PHOTO

ADIB Securities app to provide easy access to ADX services through integrated Financial APIs

New platform simplifies obtaining a National Investor Number (NIN) and eases access to investor trading accounts on ADX

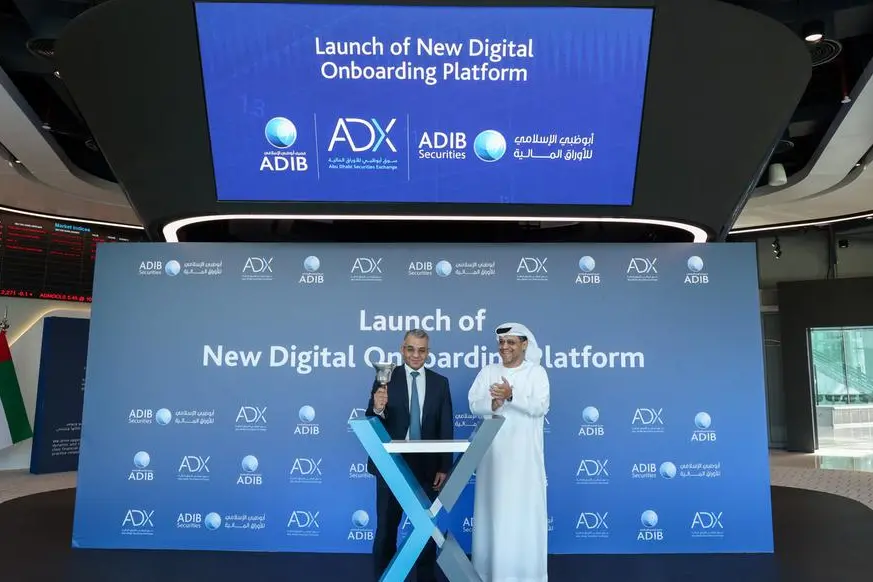

Abu Dhabi, United Arab Emirates: Abu Dhabi Securities Exchange (ADX), one of the fastest-growing exchanges in the world, announced today that it has signed a memorandum of understanding with ADIB Securities, a leading Sharia-compliant brokerage firm in the UAE and a wholly owned subsidiary of Abu Dhabi Islamic Bank (ADIB), to collaborate on the development of a new digital onboarding platform to better serve investors and provide individual investors with easier access to listed companies and investment schemes available on ADX.

The strategic partnership aims to elevate investor experience, by providing a more user-friendly and efficient onboarding process, using a secure digital platform. The new platform will integrate the process of obtaining a National Investor Number (NIN) and accessing trading account APIs directly into the ADIB Securities’ mobile app and digital platform, eliminating the need to print, sign, and email documents.

Abdulla Salem Alnuaimi, Group Chief Executive Officer of ADX, shared: “We are pleased to partner with ADIB Securities on this innovative initiative, which aligns with our ongoing commitment to Abu Dhabi’s digital transformation strategy and reinforcing investor access to investment opportunities in ADX. In the first 9 months of 2024, the number of new individual investors in ADX increased by 7% compared to the same period in the previous year, bringing the total number of investors on our platform to 1.1 million by the end of September 2024. This surge reflects the growing demand and interest from regional and international investors in accessing the capital market of Abu Dhabi. As an open exchange, ADX will continue to work closely with its brokerage community and channel partners to empower our investors with the vital tools and financial knowledge they need to thrive in their investment engagements.”

Mohamed Abdelbary, Acting Group Chief Executive Officer of ADIB, said: “We are proud to collaborate with ADX on this important partnership, which marks a key milestone in our mutual commitment to advancing digital transformation in the financial sector. This MOU underscores our shared vision to facilitate seamless, efficient business processes for our clients, enabling them to invest with greater ease and confidence. ADIB Securities continues to leverage cutting-edge technology to enhance the client experience and streamline services. The launch of a new digital onboarding platform—reflects our commitment to making investment more accessible, empowering individuals to confidently embark on their financial journeys. This initiative reinforces our dedication to providing innovative, secure solutions that meet the evolving needs of our customers and the market.”

ADIB has been continuously developing its digital offering across business units, while ADIB Securities continues to streamline traditional services by leveraging innovative digital solutions. This focus on digital transformation has resulted in an increasing number of active customers on digital platforms, with 80 per cent of ADIB's customers engaging with these platforms.

At the same time, ADX continues to explore partnership opportunities, with prominent regional and international entities, to further elevate its digital capabilities, including an ongoing partnership with the ICE Global Network from Intercontinental Exchange, Inc. (NYSE: ICE), a leading global provider of data, technology and market infrastructure, which ADX has partnered with in November 2023 to provide direct market access to global institutional investors.

About Abu Dhabi Securities Exchange

Abu Dhabi Securities Exchange (ADX) was established on November 15, 2000, by Local Law No. (3) Of 2000, the provisions of which vest the market with a legal entity of autonomous status, independent finance and management. The Law also provides ADX with the necessary supervisory and executive powers to exercise its functions.

On March 17, 2020, ADX was converted from a "Public Entity" to a "Public Joint Stock Company PJSC" pursuant to law No. (8) of 2020. ADX is part of ADQ, one of the region's largest holding companies with a broad portfolio of major enterprises spanning key sectors of Abu Dhabi's diversified economy.

ADX is a market for trading securities; including shares issued by public joint stock companies, bonds issued by governments or corporations, exchange traded funds, and any other financial instruments approved by the UAE Securities and Commodities Authority (SCA). ADX is the second largest market in the Arab region and its strategy of providing stable financial performance with diversified sources of incomes is aligned with the guiding principles of the UAE "Towards the next 50" agenda. The national plan charts out the UAE's strategic development scheme which aims to build a sustainable, diversified and high value-added economy that positively contributes to transition to a new global sustainable development paradigm.

For more information, please contact:

Abdulrahman Saleh ALKhateeb

Manager of Corporate Communication

Mobile : +971 (50) 668 9733

Email : ALKhateebA@adx.ae

About ADIB

ADIB is a leading bank in the UAE with AED 213 billion in assets. The bank also offers world-class online, mobile and phone banking services, providing clients with seamless digital access to their accounts 24 hours a day.

ADIB provides Retail, Corporate, Business, Private Banking and Wealth Management Solutions. The bank was established in 1997 and its shares are traded on the Abu Dhabi Securities Exchange (ADX).

ADIB has a strong presence in six strategic markets: Egypt, where it has 70 branches, the Kingdom of Saudi Arabia, the United Kingdom, Sudan, Qatar and Iraq.

Named World’s Best Islamic Bank by The Financial Times - The Banker publication, ADIB has a rich track record of innovation, including introducing the award-winning Ghina savings account, award-winning co-branded cards with Emirates airlines, Etihad and Etisalat and a wide range of financing products.