PHOTO

Dubai | Amanat Holdings PJSC (“Amanat” or the “Company”) (DFM symbol: AMANAT), the leading healthcare and education listed investment company, announces its preliminary unaudited financial results for the twelve months ended 31 December 2023 (“FY 2023”).

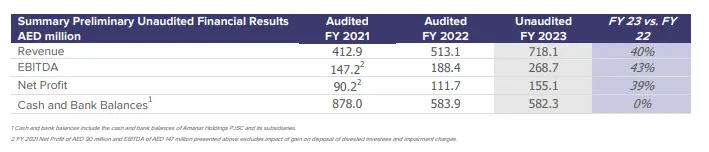

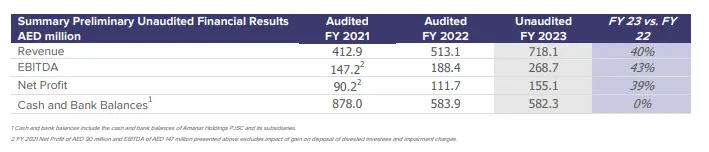

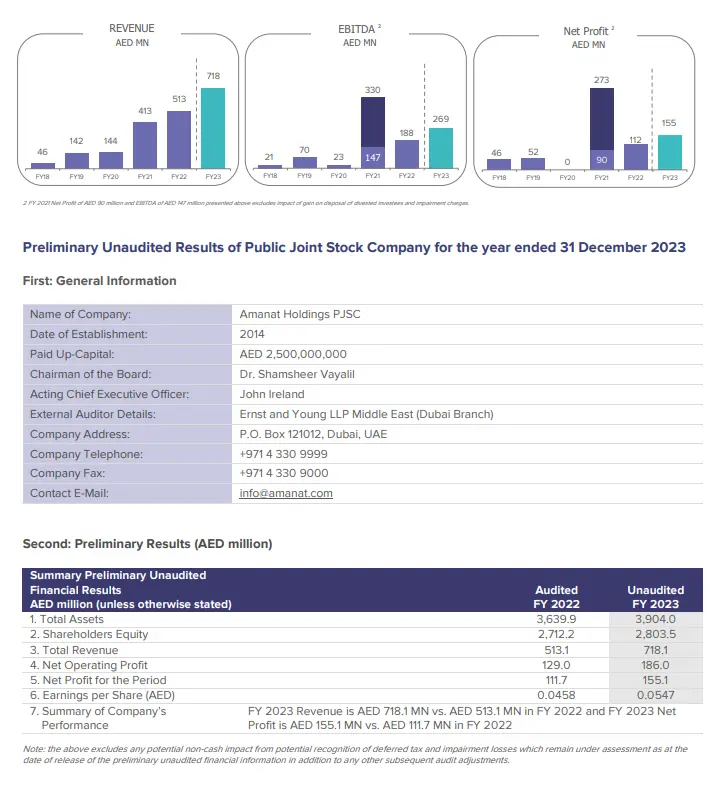

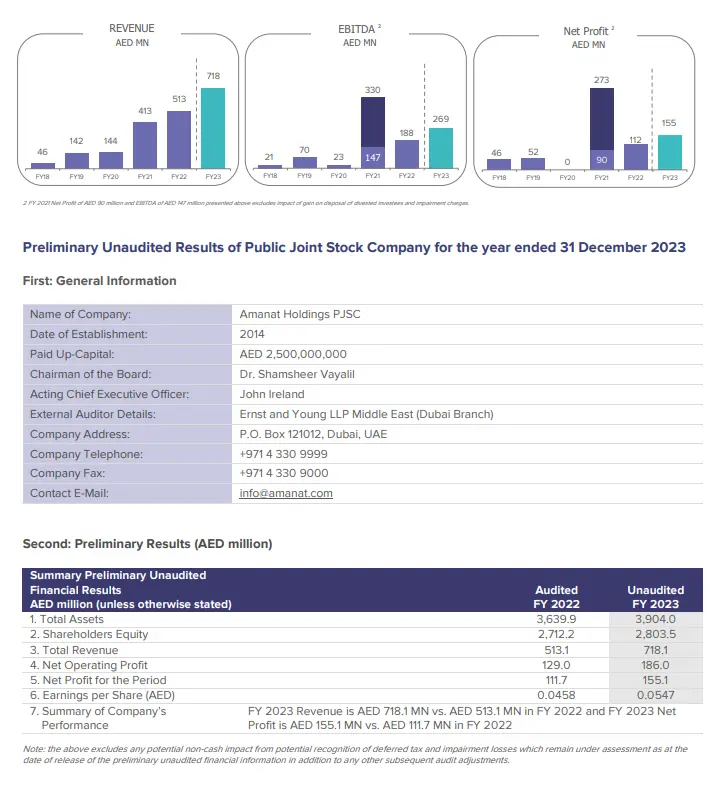

- Revenue: Grew by 40% year-on-year to AED 718.1 million in FY 2023, driven by almost two-fold growth at the Education platform, supported by higher enrollments and the acquisition of our special education needs business, and growth at the Healthcare platform through the consolidation of Sukoon and the continued expansion of our long-term care offering in KSA

- EBITDA: Increased by 43% year-on-year to AED 268.7 million in FY 2023

- Net Profit: Grew by 39% year-on-year to AED 155.1 million in FY 2023

- Balance sheet: AED 582.3 million of cash at year-end and low leverage providing significant capital to deploy on growth opportunities and return value to shareholders

- Value creation: Strong growth trajectory across both platforms with active deployment pipeline to unlock further value and potential for near-term monetization to drive shareholder returns

Amanat’s Chairman, Dr. Shamsheer Vayalil, said:

“It is a honor to be appointed Chairman of Amanat, one of the leading investors and operators in education and healthcare in the MENA region. The Company operates in two strategically important and growing sectors and I am focused on working with the Board and management teams to accelerate our platform growth plans, capitalizing on healthcare and education opportunities in the region and driving returns to shareholders, including through potential platform monetization events.”

Commenting on the results, John Ireland, Amanat’s Acting Chief Executive Officer, added:

"I am pleased to announce that Amanat delivered record results in 2023, maintaining its strong growth trajectory. Revenue increased 40% year-on-year, largely driven by the impressive performance of our education platform, which benefited from record enrollments, up 18% year-on-year, as well as growth and a full year contribution from our special education needs business. The strong revenue performance drove increased profitability with EBITDA and Net Profit increasing 43% and 39%, respectively, year-on-year.”

About Amanat Holdings PJSC

Amanat Holdings PJSC is the region’s leading operator of healthcare and education assets with paid-up capital of AED 2.5 billion. Listed on the Dubai Financial Market (DFM) since 2014, Amanat’s mandate is to establish, acquire and integrate companies in the healthcare and education sectors; and develop, manage, and operate these companies within the MENA region and beyond.

Amanat’s healthcare platform comprises the leading post-acute care provider in the GCC which includes Cambridge Medical and Rehabilitation Center (CMRC) in the UAE and KSA and Sukoon in Jeddah, Saudi Arabia and Al-Malaki Specialist Hospital in the Kingdom of Bahrain.

Amanat’s education platform includes Middlesex University Dubai, the first overseas campus of the internationally renowned Middlesex University in London, Human Development Company the leading provider of special education and care services covering educational, medical, and rehabilitation services in KSA, and NEMA Holding, a leading provider of higher education in Abu Dhabi, UAE.

Investor Relations Contact

Abdulrahman Al-Suwaidi | Director of Investor Relations

+971 4 330 9999

investor.relations@amanat.com

For further information visit: www.amanat.com