PHOTO

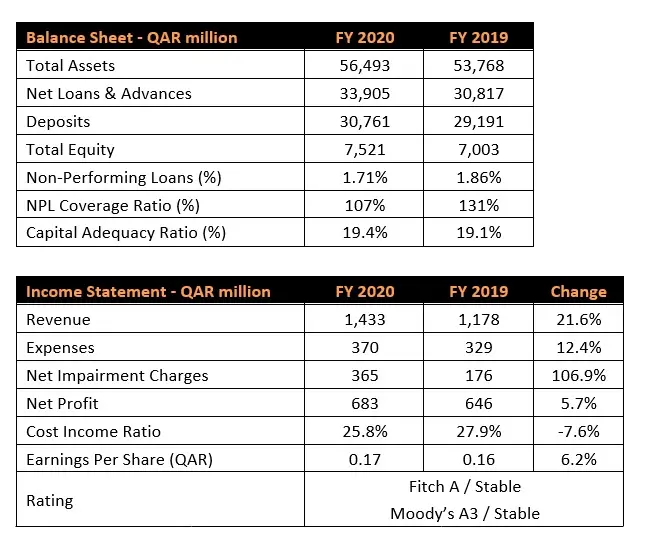

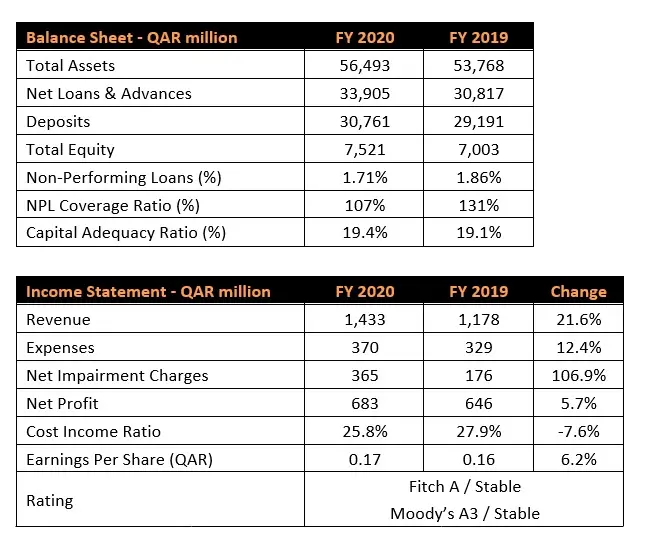

- Net Operating Income reached QAR 1,433 million, up 21.6% compared to 2019;

- Loans and advances reached QAR 33.9 billion, up 10% from 2019;

- Deposits reached QAR 30.7 billion, an increase of 5.4% compared to 2019;

- Total Assets increased by 5% to QAR 56.5 billion;

- Total Equity strengthened by 7.4% to QAR 7.5 billion;

- The Capital Adequacy ratio at year-end stood at a healthy 19.4%;

Doha: Al Khalij Commercial Bank (al khaliji) P.Q.S.C, released its consolidated financial statements for the year ended 31 December 2020 today with a Net Profit of QAR 683 million. The Board of Directors of al khaliji approved these consolidated financial statements in their meeting held in Doha on 27 January 2021. The results issued today are subject to Qatar Central Bank’s approval and endorsement by shareholders at the bank’s Annual General Assembly.

His Excellency Sheikh Hamad Bin Faisal Bin Thani Al Thani, Chairman and Managing Director stated:

“al khaliji ended 2020 on a firm footing, delivering increased profitability of QAR 683 million. We have achieved this result navigating through a challenging year in the back drop of the COVID – 19 pandemic, and this is an outcome of steady leadership, excellent dedication, integrity and hard work of our staff.

We also successfully concluded the merger discussions with Masraf Al Rayyan announced earlier in the year. This merger will, once effected, create one of the largest Shari’ah-compliant banks in the State of Qatar and in the Middle East, and contribute positively towards the local economy and Qatar National Vision 2030.

Commenting on the year’s performance, Fahad Al Khalifa, al khaliji’s Group Chief Executive Officer said:

“We ended 2020 on a positive note. The bank delivered QAR 683 million in net profit, which is +5.7% better than our performance last year. We have delivered these results by increasing operating income by growing our balance sheet as well as improving margins, and at the same time remaining prudent in our provisioning to cater for any potential future impacts of the COVID-19 pandemic.

We remained focused during a tough and uncertain year, growing Net Operating Income by 22% year-on-year to QAR 1.4 billion. This was achieved by a combination of selective growth in loans and improving margins by efficiently managing the cost of liabilities. Excluding one-off items, Operating costs also remained nearly similar to 2019 levels, at QAR 330 million. With a view to building resilience to cater for the long-term potential impacts of the pandemic, we materially increased our provisioning compared to last year, which totaled QAR 365 million for year.

With the announcement of a successful merger agreement with Masraf Al Rayan, the energies of the team and myself will be dedicated to efficiently closing the transaction in the shortest possible time and in the interim, we will continue to build on the successes of 2020, which will be positive for the combined bank

I wish to thank the entire alkhaliji team, the Qatar Central Bank, the Qatar Financial Markets Authority, the Ministry of Finance, the Ministry of Commerce & Industry and all other stakeholders for their continued support during 2020”

Key Financial highlights:

Cash Dividend

After reviewing the audited financials today, the Board was satisfied with the 2020 financial performance and has recommended (subject to QCB approval) to the Annual General Assembly the distribution of a cash dividend of 5.6% of the nominal share value, i.e. QAR 0.056 per share.

His Excellency Sheikh Hamad Bin Faisal Bin Thani Al Thani concluded by saying:

“We extend our deepest gratitude to the Government of Qatar, the Qatar Central Bank and the Ministry of Commerce and Industry for their on-going support and invaluable role in guiding and assisting Qatari financial institutions and local business in their progress towards success.”

-Ends-

For further information on al khaliji, please visit our website www.alkhaliji.com

Or contact our Investor Relations team:

Eliane Abou Atmeh

Investor Relations Officer

investor-relations@alkhaliji.com

Shabbir Barkat Ali

Group Chief Financial Officer

investor-relations@alkhaliji.com

© Press Release 2021

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.