PHOTO

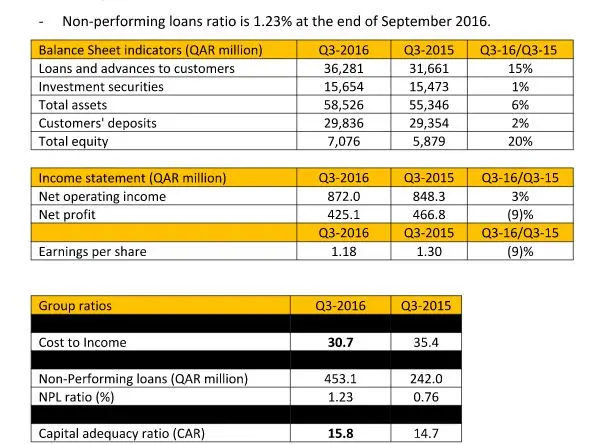

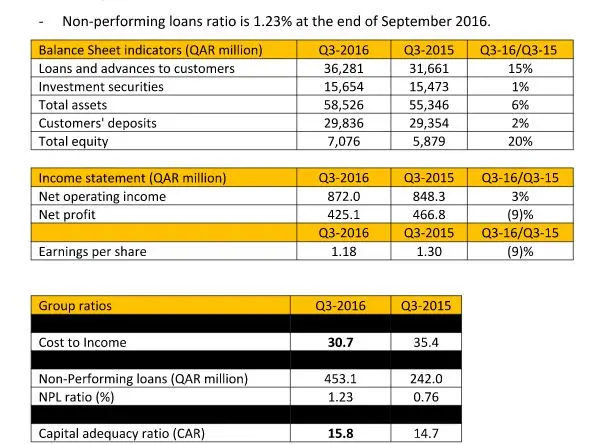

- Net profit of QAR 425 million for the first 9 months of 2016

- Total assets grew by 6% reaching QAR 58.5 billion in Q3 2016 YOY

- Loans and advances stood at QAR 36.3 billion, up 15% YOY

- Customer deposits increased 2% to QAR 29.8 billion, YOY

- Net operating income at QAR 872 million, up 3% on the same period last year

- Cost to Income ratio declines from 35% to 31%

Doha, October 19, 2016

Al Khalij Commercial Bank (al khaliji) P.Q.S.C., announced its financial results for the third quarter of 2016, reporting a Net Profit for the first nine months of QAR 425 million.

His Excellency Sheikh Hamad Bin Faisal Bin Thani Al Thani, Chairman and Managing Director stated:

“Given the decline in energy prices and the challenging global market conditions, the results achieved in the third quarter were not unexpected and in line with market expectations. Nonetheless, the bank’s outlook remains positive and healthy given our overall strong balance sheet, diversified business model, and robust capital position. We will continue to implement our strategic objectives, and I am confident that al khaliji will deliver quality growth and create further value for shareholders, enhancing our position in the local and regional market.”

Commenting on the third quarter 2016 performance, Fahad Al Khalifa, al khaliji’s Group Chief Executive Officer said:

“Our overall key financial indicators remain strong. The bank’s loan portfolio increased by almost 15% compared to the same period last year. Our total asset base grew by 6% to reach QAR 58.5 billion. Our net profit for the third quarter was impacted by our conservative approach in taking provisions which resulted in a final net profit of QAR 425 million. He further commented, “due to our prudent cost management, our cost to income ratio declined to 31% from 35% from same period last year. We will continue to improve our operational efficiency across all functions of the business, focusing on retaining client relationships, attracting new business in order to strengthen our position in Qatar and the region and generate value for our shareholders.”

Income Statement highlights

- Net Profit for the first nine months of this year is QAR 425 million.

- Earnings per share were at QAR 1.18 for the third quarter of this year.

- Net fee and commission income increased 10% to reach QAR 155 million compared to QAR 140 million in the first nine month of 2015.

- Net Impairment loss on loans amounted to QAR 178 million, derived from the Group conservative strategy in dealing with doubtful accounts; most of which are coming from our overseas operations. This measure is in place to further protect our shareholders in this volatile climate.

Balance Sheet highlights

- Total assets reached QAR 58.5 billion in the first nine months of 2016, up 6% from Q3 2015.

- Al Khaliji France S.A., headquartered in Paris with branches in UAE, represented 9% of the Group’s total assets.

- Loans and advances grew by 15% compared to same period in 2015 to reach QAR 36.3 billion, and is 8% higher than the period ending December 2015.

- Customer deposits grew to QAR 29.8 billion, up 2% compared to Q3 2015.

- Debt securities issued grew by 92% compared to Q3 2015 to reach QAR 3.7 billion and by 94% compared to the period ending December 2015.

Capitalization

- The bank’s capital adequacy ratio in Q3 2016 was 15.80% as per Basel III.

Provisioning

- Non-performing loans ratio is 1.23% at the end of September 2016.

-Ends-

About al khaliji Bank:

al khaliji is Qatar’s pioneer “next generation bank”, offering a full range of conventional banking products and services to premium, business, corporate and international customers in Qatar, UAE and France.

Headquartered in Doha, al khaliji is one of Qatar’s leading banks and a member of the Qatar Exchange since 2007, with QR 58.5 billion in total assets and QR 30 billion in customer deposits as of September 30, 2016.

Al Khaliji France is al khaliji’s subsidiary in Paris, France, with a network of branches in the UAE covering Abu Dhabi, Dubai, Sharjah, and Ras Al Khaima. This branch network offers customers and businesses local, regional and international banking services.

al khaliji products and level of service reflect the Bank’s belief that to be a successful financial institution, the Bank must meet the needs of both this generation and future generations of employees, customers, investors and business partners.

al khaliji was awarded with a positive Fitch Rating. With a Long Term Issuer Default Rating of ‘A+’ and a Short Term Issuer Default Rating of ‘F1’, this facilitates streamlined access to resources all over the globe.

In addition, al khaliji has been awarded by Moody’s for the first time credit ratings of A3 with a Stable outlook.

Achieving financial objectives is critical to sustaining prosperity in any market, at al khaliji long-term sustainability is maintained by balancing the commitment to achieving results with the commitment towards the development of people and the community.

For more information, please contact

Corporate Affairs

Tel: +974 44940477

Email: matassi@alkhaliji.com

Tel: +974 44940670

Email: pbejjani@alkhaliji.com

© Press Release 2016