PHOTO

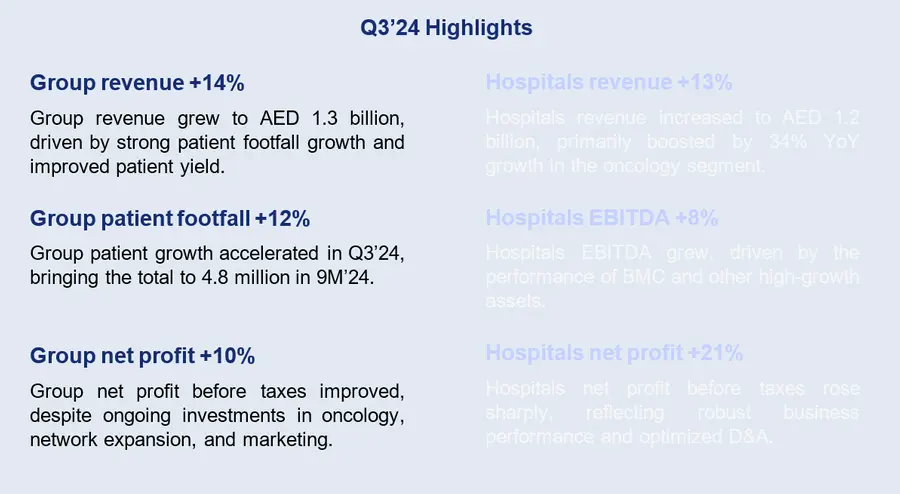

Abu Dhabi, United Arab Emirates: Burjeel Holdings PLC (“Burjeel” or “the Group”), a leading super-specialty healthcare services provider in MENA listed on the Abu Dhabi Securities Exchange (SYMBOL: BURJEEL; ISIN: AEE01119B224), announced its financial results in accordance with International Financial Reporting Standards (IFRS) for the three-month and nine-month periods ended 30 September 2024.

Continued Execution on Growth Strategy

Burjeel Holdings continued to execute its strategic growth plan during 9M’24, investing significantly to expand its presence in the UAE, penetrate the fast-growing Saudi Arabian market, and broaden its super-specialty care offerings. These investments position the Group to capitalize on favorable macroeconomic trends and rising demand for advanced healthcare across the region, driving higher patient yields, increased market penetration, and top-line growth.

In Q3’24, the Group achieved key milestones, including the launch of the UAE’s largest fertility center, offering comprehensive reproductive healthcare from conception to delivery. Burjeel also enhanced its specialty care by partnering with the Abu Dhabi Stem Cells Center to build an integrated ecosystem for bone marrow transplants, cellular therapy, and advanced care for patients with blood cancer, genetic disorders, and autoimmune diseases. Additionally, Burjeel expanded in its two key markets, opening 11 new PhysioTherabia centers in Saudi Arabia, bringing the total to 28 branches, and securing agreements with major insurers. In the UAE, it announced nine new community clinics to improve access to primary healthcare. These facilities are set to cater to over 300,000 outpatient visits per year, facilitating cross-referrals to Burjeel’s secondary, tertiary, and quaternary care hospitals.

John Sunil, Chief Executive Officer of Burjeel Holdings, said:

“During the first nine months of 2024, Burjeel Holdings achieved strong market penetration through the expansion and the ramp-up of our regional network. In the third quarter, revenue growth accelerated to 14%, driven by a 12% rise in patient footfall and improved yield. This progress reflects our enhanced super-specialty capabilities, backed by strategic investments to propel future growth and profitability.

“At Burjeel Holdings, we continue to expand through pivotal partnerships that increase access to high-quality healthcare across the region. Aligned with the UAE’s healthcare strategy, we will launch nine community-based primary care clinics, enhancing accessibility and strengthening our network through increased patient referrals. In Saudi Arabia, our fast-growing PhysioTherabia network aligns with Vision 2030, promoting wellness and rehabilitation, with plans to introduce new day surgery and primary care centers to improve health and well-being for diverse populations.

“Oncology, women & child care, orthopedics, and organ transplants are key growth priorities for Burjeel Holdings, driven by strong demand for our specialized capabilities. We aim to be the provider of choice in these services, highlighted by 26 multi-organ transplants this year, all with a 100% success rate. These achievements demonstrate our expanding expertise in advanced care and reinforce our leadership in sophisticated healthcare solutions.

“Our women’s healthcare portfolio has been further strengthened with the launch of Trust Fertility Clinic, the largest of its kind in the UAE. By integrating IVF services, this state-of-the-art facility complements our expertise in advanced gynecology, fetal medicine, and pediatric sub-specialties, offering women a seamless journey from conception to delivery.

“Our partnership with the Abu Dhabi Stem Cells Center advances cellular and regenerative medicine, developing a world-class bone marrow transplant program that positions Abu Dhabi as a global leader in complex care. Additionally, our collaboration with Axiom Space enhances medical research by exploring microgravity's effects, pioneering next-generation healthcare solutions aligned with the UAE’s vision for space innovation.

“We remain committed to our mid-term outlook, driven by strategic investments in high-growth assets, super-specialty care, and regional expansion that strengthen our healthcare services. The anticipated ramp-up of high-yield services, along with increasing patient footfall locally and internationally, provides a solid foundation for long-term growth and strong returns, supporting our value-creation strategy.”

Accelerating Revenue Growth & Business Expansion Investments

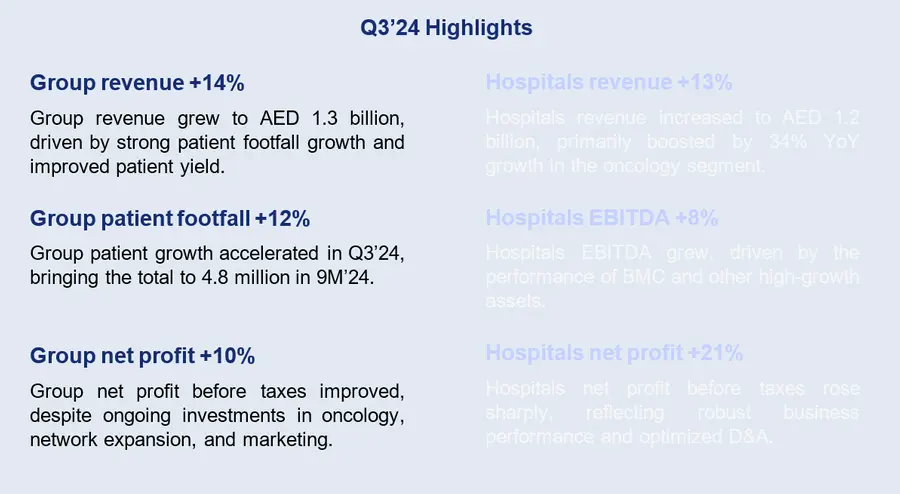

Burjeel Holdings achieved strong top-line growth of 14.1% in Q3’24, driven by an 11.8% rise in patient footfall and improved patient yield, despite a high revenue base from Q3’23 (up 24% YoY). In 9M’24, revenue increased by 11.7% to AED 3.7 billion, with total patient visits reaching 4.8 million. Key contributors included Burjeel Medical City, Burjeel Specialty Hospital Sharjah, Medeor Hospital Dubai, and Burjeel Royal Hospital Asharej.

Inpatient and outpatient footfall growth in 9M'24 reflected strong demand for its high-quality healthcare, especially in oncology, orthopedics, pediatrics, and women's care. Medical oncology revenue saw significant expansion (up 50% YoY), contributing around 20% of incremental revenue growth. Inpatient footfall rose by 13.3%, boosting bed occupancy to 66%, with over 60,800 surgeries completed (+13% YoY). Outpatient volume grew by 7.9%, supported by new facility expansions and effective cross-group referral capabilities.

EBITDA[1] grew by 5.1% in Q3’24, reaching AED 273 million, despite higher direct costs from ongoing investments in medical oncology aimed at driving future high-yield patient growth. The increase in direct costs also reflects the ramp-up of new assets and higher overheads due to additional marketing efforts to promote the international patient program and support regional expansion.

Excluding the impact of new assets, Q3’24 EBITDA rose by 11.4% to AED 290 million, with a 22.0% margin. The Group recorded AED 16 million in losses from the ramp-up of recently opened facilities, which include two day surgery centers and two medical centers in the UAE, as well as 28 PhysioTherabia centers in KSA. For 9M’24, EBITDA, excluding one-offs[2] and new assets performance, increased by 7.4% to AED 781 million, with a 21.1% margin.

Net profit before taxes rose 9.8% in Q3’24 to AED 151 million, driven by robust business performance and lower depreciation. For 9M’24, net profit excluding one-offs and taxes increased 7.4% to AED 389 million.

Robust Performance Across Segments

The Hospitals segment remained the primary revenue driver, contributing 88% of total Group revenue in Q3’24, consistent with previous periods. Revenue and EBITDA for the segment grew by 12.9% and 7.6%, respectively, driven by increased inpatient and outpatient footfall, particularly in oncology, pediatric sub-specialties, neurosurgery, orthopedics, obstetrics & gynecology, and emergency medicine. During 9M’24, Hospital segment revenue rose 10.5%, while EBITDA increased 8.2%.

The Medical Centers segment achieved strong revenue growth of 14.3% in Q3’24 and 13.7% in 9M’24. Key contributors included specialty care departments such as orthopedics, pediatrics, obstetrics & gynecology, and ENT. However, EBITDA growth was moderated by losses from the ramp-up of new centers in the UAE and KSA. Excluding the performance of new centers, Medical Centers' EBITDA increased by 9.8% YoY to AED 101 million in 9M’24.

BMC Strategically Positioned for Patient Growth & Margin Expansion

Burjeel Medical City (BMC) achieved sustainable revenue growth of 16.5% in Q3’24 and 19.3% in 9M’24, driven by strong patient footfall of 30.9% and 28.1%, respectively. This growth was supported by a rising share of outpatient revenue and robust expansion in medical oncology (up 45% YoY), which accounted for 40% of total incremental revenue. The Burjeel Cancer Institute at BMC continued to see increased demand for oncology services, delivering 11,100 medical and surgical oncology procedures (+37.6% YoY) and 6,200 radiation oncology sessions (+32.6% YoY) in 9M’24. Bed occupancy at BMC rose to 60% in 9M’24, an increase of 15 percentage points.

BMC’s EBITDA increased by 15.7% in Q3’24 and by 31.2% for 9M’24. The EBITDA margin improved to 16.1% in 9M’24, despite ongoing investments in expanding new super-specialty services. These investments are expected to drive significant margin growth as capacity utilization and patient conversion continue to ramp up.

Commitment to Conservative Financial Policy

The Group's net debt / pre-IFRS 16 LTM EBITDA[3] was stable at 1.2x as of 30 September 2024, with an average finance cost of 7.2%. The strength of the Group’s balance sheet provides adequate financial flexibility to pursue growth opportunities going forward. The Group intends to pay down and optimize maturing debt to reduce financing costs and extend tenures through various instruments.

Mid-Term Outlook Reiterated, FY'24 Guidance Updated

Burjeel Holdings maintains a positive outlook for its mid- and long-term growth, with the Group well positioned to capitalize on favorable macro trends in the UAE and Saudi Arabia, including strong GDP growth forecasts, rapid population growth, and increasing demand for healthcare capacity. We refined our year-end guidance to account for short-term changes in the service mix and accelerated investments in network expansion and super-specialty care promotion.

To achieve mid-term goals, the Group will continue to enhance and ramp up its high-growth assets to boost patient footfall, with ongoing efforts to strengthen referral networks, expand patient capacity, and leverage corporate and government wellness programs. Investments in medical tourism are expected to boost demand for super-specialty services, while the Group aims to expand advanced cancer care for its oncology patients. Complex care programs, including transplants and specialized surgeries, are expected to further increase patient yield, as well as continued expansion of its healthcare network across the UAE and KSA.

Financial Review

(Q3’24 = three-month period to 30 September 2024)

(9M‘24 = nine-month period to 30 September 2024)

| AED millions | Q3’24 | Q3’23 | 9M’24 | 9M’23 |

| Revenue | 1,319 | 1,155 | 3,705 | 3,317 |

| OPEX4 | (1,050) | (899) | (2,966) | (2,607) |

| Share of profit from associates | 5 | 4 | 12 | 17 |

| EBITDA ex-one-offs | 273 | 260 | 751 | 727 |

| EBITDA | 273 | 260 | 700 | 727 |

| Finance costs | (35) | (34) | (104) | (104) |

| Depreciation & amortization | (88) | (90) | (258) | (261) |

| Net profit ex-one-offs and taxes | 151 | 137 | 389 | 362 |

| Net profit before taxes | 151 | 137 | 338 | 362 |

| Net profit | 137 | 137 | 306 | 362 |

(4) OPEX refers to total operating expenses excluding all depreciation & amortization expenses and one-offs.

For detailed financial results for the three-month and nine-month periods ended 30 September 2024 and guidance, please visit the Group’s Investor Relations website.

Conference Call

Date: Wednesday, 6 November 2024

Time: 4:00 pm Gulf Standard Time (GST)

Please find the details of the conference call below.

Webcast Link

United Arab Emirates: 800 0320690

United Kingdom: +44 203 984 9844

United States: +1 718 866 4614

Global Dial-In Numbers

Access Code: 305568

About Burjeel Holdings

Founded in 2007, Burjeel Holdings is a leading super-specialty healthcare services provider in the UAE and Oman, and it operates a growing specialized healthcare segment in Saudi Arabia. The Group operates an integrated and multi-brand healthcare ecosystem across primary, secondary, tertiary, and quaternary medical care, ensuring complex care delivery to patients across all socioeconomic groups.

Our network comprises 97 assets across the UAE, Oman, and Saudi Arabia, including 19 hospitals, 27 medical centers, 28 physiotherapy and wellness centers, 15 pharmacies, and other allied services. Burjeel Holdings’ brands include Burjeel, Medeor, LLH, Lifecare, PhysioTherabia and Tajmeel.

Contacts

| Investor Relations: Sergei Levitskii Director of Investor Relations ir@burjeelholdings.com | Media: M. Unnikrishnan Corporate Communications Officer krish@burjeelholdings.com |

([1]) Hereinafter, EBITDA is calculated as profit for the period before income tax expense, finance costs, depreciation & amortization and interest income from related parties.

([2]) Hereinafter, one-offs exclude Employee & BoD performance bonuses for FY’23 results (paid in H1’24) and movement from the changes in the fair value of investments in tradable financial securities, which were made in Dec’23 and then divested in June’24.

([3]) Net debt / pre-IFRS 16 EBITDA is calculated as reported EBITDA less annual lease rental payments, and net debt is calculated as bank debt less cash and bank balances.