PHOTO

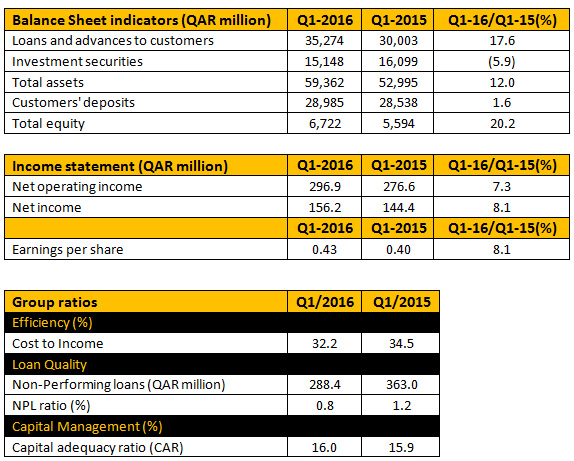

- Net profit of QAR 156.2 million increased 8% year on year

- Total assets reached QAR 59.4 billion; 12% growth on Q1 2015

- Loans and advances growth of 18% to QAR 35.3 billion

- Deposits reached QAR 29 billion

- Net operating income at QAR 297 million, up 7% on the same period last year

Doha, April 19, 2016

Al Khalij Commercial Bank (al khaliji) P.Q.S.C., in Qatar, announced its financial results for the first quarter of 2016, reporting a Net Profit of QAR 156.2 million. This represents an increase of 8% over its financial results for the same period of last year.

His Excellency Sheikh Hamad Bin Faisal Bin Thani Al Thani, Chairman and Managing Director stated:

"al khaliji's good profit reflects the momentum gained in our new Medium Term Strategy 2016-2018. This, combined with the measures approved recently at our EGA, to build adequate capital for future business growth, will enable al khaliji to continue to create additional value for shareholders and to enhance its' position in Qatar and the region."

Commenting on the first quarter 2016 performance, Fahad Al Khalifa, al khaliji's Group Chief Executive Officer said:

"Our performance in Q1 demonstrates the strength and resilience of our business. The bank's revenue displays strong growth with good activity across both our Corporate and Premium / Private Banking businesses. Prudent cost management has enabled us to maintain costs flat relative to last year and achieve a cost: income ratio of 32.2%. The bank successfully raised QAR 1 billion through capital instruments, and started issuing commercial paper, to sustain good growth, diversify sources of funding and strengthen its capital position. al khaliji's capital adequacy ratio stood at 16% at the end of March 2016. We will continue to maintain, reinforce and broaden our client relationships with a view to generating sustainable returns over the long term".

Income Statement highlights

Net Profit for the first quarter of this year is QAR 156.2 million compared to QAR 144.4 million for the same period in 2015.

Net interest income increased by 3%, to QAR 227.8 million, by end of March 2016. Net fee and commission income reached QAR 56.1 million, up 24% compared to QAR 45.2 million by the end of March 2015.

Earnings per share was QAR 0.43 in the first quarter of 2016.

Balance Sheet highlights

Total assets reached QAR 59.4 billion in the first quarter of 2016, up 12% from Q1 2015 and up 5% from the previous quarter ending December 2015.

Al Khaliji France, headquartered in Paris with branches in the UAE, represented 10% of the Group's total assets.

Loans and advances grew 18% on the same period last year and 5% higher than the previous quarter to reach QAR 35.3 billion by end of March 2016.

Deposits amounted to QAR 29 billion, up 2% compared to the first quarter of 2015.

Investment securities stood at QAR 15.1 billion by the end of March 2016.

Capitalization

The bank's capital adequacy ratio at Q1 2016 was 16.0% as per Basel III.

Asset Quality

Non-performing loans ratio is 0.81% at the end of March 2016.

-Ends-

For further information on al khaliji, please visit www.alkhaliji.com

Investor Relations:

Joe Maalouf

Head of Investor Relations

Or: investor-relations@alkhaliji.com

© Press Release 2016