- Robust H1 performance across segments driven by acquisition of Zakher Marine International, expansion of Integrated Logistics offerings and healthy charter rates for Tankers & Gas Carriers

- Company continues its smart growth strategy, expanding into new verticals, creating fresh revenue streams and expanding its fleet

Abu Dhabi, UAE : ADNOC Logistics and Services plc (ADNOC L&S) (ADX symbol ADNOCLS / ISIN AEE01268A239), a global energy maritime logistics leader, today announced exceptional financial results for the first half of 2023, marking its maiden earnings report since its record-breaking IPO in June 2023 on the ADX exchange.

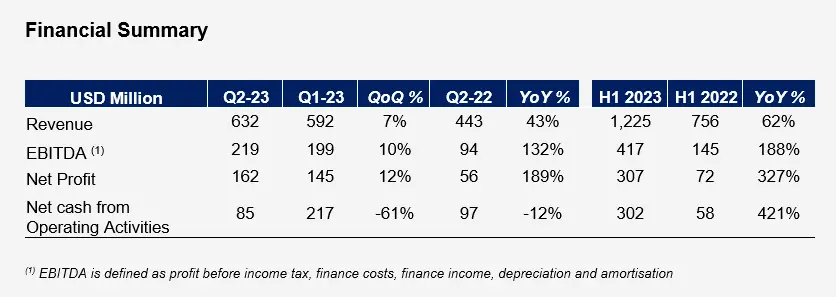

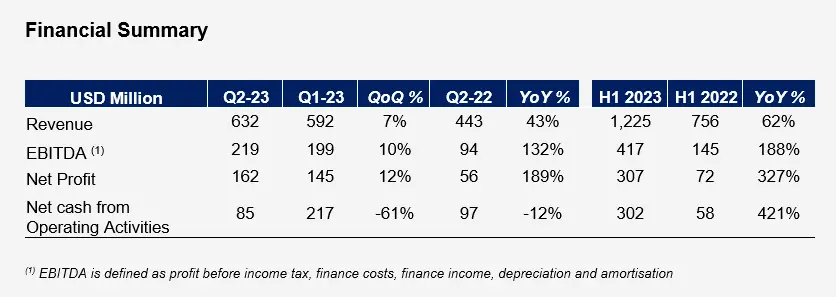

In the first half of 2023, ADNOC L&S recorded a net profit of $307 million, or $0.04 or AED0.15 per share, representing a more-than fourfold increase compared to the net profit of $72 million recorded in H1 2022.

The Company recorded revenues of $1,225 million in the first half of 2023, marking an increase of 62% compared to the first half of 2022. This increase was driven by revenue growth across the Company’s three business segments: Integrated Logistics, Shipping, and Marine Services.

The Company reported an EBITDA of $417 million in the first half of 2023, representing a 188% year-on-year (y-o-y) increase. This was driven by a higher contribution from all three business segments. This translated into an EBITDA margin of 34.1% in the first half of 2023, substantially higher than the EBITDA margin of 19.2% in the first half of 2022.

ADNOC L&S delivered a positive free cash flow of $82 million in the first half of 2023. The Company had no debt financing drawn by 30 June 2023, strategically positioning itself for the implementation of its announced smart growth strategy.

Commenting on the Company’s strong maiden results, Captain Abdulkareem Al Masabi, CEO of ADNOC L&S, said: “Following our record-breaking IPO, ADNOC L&S has delivered exceptionally strong financial results for the first half of 2023 with a 327% growth in net profit over the same period from last year. This impressive performance is driven by our responsible plans to expand our asset and customer base, decarbonize our operations and enter new verticals in a timely manner, while strategically positioning ADNOC L&S to capitalize on ADNOC’s ambitious growth strategy. As part of our smart growth strategy, we remain focused on extending our geographical footprint, exploring new revenue streams, and unlocking further value for our shareholders.”

Segment-wise Financial Performances

ADNOC L&S’ Integrated Logistics segment reported revenues of $729 million in the first half of 2023, an increase of 136% y-o-y following the successful acquisition of Zakher Marine International (ZMI) and expanding its Integrated Logistics service offering.

Integrated Logistics reported EBITDA of $232 million in the first half of 2023, an increase of 519% y-o-y. The EBITDA margins in H1 2023 showed significant improvement, reaching 31.8% compared to 12.1% achieved in H1 2022.

The Company’s Shipping segment reported revenues of $408 million in the first half of 2023, an increase of 9% y-o-y primarily driven by higher charter rates and increased vessel days for Tanker and Gas Carriers. This growth was partially offset by a lower contribution from Dry-bulk shipping due to reduced charter rates.

Shipping reported EBITDA of $168 million in the first half of 2023, reflecting an increase of 61% y-o-y. EBITDA was further supported by a 7% reduction in direct costs during the first half of 2023. This translated into delivered EBITDA margins of 41.2% in H1 2023, significantly higher than 28% in H1 2022.

The Marine Services segment reported revenues of $88 million in the first half of 2023, an increase of 19% y-o-y. Marine Services reported an EBITDA of $17 million in the first half of 2023, an increase of 70% y-o-y. EBITDA margins of 19% in H1 2023 were significantly higher than 14% in H1 2022.

Strategic Update

ADNOC L&S continues to make significant strides in executing its smart growth strategy by expanding into new business verticals, creating fresh revenue streams, and continuing to strategically expand its fleet. During Q2 2023, the Company secured a $975 million Engineering, Procurement and Construction (EPC) contract from ADNOC Offshore for the construction of an offshore artificial island. The provision of EPC services in the integrated logistics sector is a new offering by ADNOC L&S, aligned with the Company’s smart growth strategy, enabling it to generate fresh revenue streams by expanding into new business areas.

In addition, ADNOC L&S took the delivery of two of the four newbuild, LNG dual-fuel Very Large Crude Carriers (VLCCs) schedued to be delivered this year as part of its strategic fleet expansion. These vessels are categorized as one of the most environmentally efficient in operation today as a result of their dual-fuel engine that is also designed to run on lower emitting Liquified Natural Gas (LNG). ADNOC L&S has committed approximately $2 billion to building more environmentally efficient vessels and has successfully reduced the carbon intensity of its owned fleet by more than 20% between 2018 and 2022.

Health, Safety and Environment (HSE)

ADNOC L&S remains fully committed to achieving 100% compliance with HSE standards and was honored with an International Marine Contractors Association (IMCA) Award for Safety for its “Smart Vessels” in Q2 2023. This award recognizes ADNOC L&S for its successful implementation of the “Smart Vessels” initiative which uses advanced Artificial Intelligence systems on more than 80 offshore vessels, harnessing the capabilities of CCTVs, sensors and intelligent video analytics to bolster safety protocols and elevate the level of monitoring and control onboard.

Outlook

In line with guidance issued at the time of our IPO, the medium-term targets are as follows:

Group

- Consolidated Revenue: We target mid-to-high single digit growth year-on-year in the medium term.

- Consolidated EBITDA: We target an EBITDA margin of above 30% in 2023. Over the medium term, we target average annual EBITDA growth in the low teens towards an EBITDA margin of 35%.

- Capital Structure: We target 2.0-2.5x net debt / EBITDA over the medium term.

Dividend

The Board has adopted a dividend policy aimed at maximizing shareholder value while reflecting the Company’s strong earnings potential and cash flow generation. This approach enables the Company to retain sufficient capital to fund ongoing operations while investing in long-term value-accretive growth.

The Company intends to pay a dividend in Q4 2023 for the first half of 2023, with the specific dividend amount to be determined by the Board. At the time of listing, the Company indicated an H1 2023 dividend of $65 million, which equates to a dividend of AED0.032 per share to be paid in Q4 2023. A final dividend is anticipated to be paid in Q2 2024 for the second half of 2023. At the time of listing, the Company indicated an H2 2023 dividend of $130 million.

Subsequently, the Company expects to progressively increase the 2023 annual dividend per share on a basis of at least 5% annual growth over the medium term, while regularly reviewing the policy in light of value-accretive growth opportunities. The Company intends to pay dividends twice each financial year, with the initial payment of the first-half results to be made in the fourth quarter of that year, and the second payment following the second-half results to be made in the second quarter of the following calendar year.

-Ends-

About ADNOC Logistics & Services

ADNOC Logistics & Services, listed on the Abu Dhabi Securities Exchange (ADX symbol ADNOCLS / ISIN “AEE01268A239”) is a global energy maritime logistics company based in Abu Dhabi. Through its three business units; integrated logistics, shipping and marine services, ADNOC L&S delivers energy products to more than 100 customers in over 50 countries.

To find out more, visit: www.adnocls.ae

For media enquiries, please contact Maryam Alameeri, Vice President Corporate Communications on media@adnocls.ae

For investors enquiries, please contact: IR@adnocls.ae