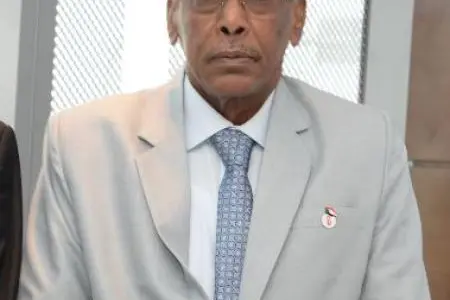

PHOTO

Manama: Al Baraka Banking Group BSC (ABG), the leading Islamic banking group headquartered in Bahrain, has announced the appointment of Mr. Elrasheed Abdelrahman Ali as the new General Manager of Al Baraka Bank Sudan, succeeding Mr. Abdullah Khairy who has retired from a month June 2019.

On this occasion, Mr. Adnan Ahmed Yousif, Chairman of Al Baraka Bank Sudan and President & Chief Executive of Al Baraka Banking Group, expressed his sincere thanks and appreciation to Mr. Abdullah Khairy for his efforts and wise leadership throughout his tenure as the GM of the Bank. Throughout this period, Mr. Khairy has displayed keenness to ensure the bank's soundness and leadership position in the banking sector in Sudan.

Mr. Adnan Ahmed Yousif added: "I am also pleased to welcome Mr. Elrasheed Abdelrahman Ali as the new General Manager of the Bank. Mr. Elrasheed previously served as Deputy General Manager of Al Baraka Bank Sudan. His long-term experience and high-efficiency work style will enable him to lead the Bank towards further progress and growth during the next phase. I wish him success in discharging his new duties and keeping the Al Baraka Flag shining high”.

Mr. Elrasheed has over 40 years of banking experience in a number of leading positions in Sudanese banks. He joined Al Baraka Bank Sudan in 2000 as Investment Manager and took charge as Deputy General Manager in 2015. He holds a Master's Degree in Banking and Finance from Giordiano Del Amore University from Milan – Italy and has a number of published research to his credit in the banking and financial research domain.

About Al Baraka Sudan:

Al Baraka Bank Sudan was established on 26 February, 1984 and was operational from 14 March, 1984. The main office is located in Khartoum, Sudan. Al Baraka Sudan is licensed by the Central Bank of Sudan to carry out all banking and investment activities in accordance with the provisions of Islamic law.

The authorized capital of the bank is 500 million Sudanese Pounds and the paid up capital is 209 million Sudanese Pounds, with Al Baraka Banking Group contributing 75.73% and Sudanese shareholders, 24.27%.

Since its establishment during the early eighties, Al Baraka Bank Sudan has strived to consolidate the Islamic banking business and make it closer to its jurisprudential roots and more closely comply with the essence of Islamic financial transactions. The public confidence, which helped the success of the business model presented by Al Baraka Sudan Bank, has obtained a leadership position in the Sudanese Islamic Banking sector.

About Al Baraka

Al Baraka Banking Group is licensed as an Islamic wholesale bank by the Central Bank of Bahrain and is listed on Bahrain Bourse and Nasdaq Dubai stock exchanges. It is a leading international Islamic banking group providing its unique services in countries with a population totaling around one billion. It is rated BBB+ (long term) / A3 (short term) on the international scale and A+ (bh) (long term) / A2 (bh) (short term) on the national by Islamic International Rating. ABG offers retail, corporate, treasury and investment banking services, strictly in accordance with the principles of the Islamic Shari'a. The authorized capital of ABG is US$ 2.5 billion. The Group has a wide geographical presence in the form of subsidiary banking units and representative offices in 17 countries, which in turn provide their services through over 700 branches. Al Baraka currently has a strong presence in Turkey, Jordan, Egypt, Algeria, Tunisia, Sudan, Bahrain, Pakistan, South Africa, Lebanon, Syria, Saudi Arabia and Morocco, in addition to a Digital bank in Germany, two branches in Iraq and two representative offices in Indonesia and Libya.

© Press Release 2019Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.