PHOTO

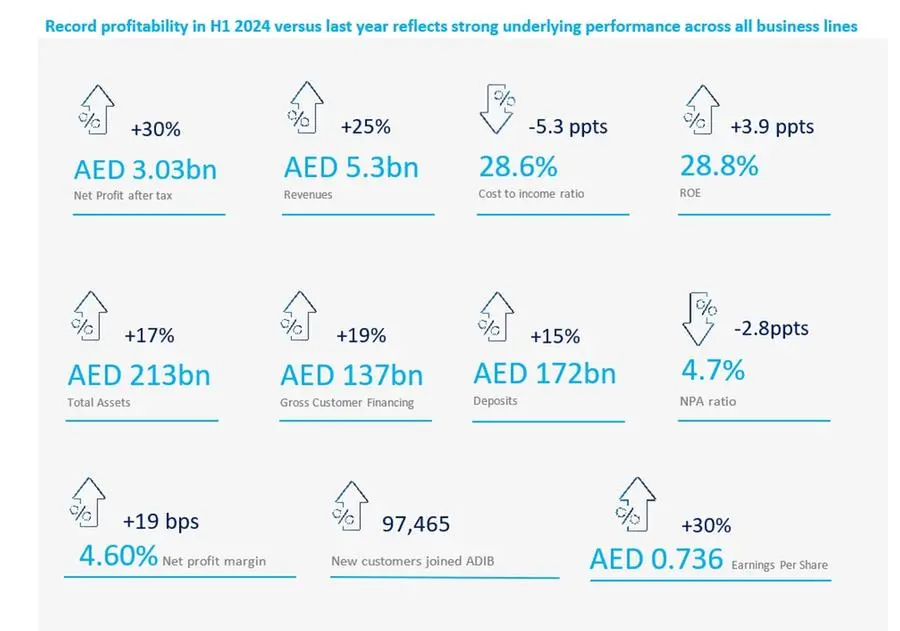

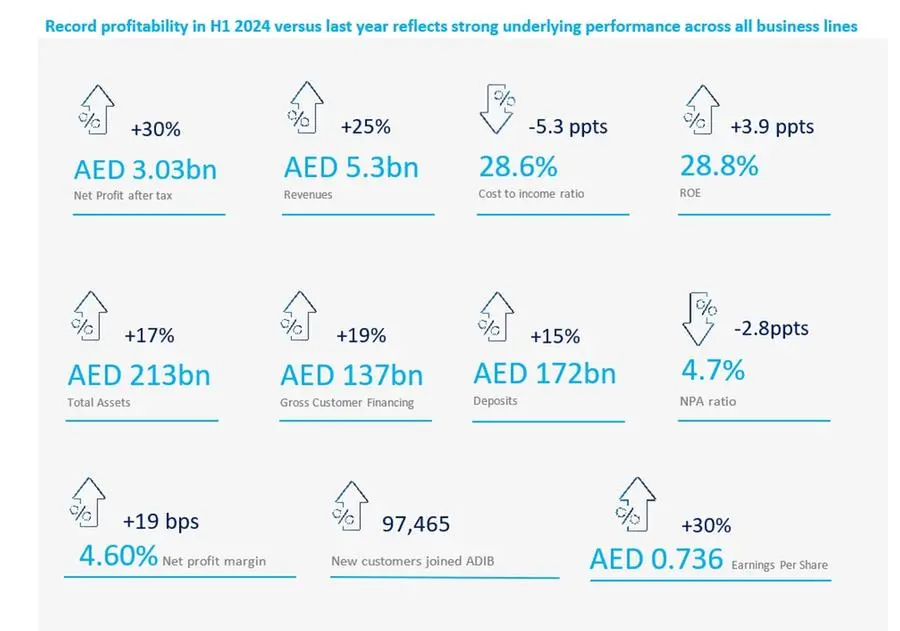

- Net Profit after tax grew 30% YoY to AED 3.03 billion

- Quarterly profit (before tax) of AED 1.78 billion up 38% YoY

- Assets surpass AED 200 billion milestone driven by strong growth in customer financing

Net Profit

- Abu Dhabi Islamic Bank reported a growth in Net Profit after tax of 30% for H1 2024 to AED 3.03 billion from AED 2.33 billion in H1 2023. Strong Balance Sheet growth coupled with enhanced Net profit margins and fee-based income generation has fueled the bank's exceptional financial performance.

- Net profit before tax was AED 3.42 billion, up 40% versus H1 2023.

- Q2 2024 Net Profit after tax reached AED 1.58 billion, up 9% sequentially and 29% YoY.

Revenues

- Revenue for H1 2024 improved by 25% to AED 5.35 billion compared to AED 4.26 billion last year for the same period supported by strong business volumes across all business segments and products, and continued strength in fee-based businesses.

- Revenue for Q2 2024 increased 27% YoY to AED 2.8 billion up 13% sequentially.

- Funded income grew by 13% YoY to AED 3.3 billion in H1 2024 compared to AED 2.9 billion last year, driven by higher volumes and better margins.

- Net Profit Margin reached 4.6% widening 19bps YoY reflecting higher rates and discipline on both asset and liability pricing.

- Non-funded income grew by 52% YoY to reach AED 2.0 billion in H1 2024 versus AED 1.3 billion last year driven by 28% growth in fees and commissions from Investment banking, retail and cards. Non-funded Income contributes 38% to Operating Income versus 31% in H1 2023, underlining continued strategic focus on revenue diversification.

Expenses

Cost to income ratio improved by 5.3 percentage points to 28.6% versus 33.9% in the previous year. This was predominantly driven by growth in income and enhanced productivity.

Provisions and asset quality

- Impairments increased 9% to AED 402 million for H1 2024 in line with Financing growth and prudent risk management translating to an annualized cost of risk (CoR) at 55bps.

- Non-Performing asset ratio improved to 4.7%, its lowest level since Q4 2018, due to active management of our legacy portfolio coupled with strong underwriting standards.

- Provision Coverage ratio, including collaterals, improved by 20.8 percentage points to 149.3%.

Balance sheet

- Total assets surpassed AED 200 billion milestone, increasing 17% YoY to reach AED 213 billion, driven by 21% growth YoY in financing as retail financing delivered a strong quarter, reflecting market share gains across key segments, and corporate banking closing landmark deals.

- Customer financing grew 15% YTD with AED 16 billion of new financing extended to customers.

- Customer deposits rose 15% YoY to reach AED 172 billion versus AED 150 billion in H1 2023, maintaining a healthy funding mix with 9% growth in Current and Savings Accounts (CASA), with CASA comprising 63% of total deposits.

Liquidity and capital

ADIB maintained a robust capital position with a Common Equity Tier 1 ratio of 12.9% and a

total Capital Adequacy Ratio of 17.2%. The bank’s liquidity position was healthy and within regulatory requirements, with the advances to stable funding ratio at 79.5% and the eligible liquid asset ratio at 19.7%.

H.E Jawaan Awaidah Al Khaili, Chairman:

“We achieved another set of record results. Our second-quarter and first-half earnings for 2024 reached new highs, with notable improvement across all metrics and total asset base crossing the AED 200 billion threshold for the first time.”

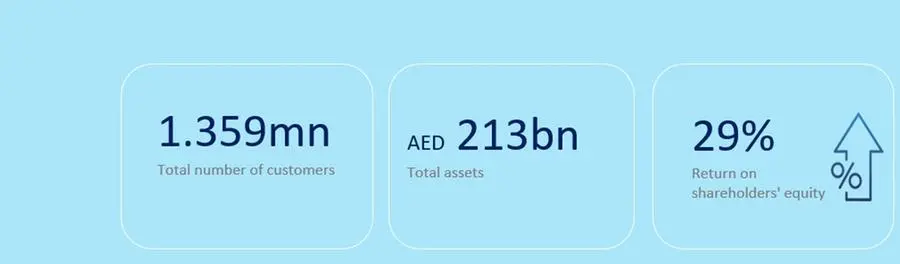

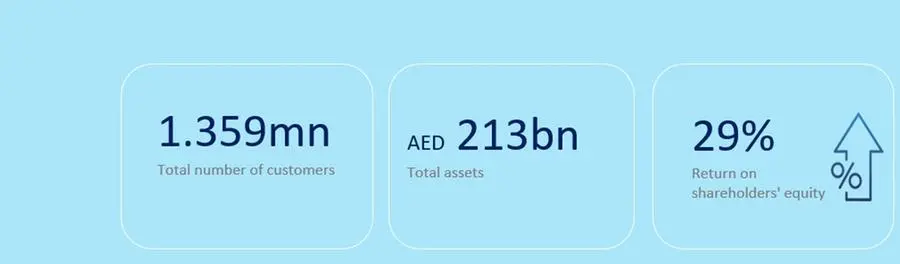

“We achieved another set of record results as second-quarter and first-half earnings reached new highs, with net profit after tax growing 30% to AED 3.03 billion implying a strong return on equity of 29%, one of the highest levels in the region’s banking sector. This strong growth reflects the healthy and resilient local economy coupled with our focus on sustaining business momentum and delivering transformational initiatives.

We have seen notable improvement across all metrics as we continued to grow market share across key segments, with total asset base crossing the AED 200 billion threshold for the first time, led by a record quarter in retail financing and corporate banking closing landmark deals.

The swift actions we are taking to deliver on our strategic priorities, serving as a trusted partner and putting our customers at the center of everything we do, have successfully deepened our relationships with our customers and expanded our customer base across all our businesses, adding 97,500 new customers in the first half of 2024, bringing the total number of customers to 1.359 million.

Equally pleasing is that this sound financial performance is underpinned by a clear commitment to excellence. It is a matter of great pride that ADIB has been named best Islamic bank in the region by Euromoney, a significant tribute to the bank's exceptional performance.

ADIB’s strategic journey is marked by a steadfast commitment to sustainability. Building on this, we have made significant progress in our sustainability journey including defining a clear pathway towards a net-zero future by setting new emission target reduction, demonstrating our commitment to reducing our carbon footprint.

The UAE once again proved itself to be a haven of economic and financial stability, recording strong growth driven by an acceleration of economic diversification. Against this backdrop, ADIB remained committed to take advantage of the growth opportunities while we continue to invest in technology and innovation to drive efficiencies and enhance our service."

Mohamed Abdelbary, Acting Group Chief Executive Officer (AGCEO):

“Our first-half 2024 results reflect sustained growth across all business lines, driven by robust financing activity, a diversified funding base, and a broadening revenue mix.”

"In the first half of 2024, we maintained our focus on implementing our long-term growth strategy and continuing to deliver the levels of customer service that have become synonymous with our brand. Our first-half 2024 results reflect sustained growth across all business lines, driven by robust financing activity, a diversified funding base, and a broadening revenue mix.

The record growth in revenue of 25%, driven by double-digit YoY growth in both income from funding and non-funding activities, reflects healthy business volumes, improved margins led by an efficient funding base and higher yields, and a continued focus on growing diversified revenue streams.

From a balance sheet perspective, we crossed the AED 200 billion milestone for the first time, driven by a record growth in customer financing of 19% YoY as we were able to gain market share in retail and closing some landmark deals in corporate banking. This was efficiently funded by adding AED 22 billion of new deposits, including growing our Current and Savings accounts by AED 8.9 billion.

Group operating efficiency improved significantly year-on-year, with Cost-to-Income Ratio at 28.6%, reflecting our ability to drive higher income while maintaining cost discipline amid continued investments in people, products, and technology to better serve our customers.

On the digital front, we have made an incredible amount of progress in modernizing our infrastructure to improve our client servicing and automating processes by making banking faster, easier, and more accessible for everyone. We have surpassed 1 million registered users on our mobile application, reflecting the growing popularity of ADIB's digital banking platform.

Asset quality improved with our non-performing asset ratio reaching 4.7%, its lowest level since Q4 2018 due to active management of legacy portfolio coupled with strong underwriting standards.

ADIB's brand equity strength, along with our strong financial and capital position allow us to leverage the opportunities presented by the strong UAE economy."

GROUP FINANCIAL REVIEW

> Income statement

| AED (Mn) | Q2 2024 | Q2 2023 | Δ% | H1 2024 | H1 2023 | Δ% |

| Net revenue from funds | 1,631 | 1,504 | +8% | 3,322 | 2,930 | +13% |

| Non-funded income | 1,201 | 724 | +66% | 2,028 | 1,335 | +52% |

| Total operating income | 2,832 | 2,228 | +27% | 5,349 | 4,264 | +25% |

| Total operating expenses before impairment charge | (763) | (719) | +6% | (1,528) | (1,446) | +6% |

| Provision for impairment | (293) | (223) | +31% | (402) | (369) | +9% |

| Profit before zakat and tax | 1,777 | 1,286 | +38% | 3,419 | 2,450 | +40% |

| Zakat and tax | (198) | (62) | +221% | (390) | (124) | +215% |

| Profit after zakat and tax | 1,578 | 1,224 | +29% | 3,029 | 2,326 | +30% |

| EPS (AED) – YTD | 0.74 | 0.57 | +30% | |||

| Net profit margin – YTD | 4.60% | 4.41% | +19bps | |||

| Cost to income ratio - YTD | 28.6% | 33.9% | -5.3ppts | |||

| Cost of risk – YTD | 0.55% | 0.48% | +7bps | |||

| ROAE – YTD | 28.8% | 24.9% | +3.9ppts | |||

| ROAA – YTD | 3.06% | 2.87% | +19bps |

- Group net profit after tax grew 30% in H1 2024 to AED 3.03 billion compared to AED 2.36 billion in H1 2023 implying earnings per share of AED 0.736.

- Net profit before tax was AED 3.42 billion, up 40% YoY.

- Revenues increased by 25% in H1 2024 to AED 5.35 billion versus AED 4.26 billion in H1 2023 on strong business volumes and improved margins coupled with strength in fee-based businesses and higher Investment income.

- Funded income rose 13% to reach AED 3.32 billion supported by higher volumes and high rates with 9% growth in average earning assets thereby increasing the net profit margin to 4.60% compared to 4.41% in H1 2023, despite an increase in the cost of funding. ADIB preserves one of the highest margins in the market, supported by one of the lowest cost of funds in the market.

- Non-funded income increased by 52% to AED 2.03 billion for H1 2024, driven by a 38% increase in investment income and 28% increase in fees and commissions. Non-funded income represents 38% of total income, underlining the strategic focus on revenue diversification compared to 31% same period last year.

- Fees and commissions income was up 28% year-on-year, driven mainly by higher processing fees, card and CFIB related fees.

- Overall revenues were supported by growth in new customers of approximately 97,500 during H1 2024, showcasing ADIB’s long-term commitment to its customers and continuous efforts to deliver superior customer service.

- Operating expenses were up by 6% only YoY to AED 1.53 billion demonstrating continued investments in talent and strategic initiatives to support business growth, partially offset by efficiency savings. Despite this, there was an overall improvement in the cost-to-income ratio of 5.3 percentage points to 28.6%.

- The net impairment charge for the same period increased by 9% to AED 402 million. The cost of risk saw a slight increase of 7 basis points to 0.55% well within the guidance.

- NPA ratio Is 4.7% declining from 7.5% same period last year. The provision coverage of non-performing financing (including collaterals) improved by 20.8 percentage points to 149.3%.

Balance Sheet

| AED (Mn) | 30 June 2024 | 30 June 2023 | Δ% |

| Cash and balances with central banks | 35,137 | 31,240 | +12% |

| Due from financial institutions | 8,584 | 8,682 | -1% |

| Customer financing, net | 132,066 | 109,329 | +21% |

| Investments | 27,153 | 22,590 | +20% |

| Investment in associates | 857 | 799 | +7% |

| Investment and development properties | 1,976 | 1,984 | -0.4% |

| Other assets | 7,629 | 7,544 | +1% |

| Total assets | 213,403 | 182,167 | +17% |

| Due to financial institutions | 7,418 | 3,459 | +114% |

| Depositors’ accounts | 172,244 | 150,401 | +15% |

| Other liabilities | 6,418 | 4,859 | +32% |

| Sukuk financing instrument | 1,836 | - | +100% |

| Total liabilities | 187,916 | 158,718 | +18% |

| Share capital | 3,632 | 3,632 | - |

| Retained earnings | 11,254 | 8,990 | +25% |

| Other reserves | 4,969 | 5,124 | -3% |

| Equity attributable to shareholders of the bank | 19,855 | 17,745 | +12% |

| Tier 1 sukuk | 4,754 | 4,754 | - |

| Non - controlling interest | 877 | 949 | -8% |

| Equity attributable to equity holders of the bank | 25,486 | 23,449 | +9% |

| Non-performing financing | 6,311 | 8,619 | -27% |

| NPA ratio | 4.7% | 7.5% | -2.8ppts |

| NPA coverage ratio | 76.9% | 72.5% | +4.4ppts |

| NPA coverage ratio with collaterals | 149.3% | 128.4% | +20.8ppts |

| Risk weighted assets | 152,045 | 128,331 | +18% |

| Common Equity Tier 1 Ratio | 12.86% | 12.82% | +3bps |

| Tier 1 Ratio | 16.03% | 16.53% | -49bps |

| Capital Adequacy Ratio | 17.17% | 17.65% | -48bps |

| Financing to deposit ratio | 76.7% | 72.7% | +4.0ppts |

| Advances to stable fund ratio (ASFR) | 79.5% | 78.0% | +1.5ppts |

| Eligible Liquid Asset Ratio (ELAR) | 19.7% | 21.8% | -2.2ppts |

- Total assets reached AED 213.4 billion as of 30 June 2024, an increase of 17% from 30 June 2023, driven mainly by a growth in net financing, growth in cash and balances with central bank, and growth of the investment portfolio. The balance sheet has expanded AED 89 billion in the last 5 years at CAGR of 11.4%.

- Gross customer financing increased 19% YoY to AED 136.6 billion from growth in retail financing portfolios and wholesale financing across government and public sector enterprises, reflecting our ability to gain market share across different segments. YTD customer financing Increased by 15% with the bank extending AED 16 billion of new financing to customers in the first half of the year.

- ADIB continued to implement a strategy to increase focus on deploying high quality assets with GREs contributing 49% of YTD in gross customer financing growth.

- Given the bank healthy financing portfolio and healthy pipeline, ADIB has updated its guidance for the full year 2024 for customer financing to above 16% from the previous 5-7%.

- The bank’s investment portfolio increased 20% YoY on 30 June 2024 to AED 27.2 billion with 80% accounted for amortized cost.

- Customer deposits amounted to AED 172.2 billion as of 30 June 2024, up 15% from 30 June 2023 as CASA deposits increased by 9% to AED 108.1 billion, comprising 63% of total customer deposits.

- Non-performing financing reached AED 6.4 billion as of 30 June 2024, compared to AED 8.6 billion at the same time last year.

- Non-performing financing ratio improved to 4.7% versus 7.5% as of 30 June 2023.

- ADIB continued to maintain a healthy liquidity position with an advance to stable funding ratio at 79.5% compared to 78.0% on 30 June 2023, while the eligible liquid asset ratio was 19.7% as of 30 June 2024 versus 21.8% at 30 June 2023.

- The bank further strengthens its capital position with the Common Equity Tier 1 ratio at 12.86%, compared to 12.82% as of 30 June 2023 on the back of strong earnings and ongoing optimization initiatives. Capital adequacy ratio of 17.17% as of 30 June 2024, exceeding regulatory requirements prescribed by the UAE Central Bank.

Strategy

ADIB's Strategy defines the bank’s renewed purpose of becoming a lifelong partner for our clients, community, and colleagues. Furthermore, ADIB’s vision was revamped to be the world’s most innovative Islamic bank.

The bank has delivered the below strategic initiatives under the 4 strategic pillars:

Continuous Innovation

ADIB launched various products that enabled a growth in market share and continue to drive innovation to better serve our customers.

- Istiqrar: ADIB launched UAE’s first long-term, fixed-rate home finance. This unique product offers customers

a consistent, fixed monthly instalment throughout the chosen tenor rate, eliminating any variations or fluctuations. - Cashback Card: ADIB launched its new Cashback Visa Covered Card signifying an expanded role for cards in the bank’s retail strategy. The new card is considered one of the industry’s best cashback cards and offers customers the opportunity to earn 4% cash rewards when they use the card across a wide range of daily spending categories.

- Digital SME Instant Account Opening: ADIB became the first bank in the UAE to provide small and medium-sized enterprises (SMEs) with convenient remote account opening services through a mobile app by deploying Emirates Face Recognition (EFR) technology. This new feature allows businesses to apply for a business account without the need to visit a branch or submit physical documents or signatures. Through this technology, ADIB can perform highly secure identity verification before opening a new account for businesses in less than 24 business hours.

- Exceed loyalty program: ADIB launched “EXCEED”, a new digital reward program that rewards customers for their loyalty to the bank. Customers will receive Exceed Rewards into their mobile bank application, which can be instantly redeemed via the Mobile App for utility payments, e-com vouchers, retail vouchers, flight purchases and more.

- Business Souq: ADIB Business Souq, an innovative digital marketplace designed to provide comprehensive support to Small and Medium-sized Enterprises (SMEs). This all-in-one digital platform aims to significantly reduce the cost of doing business by offering a wide range of exclusive offers and discounts.

Segment Focused

ADIB continued to build on its existing strength in the Emirati retail segment while attracting and developing new business segments where the bank can grow profitably. In 1H 2024, we were able to grow market share and strengthened our relationship with our customers by enhancing new offerings and strategic partnerships.

- ADIB welcomed 97,500 new customers in the first half of the year with 37,000 UAE nationals and 60,500 expats.

- ADIB continued to underpin its market leadership in the retail segment growing its retail market share to 15%.

- ADIB delivered strong financing growth in retail with Personal finance, Auto finance and Home finance growing. The cards business is also growing fueled by strong partnerships.

- ADIB continued to grow its wholesale banking portfolio with a focus on GREs and large corporates.

- ADIB expanded beyond UAE with banking services for selected top-tier names in GCC markets.

Digital excellence

Digital remains at the heart of ADIB’s 2025 strategy, and the bank strives to become a digital-first financial institution. We are digitizing at scale, investing in technology and operational capabilities to drive productivity and efficiency across the business.

- ADIB continues to leverage digital platforms to expand reach by providing seamless and Immediate access to a broad range of products.

- Digitally Registered customers crossed the 1 million mark with 80% of our customers now using the mobile app.

- Digital banking subscribers were up 30% versus last year.

- 64% of ADIB customers opened their accounts digitally.

- ADIB launched 35 new digital features in the first half of 2024 Including the balance transfer, cash on card and Easy Installment plan.

- ADIB’s mobile app is top ranked on the UAE App store at 4.7.

Sustainable Future

ADIB continues to advance Its sustainability agenda with a strong oversight from the board of directors and management.

- ADIB is a regional sustainability leader (MSCI ESG rating of ‘A’), and a constituent of MSCI ESG Leaders index.

- In first half of 2024, ADIB finalized its ESG risk policy and framework.

- ADIB continued to play a crucial role in helping to deliver the region’s sustainable finance agenda facilitating new sustainable projects that are now at AED 5.7 billion.

- ADIB made significant progress towards our Net Zero journey by setting carbon emission reduction targets across the highest emitting sectors in our portfolio.

-Ends-

About ADIB

ADIB is a leading bank in the UAE with AED 213 billion in assets. The bank also offers world-class online, mobile and phone banking services, providing clients with seamless digital access to their accounts 24 hours a day.

ADIB provides Retail, Corporate, Business, Private Banking and Wealth Management Solutions. The bank was established in 1997 and its shares are traded on the Abu Dhabi Securities Exchange (ADX).

ADIB has a strong presence in six strategic markets: Egypt, where it has 70 branches, the Kingdom of Saudi Arabia, the United Kingdom, Sudan, Qatar, and Iraq.

Named World’s Best Islamic Bank by The Financial Times - The Banker publication, ADIB has a rich track record of innovation, including introducing the award-winning Ghina savings account, award-winning co-branded cards with Emirates airlines, Etihad and Etisalat and a wide range of financing products.

ADIB Investor relations Mobile application

Please download the ADIB Investor relations dedicated mobile app available on both Apple and Google play stores. The application will keep you up to date with the latest developments - from latest share prices and press releases to investor days, financial results, and our document library. You can view stock exchange announcements, presentations, annual and quarterly reports, and interact with key data onscreen.