PHOTO

- Our digital services are more futuristic compared to others

- We aim to continue showing enormous capabilities, and providing services reflecting our boundless passion

- We put the youth at the center of all our products, services and offers

- Our mobile banking services are designed to make a difference in customers’ daily lives

- We succeeded in introducing the next generation of credit cards giving customers the freedom of choice

- “Apple Pay” complements a series of cutting-edge payment solutions, which we were the first to introduce

- We developed the design and functions of our branches, making them sustainable and more integrated with our digital channels

- Our digital successes are underpinned by the technological and regulatory leaps made by the government and the Central Bank of Kuwait

National Bank of Kuwait (NBK) starts a new year with thinking, planning and determination to build on the accomplishments made in 2022 towards enriching the banking experience of its customers. In this context, we are highlighting a few of the many milestones of Consumer Banking Group, within the ongoing progress under one slogan “meeting customers’ needs and expectations with the most advanced services, locally and globally”. This reflects a commitment to provide added-value banking solutions and totally exceptional campaigns, giving customers a more inclusive experience that makes them always feel special.

Speaking of the year’s recap, Mr. Mohamed Al-Othman, GM - Consumer Banking Group at National Bank of Kuwait said: “All figures and indicators demonstrate that NBK continues to be way ahead of competitors, with increasingly large gaps that are hard to narrow. This engraves in the minds of our team, as well as others, that NBK is the first in everything and that there is no compromise in maintaining this leadership, making everyone else compete for the second place, as the first place is always reserved for NBK.”

“The services we have provided throughout the year demonstrate our success in meeting our customers’ needs and even identifying what they see as unattainable aspirations as imperative goals, making our digital achievements more futuristic, compared to others,” Al-Othman noted.

“In 2023, we aspire to continue providing the products and services that reflect NBK’s enormous capabilities, enhance the trust placed in us by our customers over long decades, and prove our boundless passion and unwavering determination,” he added.

Al-Othman commended the major digital progress recently made by the government, which provides a solid foundation for digital advancement at all levels, especially the banking sector. He also commended the dedicated efforts made by the Central Bank of Kuwait in providing the regulatory environment supporting the continuation of digital transformation.

Superior mobile banking

Al-Othman highlighted: “We focused on enhancing the services of NBK Mobile Banking App by paying attention to the fine details of customers’ needs in a way that makes difference in their daily lives. For NBK Customers, mobile banking has become different from others; by providing them with all their needs, enabling them to pay for their purchases, helping them get a more enjoyable shopping experience, and offering them rewards, at the same time.”

“During 2022, we introduced many new services and enhancements, mainly including: linking the “SmartWealth” service with NBK Mobile Banking App, launching the “Apple Pay” service, and enabling service activation through the app, as well as allowing customers to temporarily restrict ATM cards.”

Al-Othman indicated that NBK Mobile Banking will witness further improvement in terms of design, services and additional enhancements during 2023, as part of the endeavors to match up to customers’ needs and expectations.

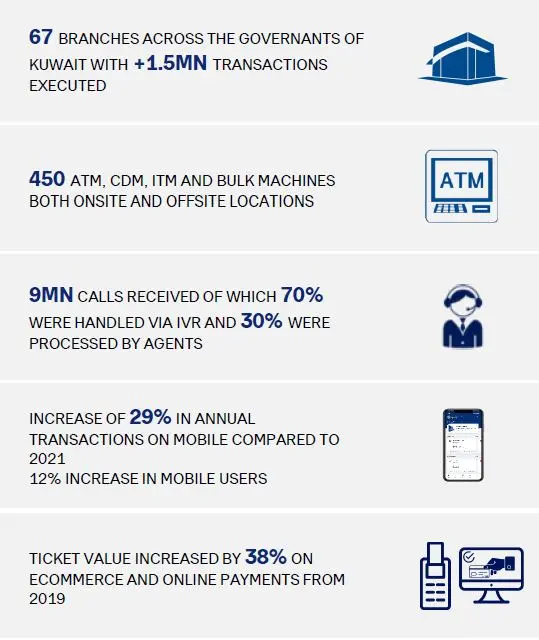

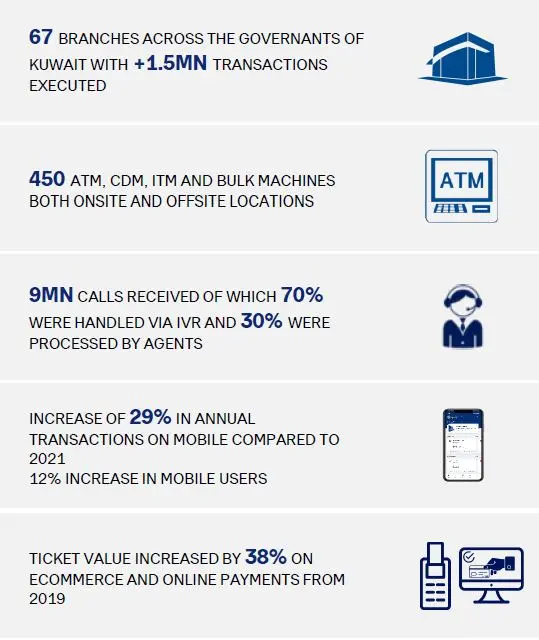

The massive interest of customers to rely on NBK Mobile Banking App for their transactions reflects the extent of progress. The number of registered users increased by 72% on year-on-year basis, and the app accounted for 64% of total banking transactions in 2022. Also, the number of transactions made through the app exceeded 17 times the number of transactions made through the branches.

Offers Like No Other

Al-Othman mentioned: “The year 2022 was a very special year for the youth, as they were the main focus of the work team’s attention, which is also mostly from by the youth. This was reflected in designing and implementing all our products and services, as well as the offers and rewards provided to customers.”

“Since the beginning of the year, NBK launched the “Offers Like No Other For Al Shabab” campaign, which offers unique and exclusive offers all year round, in partnership with many leading corporations and brands.”

“With these offers, the campaign succeeded to meet all the daily lifestyle needs of the youth. It was also exceptional in terms of the participating leading brands having strategic partnership with NBK, which were carefully selected from various sectors, not limited to shopping, but also catered to the various needs of the youth, including training, leisure… etc.

More options, more fun

This year, NBK launched the NBK KWT Visa Infinite Credit Card, marking the next generation of credit cards giving customers the freedom of choice, from the innovative design of the luxurious vertical, metal finish to the rewards tailored to the needs of all customer segments.

The new card gives customers the flexibility to choose the way they want to earn rewards based on their lifestyle; either the Spend Tier (offering NBK KWT Points up to 5% on digital payment on international POS and up to 3% on all other spends) or the Merchant Category option (offering NBK KWT Points up to 10% on dining and telecom, 5% on fitness and beauty and 3% on clothing, grocery and education).

World Cup vibes in Kuwait

NBK’s summer campaign for this year was exceptional, especially with the FIFA World Cup taking place just a few miles and days away. So, NBK brought the World Cup vibes to Kuwait by offering its customers from football fans the opportunity to enter a draw and be one of the 70 winners of exclusive packages to attend the FIFA World Cup Qatar 2022™ matches, in partnership with Visa.

Not only did NBK’s campaign stand out for being the largest in Kuwait and the region to provide tickets for the World Cup matches, but also for providing a package including air tickets, hotel accommodation, and match tickets for two persons, with 35 winners offered the experience to enjoy watching the matches from Visa’s Skybox.

Closer to you

Al-Othman says: “We are always closer to our customers, offering them extremely easy access to our services, either through our various digital channels or widespread branch network. In addition, we also strive to facilitate the process of all transactions and eliminate paperwork, making paper documents of the branches a thing of the past.”

During 2022, NBK introduced the digital signature service on all required documents related to various services including: obtaining a loan/credit card or increasing credit card limit. The service can be availed through NBK Online Banking and NBK Mobile Banking.

In addition to its success in being closer to customers in an easy and direct way, NBK succeeded in direct communication with customers through NBK Call Center, which received 9 million calls in 2022, 70% of which were handled through Interactive Voice Response (IVR), and 30% through Call Center agents.

Unique lifestyle

Al-Othman says: “We know very well how to care about the fine details that make our impeccable services provided to Premium Banking Customers enhance their unique lifestyle.”

“NBK is always keen to enrich the banking experience of Premium Banking Customers, and to include all family members as premium customers. This premium experience is available, not only inside Kuwait, but also worldwide, thanks to the Group’s broad geographical footprint.”

“Premium Banking Customers can also avail an array of exclusive services benefiting from NBK’s strategic partnerships with leading brands across different sectors to meet their needs, as well as enjoying Premium Concierge Service.”

Hassle-free payments

By the end of 2022, all NBK Mobile Banking Customers have become able to make contactless payments without using a card, regardless of the smartphone type, “Apple” or “Samsung”. Complementing the cutting-edge payment solutions, NBK launched the “Apple Pay” service for customers by year-end.

NBK provides customers with a range of contactless payment services using smartphones, smartwatches and digital devices, which offer the highest security and protection of customer data privacy, without charging any additional fees.

In addition, NBK led the way in providing this type of payment solutions for the first time in Kuwait, as of the beginning of 2020, even before the pandemic, by introducing “Fitbit Pay” service, which allows adding NBK Credit Cards to the compatible Fitbit smartwatches, giving the users of these smartwatches the advantage of safe, contactless payment during the pandemic.

Advanced and sustainable

In 2022, NBK progressed in implementing its consistent strategy towards expansion throughout Kuwait by focusing on the sustainability of these branches in terms of business sustainability as well as environmental sustainability.

To this end, the bank started gradual installation of solar panels as a supplemental source of energy in its local branches in Kuwait, after implementing this in Kaifan Branch, which will immensely contribute to its efforts to effectively reduce carbon emissions.

At the same time, NBK worked on developing branches to integrate with digital channels to meet the needs of customers, especially the high-net-worth, entrepreneurs and companies, through a comprehensive restructuring to prepare them for the future.

Youth-oriented

Al-Othman mentioned that “Weyay” is a banking experience launched a year ago and is still undergoing significant development. It mainly relies on direct communication with the youth customers, identifying their needs and meeting them in a way that suits their personality and lifestyle, especially that the digital bank’s team are also from the youth and are well aware of the needs of their generation.

“The figures demonstrate the success of the experience of launching the first digital bank in Kuwait, as the number of customers in “Weyay” exceeded 300%, compared to target levels at launch, instating “Weyay” as a new banking hub for the Kuwaiti youth.

The keyword

Al-Othman emphasized that all the achievements made during the year are mainly attributed to Consumer Banking Group staff, who exhibited relentless dedication, teamwork spirit, responsibility and commitment to cement NBK’s leading position and excellence in all respects.

The keyword to sustain NBK’s excellence remains in its team and the contributions of the high-caliber young talent who always show innovation and passion to offer customers the best services.

The best regionally

NBK has always been recognized with awards and top rankings among local and regional banks. However, the year 2022 was exceptional in terms of the number and nature of awards, as NBK gained the recognition of regional and international agencies for its digital services and cutting-edge banking solutions, winning most of the awards in this field.

Among the featured awards, NBK was garlanded with a stellar 13 awards in Global Finance’s World’s Best Consumer Digital Banks Awards for 2022 including “Best Consumer Digital Bank in the Middle East”.

-Ends-