeel Medical City driving high-yield patient growth and margin expansion

BMC is a key driver of our wider ambition and ability to deliver increasingly complex care and high-value services. BMC contributed 26% to total revenue in the Hospitals segment in H1’24. The segment still has significant utilization headroom, highlighting its continued potential to contribute to long-term value-creation.

BMC delivered a 20.8% increase in revenue to AED 574 million and an outstanding 41.2% increase in EBITDA to AED 93 million in H1’24. BMC achieved a 26.5% increase in patients, demonstrating the strong demand for Burjeel’s expertise in the super-specialty segment. Bed occupancy reached 57% in H1’24, up by 13 p.p. compared to H1’23.

BMC’s EBITDA margin increased by 2.3 p.p. to 16.2% in H1’24, despite ongoing investments in manpower and medical oncology that we believe will drive significant growth as capacity utilization and patient conversion fully ramp up.

Maintaining a healthy balance sheet

The Group's net debt / pre-IFRS 16 LTM EBITDA[2] was 1.2x as of 30 June 2024, despite the impact of one-offs. The strength of the Group’s balance sheet provides adequate financial flexibility to pursue growth opportunities going forward. It is the Group’s intention for debt maturing in 2024 and 2025 to be paid down and optimized to reduce financing costs and extend tenures, using a variety of available instruments.

Positive outlook maintained

Burjeel Holdings maintains a positive outlook for its mid- and long-term growth, supported by favorable macroeconomic tailwinds in the United Arab Emirates and the Kingdom of Saudi Arabia, which are forecast to record strong mid-term GDP growth, rapid population growth and increased demand for additional healthcare capacity. Regional aspirations to expand and diversify the non-oil-based economy will boost demand with limited supply in a regulated environment, driving the Group's performance.

Burjeel Holdings continues to see strong demand for its differentiated specialty healthcare offering. With state-of-the-art infrastructure consisting of several high-growth assets and an expansive referral network, Burjeel remains in a solid position to deliver on its value-creation strategy of increasing patient yield and utilization while unlocking strategic expansion opportunities. The Group continues to invest in deploying technology to provide a seamless patient journey and drive clinical efficiency.

Conference call information

Date: Thursday, 8 August 2024

Time: 4:00 pm Gulf Standard Time (GST)

Please find the details of the conference call below.

United Arab Emirates: 800 0320690

United Kingdom: +44 203 984 9844

United States: +1 718 866 4614

Access Code: 305568

About Burjeel Holdings

Founded in 2007, Burjeel Holdings is a leading super-specialty healthcare services provider in the UAE and Oman, and it operates a growing specialized healthcare segment in Saudi Arabia. The Group developed an integrated and multi-brand healthcare ecosystem across primary, secondary, tertiary, and quaternary medical care, ensuring complex care delivery to patients across all socioeconomic groups.

Our network comprises 89 assets across the UAE, Oman, and Saudi Arabia, including 19 hospitals, 47 medical centers, 15 pharmacies, and other allied services. Burjeel Holdings’ brands include Burjeel, Medeor, LLH, Lifecare, PhysioTherabia and Tajmeel.

Media:

M. Unnikrishnan

Corporate Communications Officer

krish@burjeelholdings.com

M: +971 50 427 5895

Investor Relations:

Sergei Levitskii

Director of Investor Relations

ir@burjeelholdings.com

M: +971 50 380 2383