PHOTO

Abu Dhabi, UAE:

Group H1 2023 Highlights

- Cross-platform growth gathers pace fueled by the execution of development revenue backlog, strong quarterly development sales, and growing contributions from the recurring income portfolio.

- Record development sales of AED 11.6 billion with 10 new project launches year-to-date.

- Sustained increase in demand from both overseas and resident expat buyers underscoring the continued appeal of Aldar’s offering and Abu Dhabi’s status as a premier investment and lifestyle destination.

- Strong growth in development revenue backlog at AED 24.4 billion, driven by robust market demand providing revenue visibility over the coming 4 years.

- Solid organic growth across the recurring income portfolio driven by stronger operating performance, with increased leasing activity, higher occupancy, and rental income.

- Acquisitions made in 2022 serve as drivers for accelerated growth, yielding strong returns and positively contributing to the bottom line.

- Ongoing execution of transformational growth strategy with a continued focus on disciplined capital deployment and geographic expansion outside of Abu Dhabi to unlock new opportunities.

- Notable transactions during H1 2023 include the acquisitions of Al Fahid Island, as well as the joint venture partnerships with Dubai Holding and Mubadala.

- Transactions announced in Q3 2023 include an AED 350 million investment to establish Cranleigh Bahrain and acquire two additional schools, Kent College Dubai and Virginia International Private School, as well as Aldar Estates’ strategic merger with Eltizam Asset Management Group.

- In July, Aldar partnered with Abu Dhabi Housing Authority to develop Balghaiylam, an integrated, sustainable residential neighborhood in the North Yas area valued at AED 8 billion. The project is scheduled to be completed by 2026 and will offer 1,743 homes for UAE Nationals.

- AED 500 million investment earmarked to redefine the retail experience at Al Jimi Mall and Al Hamra Mall.

- Healthy liquidity position with AED 4.5 billion of free cash and AED 5.9 billion of committed undrawn facilities, providing the dry powder to pursue attractive growth opportunities.

- Aldar reinforced its commitment to sustainability through the issuance of its inaugural USD 500 million green sukuk, which forms part of a wider USD 2 billion sukuk programme.

H.E. MOHAMED KHALIFA AL MUBARAK CHAIRMAN OF ALDAR PROPERTIES

“I am pleased to report that Aldar has produced a strong financial performance in the first half of 2023, driven by effective implementation of its ambitious growth strategy in the context of the UAE’s robust macro-economic fundamentals. Solid consumer and business confidence is supporting domestic demand, which is translating into strong development sales and high occupancy across the company’s portfolio of prime assets. This is a direct result of the successful socio-economic reforms enacted by the UAE government, which have positioned the country as a premier lifestyle, investment and business destination. Aldar continues to build on its formidable track record, capitalising on significant opportunities to deliver sustainable value to all our stakeholders.”

"TALAL AL DHIYEBI GROUP CHIEF EXECUTIVE OFFICER OF ALDAR PROPERTIES:

“As Aldar continues to pursue its transformational growth agenda, the company is today operating at a significantly elevated scale than just a couple of years ago. We achieved 10 new launches in the first half, more than in full-year 2022, and the investment business has seamlessly integrated new acquisitions, with the total value of Aldar’s owned recurring income asset portfolio increasing by almost a third over the last 12 months. Our operating model has proven highly effective at delivering accelerated growth. We look forward to launching our development franchise into Dubai and Ras Al Khaimah in the coming months, and deploying further capital to diversify our investment property platform.”

Business Unit Highlights

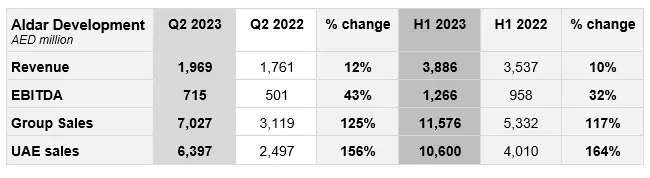

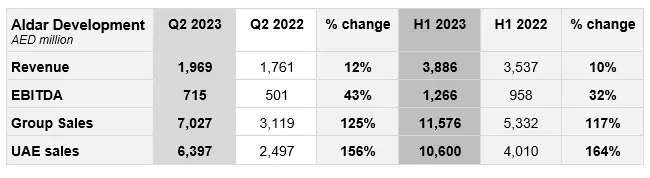

ALDAR DEVELOPMENT

This core business unit comprises three main segments: Property Development and Sales, which is responsible for developing and marketing Aldar’s diverse and strategic land bank located in key investments zones across Abu Dhabi, Dubai, and Ras Al Khaimah; Project Management Services, which manages Aldar's project management business, including government housing and infrastructure projects in the UAE; and Egypt, which manages Aldar’s investment in Egyptian real estate company SODIC.

-

Aldar Development’s Q2 2023 revenue increased 12% YoY to AED 2.0 billion with EBITDA increasing 43% YoY to AED 715 million. This was driven by construction progress and continued development backlog revenue recognition. H1 2023 revenue increased 10% to AED 3.9 billion compared to the same period last year with EBITDA increasing 32% YoY to AED 1.3 billion.

-

Group sales in Q2 2023 reached a record of AED 7.0 billion, a 125% increase from the same period last year. Meanwhile, H1 2023 group sales increased 117% YoY to AED 11.6 billion. This marks Aldar’s highest-ever quarterly and half-yearly sales, driven by a record number of launches and strong demand from a growing vein of overseas and resident expat buyers in the UAE.

-

Group revenue backlog reached a record AED 24.4 billion year to date, providing strong visibility on the group’s revenue across both the UAE and Egypt with revenue recognition expected over the next 4 years.

-

Project management services backlog of AED 61 billion demonstrates the long-term and perpetual nature of the franchise with AED 2.2 billion in new projects awarded year-to-date.

UAE Operations:

-

Total sales for Q2 2023 reached a record AED 6.4 billion, up 156% YoY, driven by high demand for existing inventory from Q1 launches as well as new Q2 launches including AlKaser, Reeman Living 2, and The Source 2. H1 2023 UAE sales increased 164% YoY to AED 10.6 billion.

-

Sales from overseas and expat buyers reached a record AED 3.3 billion in Q2 2023 underscoring the emergence of Abu Dhabi as a premier investment and lifestyle destination and the success of Aldar in attracting demand from a diverse range of international investors and expat resident buyers. Meanwhile, H1 2023 sales from overseas and expat buyers totalled AED 5.2 billion, representing a four-fold increase compared to H1 2022.

-

Revenue backlog of AED 19.9 billion, increased 65% year to date with an average duration of 29 months.

-

Cash collections stood at AED 1.55 billion.

Egypt Operations:

-

SODIC contributed AED 158 million (EGP 1.3 billion) to Aldar Development’s Q2 2023 revenue, with EBITDA standing at AED 49 million (EGP 409 billion). SODIC’s H1 2023 revenue stood at AED 335 million (EGP 2.7 billion), with EBITDA reaching AED 72 million (EGP 590 million).[1]

-

SODIC’s Q2 2023 sales reached AED 630 million (EGP 5.3 billion) while H1 2023 sales totalled AED 976 million (EGP 8 billion).1

-

Revenue backlog for SODIC reached AED 4.5 billion (EGP 37.8 billion), with an average duration of 25 months, providing strong visibility on revenue over the next 2-3 years.2

-

SODIC continues to maintain a strong liquidity position with total cash and cash equivalents amounting to AED 191 million (EGP 1.6 billion).[2]

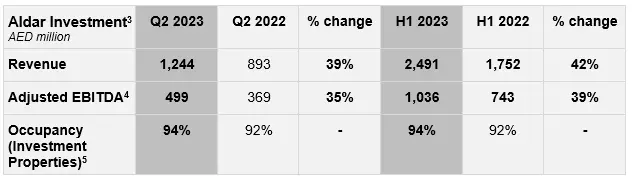

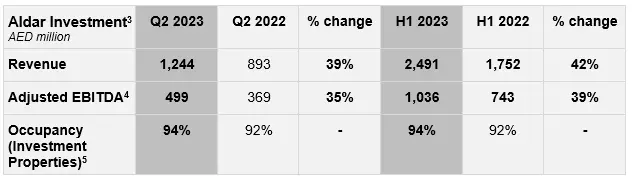

ALDAR INVESTMENT

Aldar Investment comprises four main segments representing over AED 33 billion of assets under management. Investment Properties houses Aldar’s core asset management business comprising over AED 24 billion of prime real estate assets across retail, residential, commercial, and logistics segments. Hospitality and Leisure owns a AED 4 billion portfolio of hotel and leisure assets principally located on Yas Island, Saadiyat Island, and Ras Al Khaimah. Aldar Education is the leading private education provider in Abu Dhabi with owned and managed schools footprint extending across UAE. Principal Investments comprises Aldar Estates, the region’s largest integrated property and facilities management platform offering a comprehensive range of services including property management, facilities management, advisory, security, and landscaping through its diverse portfolio of businesses, as well as Pivot, a construction services business, and Cloud, a flexible workspace solutions provider.

-

Aldar Investment’s Q2 2023 revenue reached AED 1.2 billion, representing a 39% YoY growth while Q2 2023 Adj. EBITDA rose 35% YoY to AED 499 million. H1 2023 revenue stood at AED 2.5 billion, representing a 42% YoY growth with Adj. EBITDA reaching slightly above AED 1.0 billion. This growth was mainly driven by contributions from acquisitions in 2022 as well as strong performance across core real estate assets and a notable rebound of the Hospitality portfolio.

-

The Investment Properties Q2 2023 Adj. EBITDA[6] increased 26% YoY to AED 347 million while H1 2023 Adj. EBITDA increased 21% YoY to AED 694 million. This was primarily driven by higher occupancy and rental rates across the portfolio, as well as positive contributions from 2022 acquisitions. Occupancy across the portfolio rose to 94% compared with 92% for the same period last year.

-

-

Residential Q2 2023 Adj. EBITDA was stable at AED 97 million, while H1 2023 Adj. EBITDA fell 7% YoY to AED 192 million due to the sale of strata units, and increased investment into the platform. The overall portfolio showed continued strength with a solid occupancy rate of 95%.

-

Retail Q2 2023 Adj. EBITDA rose 4% to AED 115 million supported by strong occupancy rate at 92% compared to 90% for the same period last year. H1 2023 Adj. EBITDA increased 2% YoY to AED 231 million. Tenant sales and footfall in Yas Mall rose 30% and 36% YoY respectively. Meanwhile, the occupancy rate at Yas Mall stood at 99%, representing a 4-percentage point increase compared to the same period last year. In July, Aldar announced an AED 500 million investment plan to redevelop two of its key retail portfolio assets in the UAE - Al Jimi Mall in Al Ain and Al Hamra Mall in Ras Al Khaimah.

-

Commercial Q2 2023 Adj. EBITDA increased 147% YoY to AED 140 million, while H1 2023 Adj. EBITDA increased 115% YoY to AED 281 million. This was driven primarily by stronger operating performance across the portfolio with occupancy at 96%. On the asset front, HQ and International Towers witnessed strong leasing activity, while Aldar’s four ADGM office towers have continued to outperform with occupancy at 98%. Continued robust demand for prime offices among GREs and international corporates has also led to Aldar’s upcoming Al Maryah Tower being 35% pre-leased with tenant handovers expected in August 2023.

-

Aldar Logistics recorded H1 2023 Adj. EBITDA of AED 25 million, with occupancy of 89%.

-

-

-

Hospitality and Leisure Q2 2023 EBITDA surged 184% YoY to AED 66 million while H1 2023 EBITDA increased three-fold YoY to AED 181 million. This was driven by positive contributions from 2022 acquisitions, as well as stronger operating performance across the portfolio. On a like-for-like basis (excluding the 2022 acquisitions), H1 2023 revenue rose 25% while EBITDA increased 153% YoY. Occupancy across the portfolio stood at 69%, up from 66% as at the end of Q2 2022 with average daily rates (ADRs) rising 53% across the portfolio.

-

Aldar Education Q2 2023 EBITDA increased 11% YoY to AED 52 million while H1 2023 EBITDA increased 12% YoY to AED 93 million driven by a 22% YoY increase in enrolments to just under 33,000 students across 27 operated and managed schools, up from over 27,000 students and 21 schools as at the end of Q2 2022. In July, Aldar Education increased its investment programme by AED 350 million to AED 1.35 billion with the acquisition of Kent College Dubai and Virginia International Private School as well as the establishment of Cranleigh Bahrain, which is set to open in the academic year 2024/2025.

-

The Principal Investments[7] witnessed a 51% YoY increase in Q2 2023 EBITDA to AED 35 million largely while H1 2023 EBITDA increased 70% YoY to AED 67 million driven by increased contributions from 2022 acquisitions. This was further supported by the organic growth of the Aldar Estates platform (mainly Khidmah and Provis).

-

-

Aldar Estates H1 2023 EBITDA increased 51% YoY to AED 59 million driven by meaningful contributions from new acquisitions and organic growth across existing businesses. During the year, Aldar Estates acquired Basatin Landscaping, and announced a strategic merger with Eltizam Asset Management Group as part of its drive to add scale, enhance diversification and broaden the offering and reach of its integrated property and facilities management platform.

-

-

ESG Highlights

As one of the UAE’s leading real estate developers, Aldar has a duty to uphold best practice international ESG standards. ESG is a core pillar of the company’s long-term growth strategy, with strong governance and responsible environmental and social impact integrated into its investment processes and business decisions. Highlights of Aldar’s recent ESG activities include:

-

During the year, Aldar Investment Properties (AIP) successfully raised USD 500 million through an inaugural green sukuk which forms part of a wider USD 2 billion sukuk programme. The 10-year sukuk was priced with a 4.875% coupon rate and is amongst the highest price tightening of any corporate issuance in 2023. The issuance was four times oversubscribed, attracting a range of local, regional, and international investors that placed total orders of over USD 2.3 billion. The proceeds of the sukuk will be used in accordance with Aldar’s Green Finance Framework to finance green initiatives and acquisitions.

-

The successful green sukuk issuance has bolstered Aldar's sustainability-linked financing to a total of AED 3.3 billion.

-

During Q2, Aldar completed a LEED gap assessment for its existing portfolio with plans to uplift more than 20 assets to LEED Gold and Platinum standards by H2 2024. The Company is also introducing green leases across its recurring income portfolio and finalising a tender for an onsite solar energy generation project to reduce Scope 2-related emissions.

-

Aldar and its subsidiaries have made considerable progress in attracting Emirati talent, resulting in UAE nationals now accounting for 42% of the total workforce. Since the beginning of the year, a total of 104 Emiratis have been successfully recruited, while 432 Emiratis have been hired since the announcement of NAFIS.

-

In Q2 2023, 41 graduate trainees successfully completed the Aldar Graduate Program and have been confirmed for full-time positions in various departments across Aldar Group. This achievement reflects Aldar's strong commitment to nurturing and empowering local talent.

-

Aldar launched a number of initiatives to deliver a positive impact to communities including the Annual Thrive Scholarship Programme for low-income families, a Worker Wellbeing Programme, and internships for people of determination.

Market Highlights

The UAE introduced corporate tax from June 1, 2023, which is aligned with the new global minimum corporate tax from the Organisation for Economic Cooperation and Development (OECD) that aims to combat tax avoidance in a global economy. The 9% corporate tax reflects the UAE’s determination to remain competitive and business friendly, especially for SMEs and startups. The Ministry of Finance have since issued multiple clarifications in relation to the real estate sector.

-

The Ministry of Finance issued transitional rules to help businesses to transition smoothly from the pre-implementation period of the Corporate Tax Law to post-implementation. As per these rules, companies with immovable property, such as land, buildings, and infrastructure assets, recorded on a historical 'cost basis,' are given relief on gains related to pre-implementation period and have an option to select the basis of relief, using either a 'time apportionment method' or 'valuation method'. This allows business groups to determine the most favorable outcome on immovable property on an asset-by-asset basis, ensuring a fair and transparent approach for assets and liabilities held.

-

The Ministry clarified that real estate investment income earned from immovable property owned by foreign or resident individuals, either directly or through a trust, foundation or other vehicle that is treated as fiscally transparent for Corporate Tax purposes, would not be subject to Corporate Tax. Moreover, REITs and other qualifying investment funds may benefit from an exemption from Corporate Tax on income derived from the investment in UAE immovable property, provided that the relevant conditions are met.

-Ends-

For further information, please contact:

Media

Obaid Al Yammahi

Aldar Properties

Investor Relations

Omar Nashaat

Aldar Properties

Sarah Abdelbary

Brunswick

aldar@brunswickgroup.com

About Aldar

Aldar Properties PJSC is the leading real estate developer, investor, and manager in the UAE with a diversified and sustainable operating model centered around two core businesses: Aldar Development and Aldar Investment.

Aldar Development is a master developer of integrated, liveable, and thriving communities across Abu Dhabi’s most desirable destinations, including Yas Island, Saadiyat Island, Al Raha, and Reem Island. It is responsible for developing Aldar’s c. 69 million sqm land bank and includes three businesses: Aldar Projects, which is Aldar's dedicated project delivery arm and the manager of its project management business; Aldar Ventures, which incubates and nurtures new business opportunities and innovation areas; and Aldar Egypt, the platform focused on developing mixed-use communities in Egypt.

Aldar Investment houses Aldar’s core asset management business comprising over AED 33 billion portfolio of investment grade and income-generating assets diversified across retail, residential, commercial, hospitality, and logistics segments. Aldar Investment also manages three core platforms: Aldar Education, Aldar Estates, and Aldar Hospitality and Leisure. Aldar Education includes Aldar’s entire educational portfolio, with almost 33,000 students across 27 operated and managed schools, and a growing network of 3,000 educators from over 100 nationalities, offering a wide range of curriculum and ancillary services such as a Teacher Training Academy. Aldar Estates, the region’s largest integrated property and facilities management platform, consolidates Aldar’s Retail Operations alongside existing Residential and Commercial real estate operations within Provis and will further include Community Management under one integrated property management platform. Aldar Hospitality and Leisure looks after Aldar’s portfolio of hotel and leisure assets, which are anchored around Yas Island and Saadiyat, in addition to Ras Al Khaimah. It includes Aldar’s portfolio of 13 hotels, comprising over 4,250 hotel keys and managing operations across golf courses, beach clubs, and marinas.

Aldar’s shares are traded on the Abu Dhabi Securities Exchange (Stock quote: ALDAR:UH), and is a profitable, cash-generative business that provides recurring revenues, and benefits from a diverse and supportive shareholder base. Aldar operates according to high standards of corporate governance and is committed to operating a long-term and sustainable business in order to provide ongoing value for its shareholders.

Aldar is driven by a vision to be a leading real estate developer and manager in the region by playing a key role in the development of quality, comfortable, desirable destinations that people can live in, work at and visit.

For more information on Aldar please visit www.aldar.com