PHOTO

Abu Dhabi, UAE: Abu Dhabi Islamic Bank (ADIB), a leading financial institution, announced today the launch of their first-ever plot financing offering, enabling customers to purchase a piece of land for the purpose of investment or to fulfil their homeownership goals. The offer, available to both residents and non-residents, allows buyers to purchase property or make plot handover payments to own freehold residential plots at renowned residential communities.

The new offering comes in response to the rising interest in land purchases among nationals and residents alike. With property and land prices rising in the UAE since last year, people are increasingly looking to purchase land as an asset or as a way of building their own property.

Buyers can expect financing of up to 60% of the land plot value, with waiver of early settlement charges up to 30% of outstanding finance each year.

Sameh Awadallah, Acting Global Head of Retail Banking, said: “Over the years, ADIB has introduced many innovative financing offerings that have been well-received by our customers. With more than 1 million customers banking with us, we have been able to leverage on our customer insights to bring new offerings that continue to support our customers. With the significant increase in people asking about purchasing property or buying their own land across the UAE, we decided to design a product that allowed both residents and UAE nationals to finance their lands.”

ADIB Plot Finance is currently available for select developments, including Al Dar Properties and Emaar Properties, and features attractive low profit rates.

About ADIB

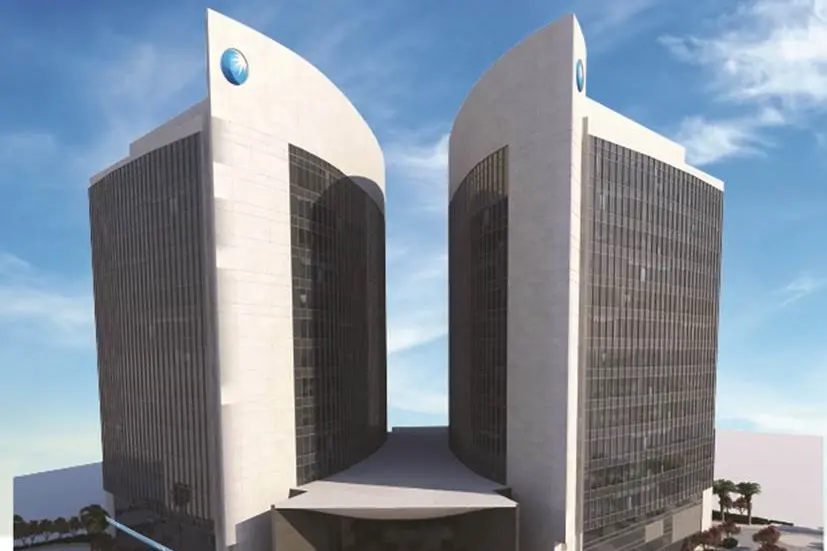

ADIB is a leading Islamic bank with more than AED 133 billion in assets that was established in 1997 with its shares traded on the Abu Dhabi Securities Exchange (ADX). Over 1 million customers benefit from its large distribution network of 70 branches and more than 500 ATMs. The bank also offers world-class online, mobile and phone banking services, providing clients with seamless digital access to their accounts 24 hours a day. ADIB provides retail, corporate, business, private banking and wealth management solutions. ADIB remains one of the leading banks in the recruitment, development and promotion of local talent. The bank has one of the highest Emiratisation ratios with more than 40 percent of the bank’s workforce being UAE Nationals. ADIB has presence in six strategic markets: Egypt, where it has 70 branches, the Kingdom of Saudi Arabia, the United Kingdom, Sudan, Iraq and Qatar.

Named “Best Islamic Bank globally” by The Financial Times’ The Banker publication and Best Bank in the UAE by Forbes, ADIB has a rich track record of innovation, including introducing the world’s first digital Islamic bank for youth and being the first bank in the UAE to enable account opening through facial recognition.