PHOTO

- Demonstrates Alpha Dhabi’s continued success and accelerated momentum as it executes on its growth and expansion strategy across its core verticals and diversified platform

Abu Dhabi, UAE: Alpha Dhabi Holding PJSC (“Alpha Dhabi” or “the Group”), one of the fastest-growing investment holding companies in the UAE, listed on the Abu Dhabi Securities Exchange (ADX: AlphaDhabi), has announced its financial results for the 9-month period ending 30 September 2022.

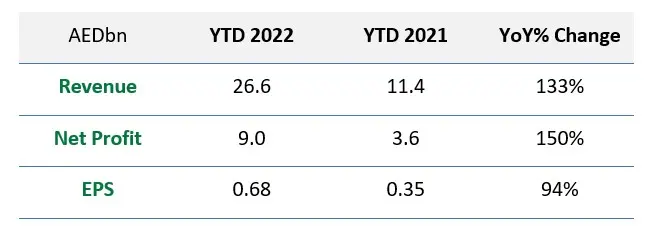

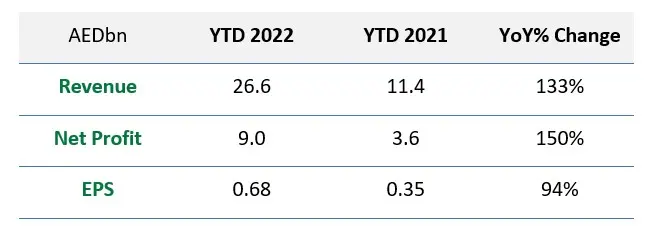

Throughout the year Alpha Dhabi has continued to ramp up its transaction activity, building on its strong performance across its core verticals and diversified platform. As a result, Alpha Dhabi reported a strong set of financial results for the 9-month period ending 30 September 2022 with net profit of AED 9.0 billion, up 150% year-on-year from AED 3.6 billion. Furthermore, revenues also grew significantly standing at AED 26.6 billion, representing a year-on-year increase of 133% with strong contributions from the existing portfolio in the healthcare sector, which continue to see strong demand, and from the real estate, construction and industrial verticals, which continue to be strong drivers of growth for the Group.

Eng. Hamad Al Ameri, CEO of Alpha Dhabi Holding, said: "Alpha Dhabi has delivered another set of record financial results as we continue to cement our position as a leading regional investment holding company. Our diversified business continues to grow from strength to strength with a positive market sentiment in the UAE, underpinned by strong economic fundamentals and a buoyant capital markets landscape in contrast with the global outlook.”

“Over the year, we deployed and committed a significant amount of capital adding considerable scale and diversification to our portfolio as we expanded into new markets and enhanced earnings growth across our platform. Looking ahead and backed by a strong liquidity position, we will remain active on the investment and acquisition front as we continue to deploy capital effectively in value-accretive opportunities that meet our strict return thresholds and also allow us to build scale and diversify our platform further while creating value for our shareholders.” Eng. Hamad Al Ameri added.

Alpha Dhabi continues to pursue acquisitions and investments as part of Its growth strategy and has announced several key transactions over the quarter. This includes the acquisition (subject to closing and regulatory approvals) - through Alpha Dhabi's subsidiary Pure Health - of a minority equity stake in Ardent Health Services, the fourth largest privately held acute care hospital operator in the U.S which will serve to add both scale and diversification to Alpha Dhabi’s growing healthcare vertical. Furthermore, Alpha Dhabi continues to build on its ESG and sustainability commitment and credentials having acquired a minority stake in Kalyon Enerji, a clean and renewable energy company based in Turkey at the beginning of October.

This transaction also represents Alpha Dhabi's first foray into the Turkish market as it continues to execute on its diversification strategy and capitalize on investment opportunities in new markets. Alpha Dhabi's portfolio expansion outside of the UAE continues to bear fruit with overseas revenue accounting for AED 3.4 billion year-to-date 2022, representing a 160% increase year-on-year.

Alpha Dhabi’s balance sheet remains strong and continues to grow with AED 109.1 billion in total assets, up significantly from year-end 2021 on the back of strong investment activity and the recent consolidation of Aldar Properties. The Group remains well-funded with a strong cash position of AED 16.9 billion to support and drive the execution of the Company’s growth and expansion across both sectors and geographies. Through our strong operating model, financial position, capital deployment track record and agile investment approach Alpha Dhabi remains uniquely positioned to continue to drive growth further and capitalize on investment opportunities while also generating value for shareholders in both the short and long term.

FINANCIAL PERFORMANCE AND METRICS

QUARTERLY INVESTMENT HIGHLIGHTS

Ardent Health Services (Ardent)

Alpha Dhabi entered into a definitive purchase agreement to acquire a minority equity investment in Ardent Health Services (Ardent), a leading U.S. healthcare provider based in Nashville, Tennessee, for a total investment of AED 1.8 billion. The investment is subject to customary closing conditions and will be finalized after receipt of all necessary U.S. regulatory approvals.

Kalyon Enerji Yatrimlari A.Ş (Kalyon Enerji)

During the current period, Alpha Dhabi agreed to invest AED 370 million alongside Multiply Utilities Holding LLC in Kalyon Enerji Yatrimlari A.Ş. The investment represents 20% of a 50% interest in the share capital of Kalyon Enerji. This transaction is the Group’s first investment in Turkey as part of its geographic diversification strategy.

-Ends-

ABOUT ALPHA DHABI HOLDING

Alpha Dhabi Holding (ADH), the UAE listed conglomerate, was established in 2013 and is one of the fastest growing Abu Dhabi based investment holding companies, with more than 100 businesses spread across healthcare, renewable energy, petrochemical and other industries as well as real estate, construction and hospitality. With over 72,000 employees, ADH is a strategic contributor to the UAE economy and is committed to drive continuous growth for its stakeholders through investments in emerging businesses, supporting innovation and diversity.

MEDIA CONTACTS

Alpha Dhabi Holding

Archana Koka

Investor Relations Officer

IR@alphadhabi.com

Brunswick Group

Omar Abu Khadra / Jade Mamarbachi

alphadhabi@brunswickgroup.com