PHOTO

Muscat: Cementing its position as the leading and most trusted Islamic bank in the Sultanate of Oman, Bank Nizwa participated in the AAOIFI Week for Training and Qualification Programs and the 18th AAOIFI-IsDB Annual Islamic Banking and Finance Conference, organized by the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) and the Islamic Development Bank, held in the Kingdom of Bahrain. The two events witnessed enlightening workshops and thought-provoking sessions led by experts and decision makers from the Islamic Finance sector in the region, along with Bank Nizwa’s experts.

The two-day conference themed ‘Strategies for the Impending Economic Slowdown and a Post Oil World: Through Economic Diversification and Leveraging Islamic Finance’ saw keynote addresses by leading master trainers, as well as various panel discussions which deliberated on the key aspects of Islamic finance, and challenges facing the sector.

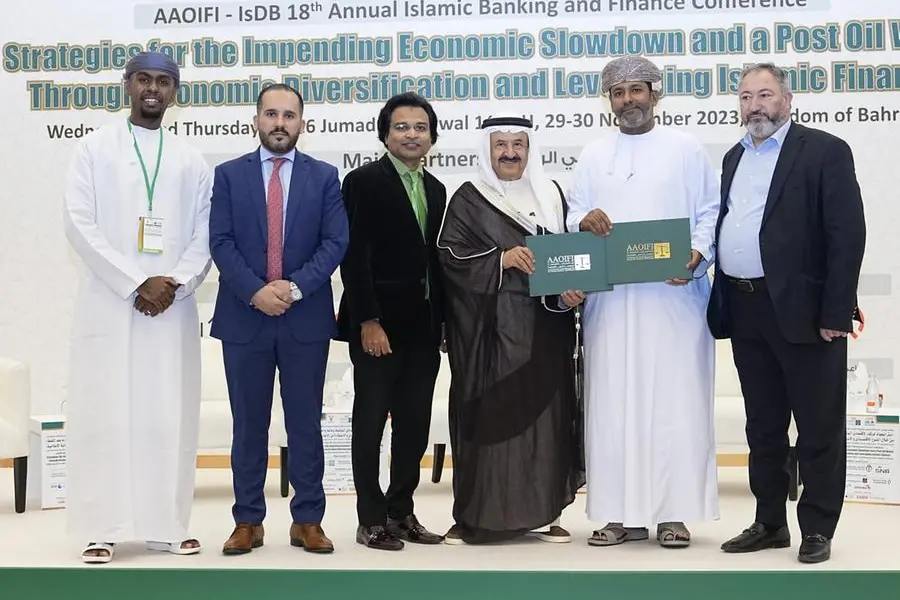

The event witnessed the signing of a Memorandum of Understanding (MoU) between Bank Nizwa and the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI), further strengthening the bank’s efforts to raise awareness about Islamic banking. The MoU was signed by Mr. Salim Al Maharbi, Chief Financial Officer, Bank Nizwa, and His Excellency Sheikh Ebrahim bin Khalifa Al Khalifa, Chairman of AAOIFI Board of Trustees, representing the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI). The understanding outlined Bank Nizwa’s active pursuit to extend its Islamic Finance Knowledge Sessions (IFKS) locally and regionally with the launch of the first comprehensive Islamic Finance academic program. Aimed at enhancing skills and competencies in the Islamic finance sector, a group of experts at Bank Nizwa will be responsible for delivering the program, and upon completion, participants will be awarded certifications by the AAOIFI.

Bank Nizwa's partnership with the Accounting and Auditing Organization for Islamic Financial Institutions is a stellar example of the growth and prosperity of the Islamic banking sector. As part of this cooperation, four trainers from Bank Nizwa, Dr. Mansour Al Qudah, Head of Sharia Compliance, Mr. Mohamed Sajari – Head of Sharia Structuring, Mr. Mundher Al Ghazali, Manager of Sharia Risk Control and Mr. Mustafa Al Naabi – Deputy Manager Sharia Training, will be accredited as certified trainers by the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI).

Commenting on the occasion, Mr. Salim Al Maharbi said, “It gives us great pride to be at the forefront of promoting Islamic finance education and awareness in the Sultanate. At Bank Nizwa, we believe it is imperative to share knowledge about Sharia-compliant banking and finance practices across communities, so that people in the region can make informed financial decisions in line with their principles and lifestyles. This participation and the signing of this agreement will help bring our keen insights to a larger audience, and educate the masses about the core principles of Islamic finance.”

Taking place alongside the conference was the first-ever ‘Capacity Building Week’ organized by Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI). The event shed light on the importance of developing human capital in Islamic finance, and saw the participation of over 30 countries in a wide range of workshops led by master trainers. Bank Nizwa participated in several illuminating sessions as part of the five-day event.

Bank Nizwa’s Islamic Finance Knowledge Sessions (IFKS) series exemplifies the bank’s commitment to fostering a deeper understanding of Sharia-compliant finance principles and banking practices. Conducted in various cities across Oman, the sessions have helped the bank reach communities spanning the country. Moreover, by collaborating with universities, colleges, private and government institutions to host these sessions, the bank has been able to raise awareness among different segments of society. Through its multifaceted efforts to drive knowledge about Islamic Finance, the bank continues to empower the masses to make astute financial decisions aligned with their lifestyles.