PHOTO

Dubai: Both Sharjah and Ajman remain affordable alternatives for buying and renting properties in the UAE. Prices have dropped on average across popular districts for both Sharjah and Ajman, but ROI has remained high, reaching up to 7% in Sharjah and over 11% in Ajman for certain neighbourhoods as per Bayut’s Q1 market reports for 2019.

Sharjah:

Price trends for Q1 2019 reveal that apartments in Sharjah have mostly witnessed minimal decreases between 2% - 6% for both sales and rentals, with prices staying stable in certain areas.

According to Bayut’s data, larger apartment units for sales in popular locations like Al Majaz and Al Khan have seen price declines under 6%. The most significant rental price changes have included decreases around the 11% mark in Abu Shagara and Al Khan. According to search trends, Al Majaz is most popular with investors to buy apartments in Sharjah. However, potential tenants turn to Al Nahda as their first choice for renting apartments in the emirate.

When it comes to villas in Sharjah, the area of Al Sabkha generated the most searches by both investors and renters.

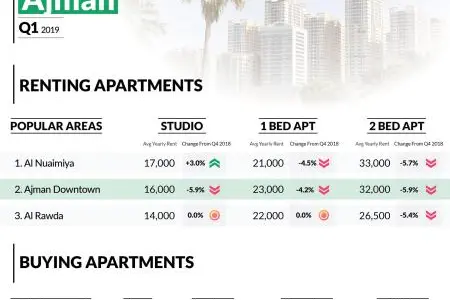

Ajman:

For apartments in Ajman, the overall price trends for both sales and rents show marginal declines between 1%-6% with prices remaining stable in many areas. For apartment sales, the only significant declines are at the 7%-8% margin for units in Garden City and Al Sawan. As for the rental apartments, the most significant decreases are for units in Ajman Downtown, Al Rashidiya and Al Jurf, where prices have gone down by an average of 6%. In terms of popularity, Ajman Downtown has received the most interest from investors while for apartment rentals, Al Nuaimiya retains the top position in Q1 2019.

For villas in Ajman, Al Mowaihat is the most popular among investors whereas tenants are most interested in Al Rawda.

Haider Ali Khan, CEO of Bayut, said, “The property markets in both Sharjah and Ajman have grown substantially in recent years, with reputed builders such as Eagle Hills and Emaar exploring options here. Over the first quarter of 2019, both Sharjah and Ajman present a lucrative opportunity for investors. From a rental perspective as well, the combination of reasonable rents and easily accessible schools makes both these emirates extremely attractive options for families in the UAE.”

Offering a complete suite of real estate services and insights, Bayut releases detailed market reports highlighting the property trends in the UAE on a regular basis. Bayut is already a great success story in the UAE and has recorded impressive growth in the last few years, growing over 100% year-on-year over the last 5 years. It is well on its way to becoming the largest real estate portal in the UAE and have Bayut’s presence felt across the region.

For further details take a look at the full Q1 Sharjah market report by Bayut and Q1 Ajman market report by Bayut.

Disclaimer: The above report is based on prices advertised by real estate agencies on behalf of their clients on Bayut.com, and not representative of actual real estate transactions conducted in Sharjah and Ajman.

About Bayut.com

Bayut.com is the UAE’s most trusted property platform for buying, selling and renting homes. Bayut provides detailed insights and updated statistics allowing end-users to make the best decision when searching for properties in the UAE. Bayut was established in 2008 by the Ali Khan brothers and later became a part of the Emerging Markets Property Group (EMPG) which also operates the largest property classified sites in Pakistan, Bangladesh and Morocco. Since then, the company has seen accelerated growth, increasing not only the number of real estate partners it works with, but also attaining substantial traffic growth over the past few years. In 2014, Haider Ali Khan was appointed as the CEO of Bayut.com. Following his appointment, the company has closed rounds of capital expansion investments including series A round of investment from private equity funds in 2014 followed by $100M series D round of funding in 2019 with a total of $160M raised till date. In April 2019, Bayut announced the acquisition of the GCC assets of Lamudi.com to expand its footprint across UAE, KSA and Jordan.

For media enquiries, please contact:

Khalid Yahya

PR & Communications Manager

Khalid.Yahya@bayut.com

+971 54 455 0186

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.