PHOTO

In accordance with the 2023 dividend policy of the Group, a minimum dividend of AED 600 million (8 fils per share) will be distributed, resulting in an annual dividend yield of 7.74% based on the share price of AED 1.03. In November 2023, the Group disbursed a cash dividend of AED 300 million (4 fils per share) for the first half of the year. The remaining portion of the 2023 dividend, amounting to AED 300 million (4 fils per share), is scheduled for payment in April 2024. These proposed dividends await approval from shareholders during the upcoming General Assembly Meeting as recommended by the Company's Board of Directors. The dividend policy for subsequent years outlines a commitment to distribute a minimum of 70% of distributable profits. This dividend strategy reflects the Group's robust financial position and its confidence in generating substantial cash flows in the future.

SELECTED FINANCIAL HIGHLIGHTS FY’2023

| Operating Income -1.9% YoY | No. of Transactions +8.5% YoY |

| EBITDA -12.7% YoY |

9% growth in Non-Remittance Operating Income amid positive increase in diverse business streams.

FY’23 vs. FY’22

- Non-Remittance Operating Income increased by 9%

- Remittances Operating Income saw an 8% drop

- Total Transactions increased by 8.5% YoY

- Bank Notes have witnessed consistent growth in volumes marking 14.3%

- Wage Protection System (WPS) volumes saw a growth of 22.8%

- Prepaid Cards exhibited a 32.2% YoY surge in volume growth

- Corporate Business registered a notable 19.2% YoY increase in the value of transactions

- Digital channels reported an increase 27.5% YoY growth in the number of transactions conducted across the Group's digital platforms, accounting for 20% of the overall number of transactions

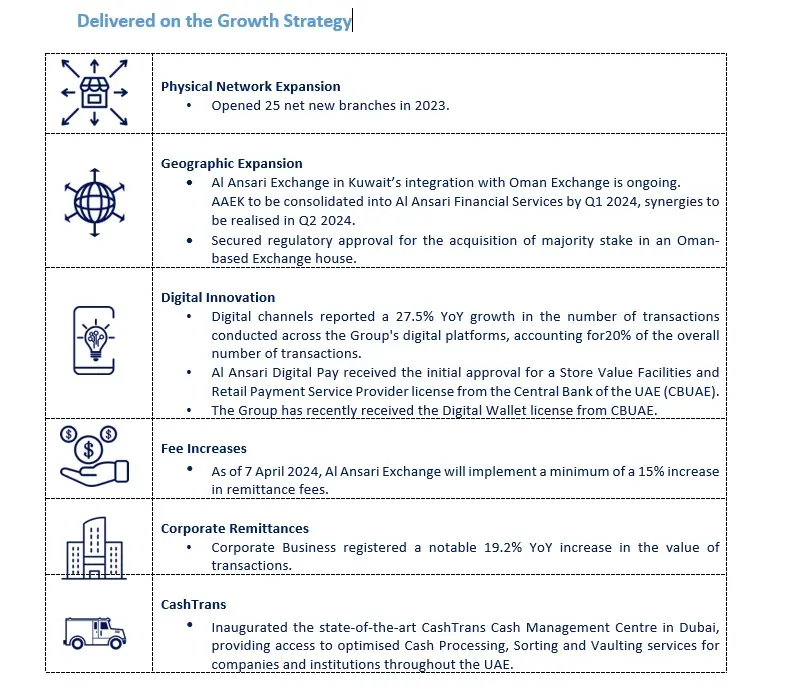

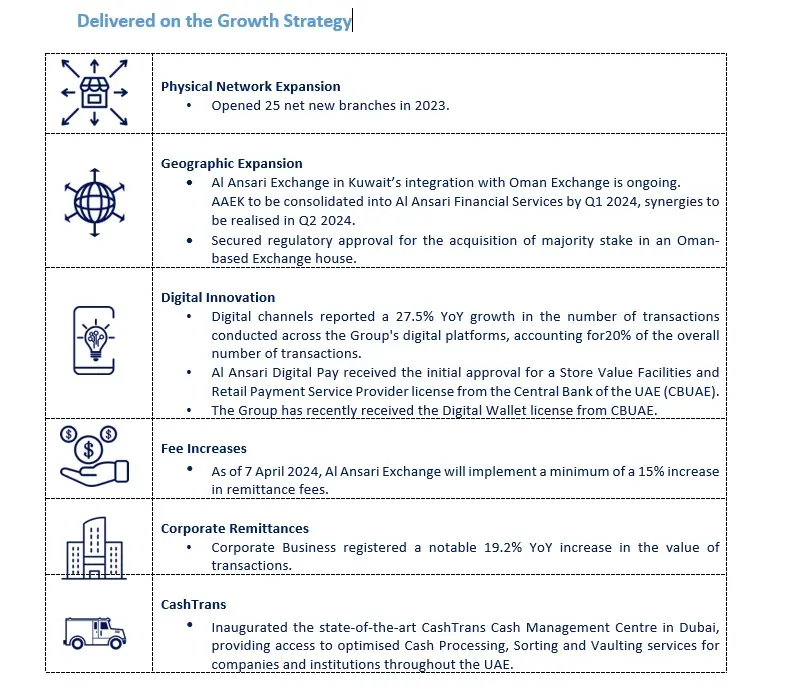

Expansion in line with the Group’s strategy and ambition, solidifying its market leadership position and regional plans.

- Al Ansari Exchange total number of physical branches reached 256 by end of 2023

- Al Ansari Exchange in Kuwait integration with Oman Exchange is still on going, to be consolidated into Al Ansari Financial Services by Q1 2024, with synergies to be realised Q2 2024

- Al Ansari Financial Services secured regulatory approval for the acquisition of majority stake in an Oman-based Exchange house

- Al Ansari Financial Services inaugurated the state-of-the-art CashTrans’ Cash Management Centre

Positive outlook amid receiving approval to raise remittance fees by a minimum of 15%.

The Foreign Exchange and Remittance Group (FERG) announced on Monday, 12 February 2024 that exchange houses under the jurisdiction of UAE authorities have received approval to implement a fee adjustment for a minimum increase of 15%.

Awards FY 2023

FORBES ME

- Forbes Middle East’s Top CEOs – Rashed A. Al Ansari (Group CEO) position 66, Raja Al Mazrouei (Board Member) position 86.

Dubai Quality Award

- Emirates Women Award in the Professional Category- Georgette Yousef (Group CHRO)

Government of Dubai’s Department of Economy and Tourism

- Consumer-Friendly Company – Al Ansari Exchange

the Pakistan Remittance Initiative

- Distinguished as Highest Remittance Sending Financial Institution to Pakistan

XB Payment Summit & Awards

- Best Mobile Remittance App– Al Ansari Exchange

MEA Finance

- Best Remittance and Foreign Exchange Service Provider- Al Ansari Exchange

- Best User Experience in Payments in the UAE -Al Ansari Financial Services

Sheikh Khalifa Excellence Award (SKEA) – 20th Cycle

- Gold Category (2023) – Al Ansari Exchange

Dubai, UAE – 14 February 2024 - Al Ansari Financial Services PJSC (DFM: ALANSARI), (the “Group”), one of the leading integrated financial services groups in the UAE, today reports its financial results for the full-year 2023 (FY’23) and the fourth quarter of 2023 (Q4’23).

Operating Income for the Group showed a marginal decline for the full-year 2023 of 1.9% year on year (YoY), attributed to a decline in the Remittance business that was offset by an 9% increase in demand across all other products and services.

Financial Highlights

| In AED thousands (unless otherwise stated) | Q4 ‘23 | Q4 ‘22 | % change (YoY) | FY’23 | FY’22 | % change (YoY) |

| Operating Income | 268,786 | 303,518 | (11.4%) | 1,132,102 | 1,154,480 | (1.9%) |

| EBITDA | 124,289 | 169,617 | (26.7%) | 563,156 | 644,726 | (12.7%( |

| EBITDA Margin (%) | 46.24% | 55.88% | (9.6%) | 49.74% | 55.85% | (6.1%( |

| Net Profit | 107,386 | 159,735 | (32.8%) | 495,189 | 587,658 | (15.7%) |

| Earnings per Share | 0.0143 | 0.0213 | (32.9%) | 0.0660 | 0.0784 | (15.8%( |

| Free Cash Flow (FCF) | 110,799 | 158,984 | (30.3%) | 571,963 | 613,771 | (6.8%) |

FY’23 Operational Highlights

| FY’23 | FY’22 | Change (unit) | |

| No. of physical branches in UAE | 256 | 231 | Net 25 new branches in 2023 |

| Total No. of transactions | 49.01 mn | 45.2 mn | 8.5% YoY |

| Corporate business - value of transactions | AED 106.7 bn | AED 89.5 bn | 19.2% YoY |

| Digital Channels - No. of transactions | 3.9 mn | 3.1 mn | 27.5% |

Financial Performance Commentary (FY’23)

- Headwinds in major remittance markets (such as India, Egypt, Pakistan) caused an 8% drop in remittance operating income. However, strong diversification drove an overall 9% increase in non-remittance operating income, largely mitigating the decline. Notably, transactions across all services grew by 8.5%, demonstrating customer trust and a resilient business model. This resulted in a marginal 1.9% decrease in total operating income, showcasing the company's adaptability and success in expanding beyond the remittances business.

- A 19.2% year-over-year increase in the total value of Corporate Business transactions, reaching AED 106.7 billion, underscores the Group’s successful strategic approach. This growth was driven by a focus on unmet needs in the segment, as evidenced by the strategic expansion of product offerings and notable growth in specific services like WPS.

- Customer demand for Digital Channels skyrocketed, with a remarkable 94% year-over-year increase in transaction values and a 27.5% growth in the number of transactions. This surge serves as a powerful testament to the success of the Group's user experience strategy, demonstrating its ability to seamlessly meet customer needs through convenient and accessible digital solutions.

- Despite ongoing expansion, increased manpower needs, and challenging regional economic conditions, the Group maintained a remarkable EBITDA margin of near 50%. This resilience reflects the Group’s commitment to cost-effective operations, even as it invested in growth initiatives. By effectively managing expenses and leveraging economies of scale, the Group was able to mitigate the impact of rising costs and ensure profitability amidst external pressures. This unwavering focus on cost optimisation positions it well for continued success in the evolving market landscape.

- A 15.7% year-over-year decline in Net Profit to AED 495 million was due to a temporary drop in the remittance segment and increased expenses. The recently announced approval to increase remittance fees will help offset these costs and strengthen financial performance in the future.

- Demonstrating commitment to its growth strategy, the Group strategically allocated AED 45.2 million in capital expenditures (CAPEX), representing a 45.4% increase year-over-year. This ongoing investment fuels business expansion and positions the Group for continued success in the evolving market landscape.

- The Group‘s Cash Flow from operations after adjusting for CAPEX amounted to AED 518 million, reflecting a very healthy 92% EBITDA to cash conversion rate.

Q4‘23 Financial Performance Commentary

- Operating income for Q4 2023 fell 11.4% year-over-year to AED 269 million. While primarily driven by a drop in the Remittance business, strong growth in Corporate Business, Bank Notes, WPS, and other services mitigated the decline. This highlights the success of the Group's diversification strategy and its ability to adapt to changing market conditions.

- EBITDA in Q4 2023 declined by 26.7% year-on-year and amounted to AED 124.3 million. This drop was primarily driven by increased operating costs, largely stemming from the Group's network expansion, as well as industry-wide rising costs. Additionally, a lower margin in the Remittance business contributed to this decline.

- The Group's Net Profit for the quarter fell by 32.8%, dropping to AED 107 million. This decline was driven by two main factors: an increase in depreciation charges associated with the branch network expansion and a temporary decrease in outward personal remittances to major receiving countries.

FY ‘23 Performance of other offerings

- FY'23 saw phenomenal success for Worldwide Cash Express, the Group’s dedicated money transfer service. Transaction numbers surged by 33% year-over-year, a testament to the vital role it plays in meeting the financial needs of the corporate customers.

- Robust growth propelled the Wage Protection Services (WPS) business in FY'23, with transaction volumes soaring by 26% year-over-year and Operating Income climbing by 11%. This momentum stemmed from two key factors: the successful onboarding of new corporate clients and a significant rise in the number of wage disbursals facilitated through the service.

- 2023 was a banner year for CashTrans, the Group’s comprehensive cash management solution. It saw an impressive 110% increase in its external customer base, coupled with a 33.5% year-on-year jump in the number of trips completed, demonstrating its growing popularity and effectiveness.

-

- The Group inaugurated its first state-of-the-art Cash Management Centre in Dubai, providing access to optimised Cash Processing, Sorting and Vaulting services for companies and institutions throughout the UAE.

Dividend

- The Board of Directors recommended a dividend of AED 0.04 per share to be approved by the shareholders at the upcoming Annual General Meeting, representing a payout of AED 300 million for the second half of 2023.

- A total dividend payment of AED 600 million implies a dividend yield of 7.55% based on the closing price of AED 1.06 per share on 31 December 2023.

Commenting on the results, Mohammad A. Al Ansari, Chairman of Al Ansari Financial Services, said:

“In the face of a challenging economic environment, Al Ansari Financial Services has successfully weathered the storm, emerging from FY 2023 stronger and more resilient than ever. Our commitment to excellence and unwavering focus on customer satisfaction have been pivotal in achieving significant milestones during the fiscal year. We are proud to report that our strategic growth initiatives and dedication to innovation have resulted in substantial achievements, delivering long-term value to our stakeholders.

Our financial metrics underscore the strength of our operations and the effectiveness of our growth strategies. Al Ansari Financial has managed to maintain its stability thanks to the hard work and dedication of our team and the continued support of our stakeholders.

As we look to the future, Al Ansari Financial remains steadfast in its commitment to upholding the highest standards of excellence and contributing positively to financial inclusivity. Our focus on innovation and customer satisfaction will continue to be the driving force behind our success.

We extend our sincere gratitude to our shareholders, customers, and partners for their trust and collaboration. Al Ansari Financial is optimistic about the future, confident in our ability to navigate challenges, and poised to seize new opportunities.”

Rashed A. Al Ansari, Group CEO of Al Ansari Financial Services, said:

“Today, I am delighted to share a pivotal development as part of our comprehensive 6-pillar growth strategy. The Foreign Exchange and Remittance Group (FERG) has obtained approval for exchange houses under the jurisdiction of UAE authorities to implement an optional strategic fee adjustment, allowing for a minimum increase of 15%. This strategic move aligns seamlessly with our commitment to sustainable expansion and is anticipated to exert a substantial positive influence on our financial performance, directly impacting our bottom line and bolstering overall profitability.

As we implement these changes, we emphasise transparent communication with our valued stakeholders. Clear and open dialogue will be integral to ensuring a smooth transition and fostering positive relationships with our clients.

I am also pleased to report a resilient performance for FY 2023 where we successfully executed on our strategy, generating strong growth in non-remittance earnings and forging progress on all fronts.

Our non-remittance operating income across all verticals experienced a noteworthy 9% year-on-year increase, reflecting the strength of our diversified portfolio.

Challenges related to parallel exchange rates impacted outward remittances, leading to an 8% decline. However, our total operating income demonstrated a marginal 1.9% decline to AED 1.132 billion, driven by an impressive 8.5% year-on-year growth in the total number of transactions, surpassing 49 million, which is an all-time high in the company’s history and equivalent to more than 134 thousand transactions per day.

Our standout performers include Bank Notes, WPS, and B2B transactions reflecting our commitment to serving the corporate segment.

Digital channels continued to gain popularity, with a 27.5% year-on-year growth in transactions, enhancing the customer journey and lowering costs. Despite a rising operating cost environment, our EBITDA margin held steady at near 50%, a testament to our operational efficiency.

In line with our aggressive expansion strategy in 2023, we opened the state-of-the-art CashTrans’ Cash Management Centre and 25 net new branches. In addition, Al Ansari Digital Pay received the initial approval for a Store Value Facilities and Retail Payment Service Provider license from the Central Bank of the UAE. Each of these milestones marks progress against the six pillars of our strategy. Developing and delivering products that drive financial inclusion and enable our customers to attain financial wellbeing is essential to our strategy.

Our commitment to Emiratisation is evident, as we proudly welcomed 286 UAE Nationals to our Group, bringing the total number of Emirati employees to over 641. This remarkable achievement represents 14% of the Group's employee base in the UAE. Moving forward, we remain dedicated to fostering a workplace that reflects the diversity and inclusivity of our nation. We view Emiratisation as a strategic imperative, and we are excited about the opportunities it brings for both our organisation and the communities we proudly serve. As we look ahead, we remain committed to resilience, operational excellence, and creating sustainable value for our stakeholders."

Other Major Updates

EMPLOYEES

The Group's workforce expanded by 14.3% in 2023 compared to 2022, reflecting its ongoing expansion strategy. This consistent growth is necessary for the Group's ability to meet its ambitious goals.

Emiratisation initiatives yielded remarkable results in 2023, with a substantial 81% increase in the number of Emirati employees compared to 2022. This aligns with the Group's strong commitment to supporting the government's Emiratisation drive. Dedicated training programmes, active recruitment at career events, and collaborations with leading universities in the region have been instrumental in achieving this progress.

NEW FEE ADJUSTMENT

The Group reports a significant milestone in its 6-pillar growth strategy with the successful approval of the revision of transfer fees. This strategic move is poised to have a profound impact on the Group's financial performance, aligning seamlessly with its commitment to sustainable expansion.

Effective April 7, 2024, AlAnsari Exchange will initiate a gradual, minimal 15% adjustment to transfer fees. It's important to note that this adjustment will be segmented, ensuring a strategic and targeted approach to enhance overall profitability.

Al Ansari Financial Services and Al Ansari Exchange look forward to the positive impact this strategic decision will bring and remain committed to delivering exceptional value to its customers, shareholders, and stakeholders.

For further information, please contact:

Orient Planet Group (OPG)

Email: media@orientplanet.com

Website: www.orientplanet.com