PHOTO

Dubai | Amanat Holdings PJSC (“Amanat” or the “Company”) (DFM symbol: AMANAT), the leading healthcare and education listed investment company, announces its financial results for the six-month period ended 30 June 2024 (“H1 2024”).

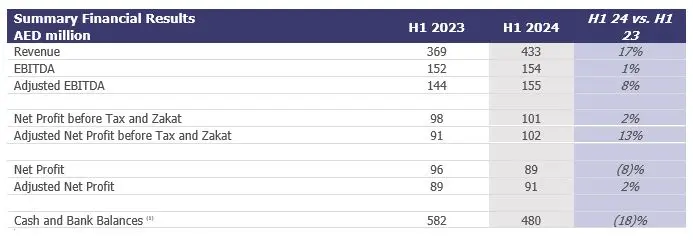

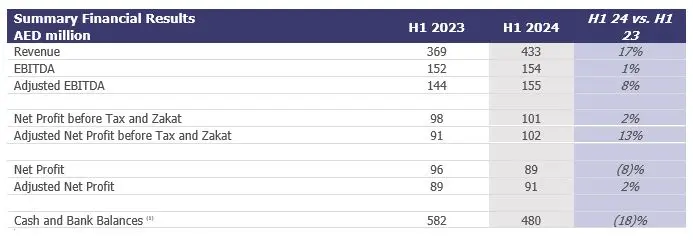

Revenue: Grew by 17% year-on-year to AED 433 million in H1 2024 driven by strong performance in Education, which grew 26% year-on-year

EBITDA: Increased by 1% year-on-year to AED 154 million in H1 2024, with an 18% increase in Education partially offset by a decline at Healthcare due to a one-time prior year gain and near-term revenue pressure in the UAE. Excluding the prior year one-time gain, adjusted EBITDA increased by 8%

Net Profit before Tax and Zakat: Increased 2% year-on-year to AED 101 million in H1 2024, or 13% excluding a prior year one-time gain

Balance sheet: Significant cash balance of AED 480 million with low leverage at the end of H1 2024

Dividend: Board endorsed an interim dividend of AED 75 million for the period, equivalent to AED 3 fils per share, reflecting Amanat’s commitment to returning value to its shareholders

H1 2024 Operating Highlights

Strong student and beneficiary growth: Over 3,000 students and beneficiaries added across Education, bringing total enrollments to more than 20,000 with record increases at Middlesex University Dubai (“MDX”) (up 20%) and Human Development Company (“HDC”) (up 22%) and a 14% increase at NEMA

Expanding special education needs network: HDC opened 3 new centers in the first half of 2024, following the launch of 6 new centers in 2023 taking total centers to 31. An additional 9 centers are under development and scheduled for opening through 2025

H1 2024 Financial Highlights

- Revenue: Grew by 17% year-on-year to AED 433.4 million in H1 2024

-

- Education: 26% year-on-year increase to AED 232.0 million, enabled by over 20% growth in enrollments at MDX and HDC

- Long-Term Care: Revenue growth of 11% year-on-year to AED 182.1 million, supported by growth in KSA and the UAE PPP project, which more than offset near-term pressure on UAE revenues following the cessation of COVID related treatment programs in July 2023

- EBITDA: Grew by 1% year-on-year to AED 153.5 million in H1 2024 or 8% on an adjusted basis, impacted by a one-time gain in the prior year

-

- Education: Growth of 18% year-on-year to AED 132.1 million due to strong topline growth

- Long-Term Care: EBITDA declined 23% year-on-year to AED 40.6 million, impacted by the phasing of revenue as the Company ramps up utilization in the UAE following the cessation of COVID programs with future growth anticipated from new beds and the ramp-up of KSA operations

- Net Profit Before Tax and Zakat: Increased by 2% year-on-year to AED 100.7 million in H1 2024 or 13% on an adjusted basis

- Net Profit: Declined by 8% year-on-year to AED 89.1 million in H1 2024, impacted by the one-time gain in the prior year and the impact of corporation tax in the UAE. Excluding these items net profit was 12% higher year-on-year

Amanat’s Chairman, Dr. Shamsheer Vayalil, said:

“Amanat made strong progress on its value creation strategy in the first half of 2024, with continued growth at the Education business and with both our Healthcare and Education businesses well positioned to capture significant demand growth, underpinned by favorable market and sector fundamentals.

“The payment of an interim dividend of AED 75 million also demonstrates our ongoing commitment to translate growth into consistent shareholder returns through our attractive dividend policy.”

Commenting on the results, John Ireland, Chief Executive Officer, added:

“Amanat delivered a robust set of results in the first half of 2024, with revenue and adjusted EBITDA up 17% and 8% respectively year-on-year, driven by the strong performance of our Education business, which saw revenue increase 26% year-on-year, supported by record enrollments with over 3,000 students and beneficiaries added in the period.

“We remain committed to both driving growth in long-term care through increasing bed capacity, with c.200 beds currently under construction, and growing our Education business through increasing enrollments in the UAE, further expansion of HDC and exploring M&A opportunities.”

(1) Cash and bank balances include the cash and bank balances of Amanat Holdings PJSC and its subsidiaries. Comparative figures refer to the balance as at 31 December 2023

About Amanat Holdings PJSC

Amanat Holdings PJSC is the region’s leading listed operator of healthcare and education assets with paid-up capital of AED 2.5 billion. Listed on the Dubai Financial Market since 2014, Amanat’s mandate is to establish, acquire and integrate companies in the healthcare and education sectors; and develop, manage, and operate these companies within the MENA region and beyond.

Amanat’s Healthcare platform comprises the leading post-acute care provider in the GCC which includes Cambridge Medical and Rehabilitation Center in the UAE and KSA and Sukoon in Jeddah, KSA. The platform also includes Al-Malaki Specialist Hospital in the Kingdom of Bahrain.

Amanat’s Education platform includes MDX, the first overseas campus of the internationally renowned Middlesex University in London, HDC the leading provider of special education and care services covering educational, medical, and rehabilitation services in KSA, and NEMA Holding, a leading provider of higher education in Abu Dhabi, UAE.

Investor Relations Contact

Abdulrahman Al-Suwaidi | Director of Investor Relations

+971 4 330 9999

investor.relations@amanat.com

For further information visit: www.amanat.com