PHOTO

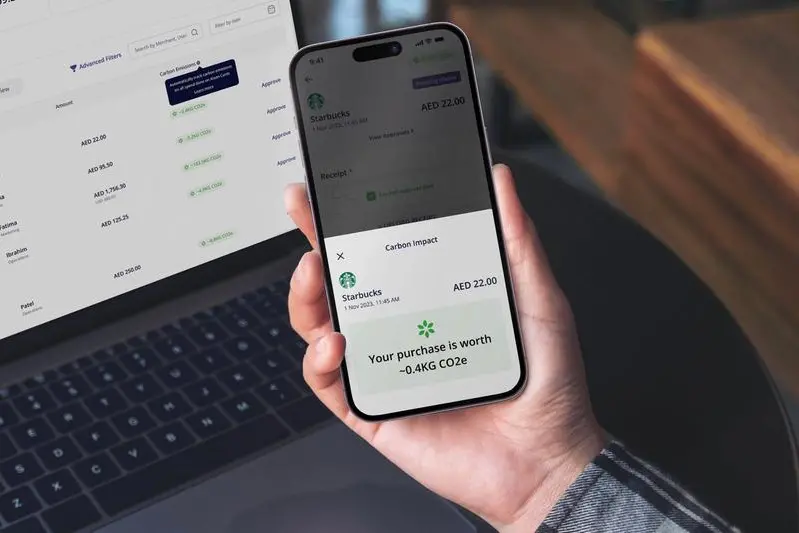

- Developed in partnership with Lune Technologies, innovative tracking feature allows enterprises with net-zero ambitions to estimate Scope 3 emissions for every transaction made with Alaan’s corporate card.

- Alaan aims to help enterprises address their Scope 3 emissions with tangible solutions by offering real-time insights and monthly summarised reports through tracking feature.

- Nearly 86% of the executives faces challenges measuring Scope 3 GHG emissions according to a Deloitte 2022 Sustainability Action Report.

Dubai, United Arab Emirates: Alaan, a leading corporate spend management fintech in the UAE, today announced the launch of a first-in-the-region Scope 3 emissions estimation feature for enterprises aiming for net zero. Alaan has partnered with Lune Technologies, an Emirati transaction data enrichment and analytics firm, to help companies track and report Scope 3 emissions for every transaction made with Alaan’s corporate card.

According to the Carbon Disclosure Project (CDP), Scope 3 emissions account for around 90% of an average company’s emissions. Further, Deloitte’s 2022 sustainability action report shows that nearly 86% of the executives reported challenges measuring Scope 3 emissions. In support of the UAE’s transition to net zero, Alaan will offer this tracking feature at no additional cost to all its customers, regardless of their pricing plan. The company has also ensured that all its corporate cards are carbon neutral, further assisting clients in reducing their Scope 3 emissions.

The emissions will be presented in real-time as a widget on the Alaan app beside each transaction, providing immediate insights. A monthly summarised report will also be available for enterprises to review and identify areas with the highest emissions, enabling them to address these with tangible solutions. Additionally, Alaan has worked with sustainability experts to create an emissions reduction playbook, a compilation of resources that helps enterprises reduce their scope 3 emissions.

Parthi Duraisamy, CEO and co-founder of Alaan, said: “As the UAE government and businesses make strides towards net zero, it is important that the right tools are available to businesses for the transition. Our new emissions-estimation feature represents the future of responsible corporate spending, which will be an integral component of every sustainability-focused company in the country.”

Helal Lootah, Co-CEO of Lune Technologies, said: “At Lune, we consistently evaluate the impact of our work, striving to improve end-customers' understanding of their spending and to empower them to make ethically conscious spending decisions. We are thrilled to partner with Alaan to introduce this pioneering feature and are eager to see how this new offering would shape the way enterprises look at sustainability in their expenses.”

Alaan is also leading by example with its own sustainability measures. All annual company gatherings are carbon-neutralised, and the company ensures carbon-neutral vendors are prioritised. Moreover, virtual meetings are the default mode of communication within Alaan, underscoring its dedication to reducing its own carbon footprint.

Launched in 2022, Alaan enables businesses to instantly issue physical and virtual corporate cards for managing a range of their business expenses, from e-commerce transactions and SaaS subscriptions to vendor payments, government services, and in-store purchases. The cards can be set up with daily or monthly spending limits and can also be configured for exclusive use with designated vendors, such as fuel stations. Alaan currently supports over 350 businesses in the UAE, which collectively employ more than 50,000 people across various sectors, including real estate, aviation, logistics, and retail.

About Alaan

Alaan’s mission is to simplify finance for businesses in the Middle East and help them prosper. Alaan is the largest and most comprehensive spend management platform in the Middle East, currently working with more than 350 companies.

About Lune Technologies

Lune is a UAE-based transaction enrichment and analytics platform. The company aims to unlock the value of transaction data across MENA by converting raw transaction data into valuable insights both for institutions and their end-users.