- Survey reveals top 10 most preferred property locations by Filipino expats in the UAE

Dubai, UAE:

A survey of 10,000 Filipino expats in the UAE reveals that Filipinos’ appetite for investments have reached all-time high, with 82 per cent confirming their plan to invest, primarily in property. This is significantly higher than the 2014 survey which showed only 2 out of 10 Filipinos have investment plans.

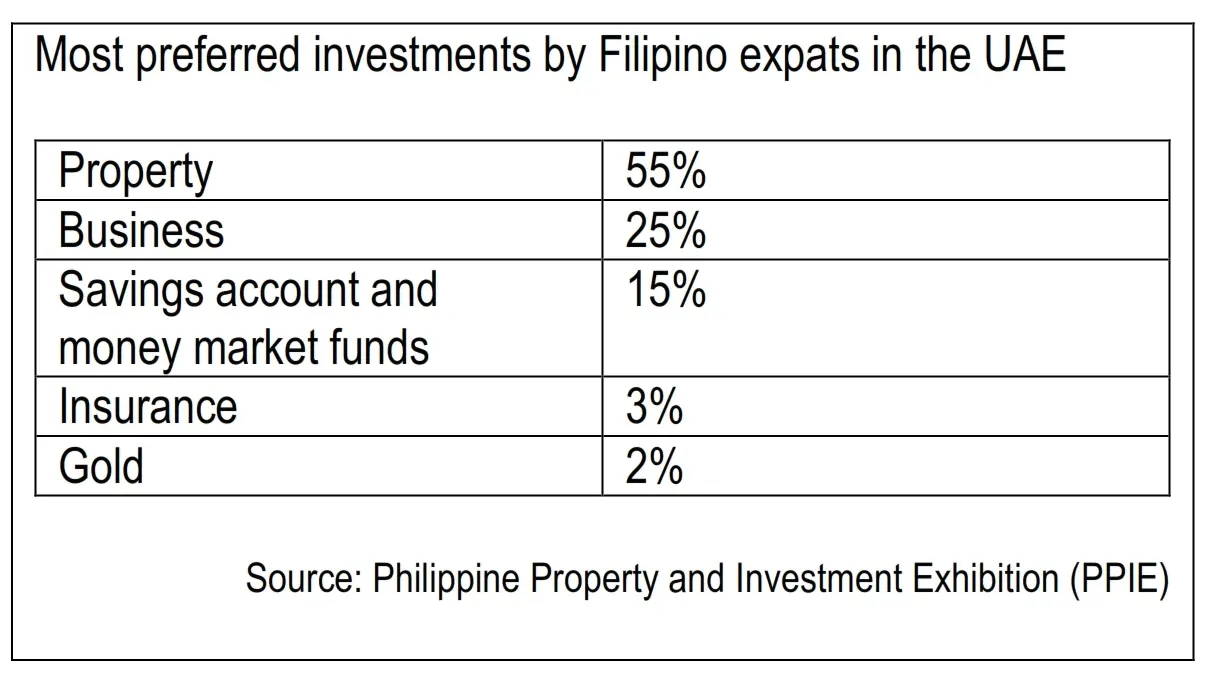

The polls, undertaken by New Perspective Media Group, organiser of Philippine Property and Investment Exhibition, the biggest investment event for Filipinos in the Middle East, show that property tops the list of the preferred investment (55 per cent), followed by acquiring a franchised business or starting up small business (25 per cent). Fifteen per cent of the respondents said they will invest in savings account and money market funds (mutual funds) while the rest of the respondents said they are keen to invest in insurance and gold investments (3 per cent and 2 per cent, respectively).

Philippine Property and Investment Exhibition, now on its seventh edition, has been gauging the investment sentiment of Filipinos, one of the fastest growing consumer market segments in the UAE, since 2014. PPIE will once again provide an avenue to learn about various investments options in the Philippines both for Filipinos and foreign nationals this coming week-end, April 26-27 at the JW Marriott Hotel Dubai in Deira.

Most preferred locations

Of the 5,500 respondents who preferred property as their primary investment, more than half of them (54 per cent) said they plan to make the purchase within the next 12 months.

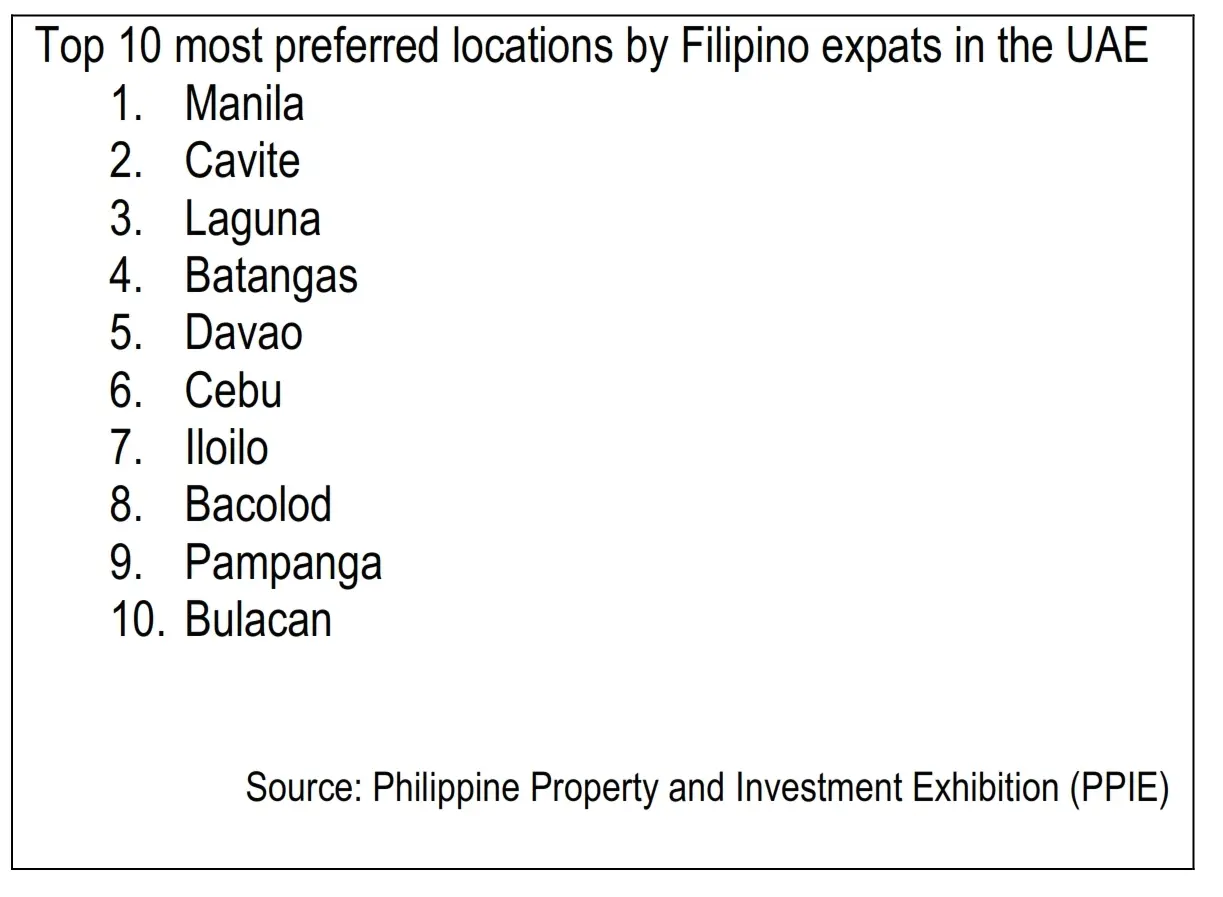

The top 10 most preferred locations are Manila, Cavite, Laguna, Batangas, Davao, Cebu, Iloilo, Bacolod, Pampanga and Bulacan. Manila has the lion’s share with 53 per cent.

Dr. Karen Remo, Co-founder and Managing Director of New Perspective Media Group, organiser of Philippine Property and Investment Exhibition, said: “As World Bank has pointed out, Philippines continues to be one of the fastest growing economies in the world, with increasing urbanisation, a growing middle-income class, and a large and young population. This positive trend comes at a time when more and more Filipino investors are getting into the property market, either as first time or repeat investors.”

“The culture of acquiring a property is spreading fast amongst Filipinos back home and those residing overseas, as this becomes one of the fastest and safest means to accumulate wealth. Over the last few years, too, an increasing number of foreign investors all over the world, and noticeably from the Middle East, have taken advantage of the massive growth potential that the Philippines has to offer,” Dr. Remo added.

Thomas Mirasol, General Manager of Federal Land, Inc., said: “The Asia-Pacific region, in general, has been a very good investment region and the Philippines has long been an attractive market. Manila, in particular, rates higher than Taipei, Auckland and Kuala Lumpur in a 2019 report by PwC and the Urban Land Institute (Emerging Trends in Real Estate 2019). Rental rates and capital values continue to do well as vacancies continue to remain low. Despite increasing prices, costs over-all are much more affordable than key cities in the region so investment decisions are relatively easy.”

Hottest luxury home market in the world

A report posted by property consultancy Knight Frank recently hailed Manila, the Philippines as the hottest luxury home market in the world – besting other popular luxury housing cities in the world like Boston, Tokyo, Paris, and more. With robust economy coupled with the increase in demand for luxury homes by foreigners who decided to call the Philippines their home, the country experienced a price increase of 11.1 per cent making it the fastest growing luxury market to date.

Atty. Duane Santos, General Manager and Executive Vice President of Greenfield Development Corporation, said: "The Philippine real estate market has seen significant growth because of local and foreign buyers heavily investing in property ownership and asset holdings. This growth can also be attributed to foreigners who are continuously purchasing condominium units in Metro Manila and other major cities in the Philippines, such as Cebu, Davao and Laguna. Filipino and foreign investors in Dubai can also avail of this investment opportunity in the upcoming PPIE event. Dubai is one of the biggest markets for our sales overseas and PPIE has helped us in developing this market."

Mirasol said: “On top of the financials, the Philippines offers a cosmopolitan, trendy, welcoming life for overseas investors. The cost of luxury living is much more affordable in the Philippines. It is quite easy actually for a non-Filipino to own a property in the Philippines. There are no special requirements on buying strata-title (condominium) properties and no extra taxes. Re-selling their investments is just as simple with no special requirements.”

In addition, the Philippine government’s “Build. Build. Build” programme, President Rodrigo Duterte administration’s medium-term goal effectively ushered in the Golden Age of infrastructure in the Philippines by raising the infrastructure spending from 5.4 per cent of the country’s GDP in 2017 to 7.3 per cent by the end of 2022. The Philippines' economic dynamism remains buoyant due to strong consumer demand supported by vibrant labor market and robust remittances.

Manuel Arbues II, Regional Head for North America and the Middle East, Ayala Land International Sales, Inc. (ALISI), the sales and marketing arm of one of the Philippine’s leading property developer, Ayala Land Inc. (ALI), said: “We have registered an average yearly sales growth of almost 20 per cent from the UAE for the past five years. For the most part, we attribute this growth to the increase in financial awareness amongst Overseas Filipinos in the UAE. Likewise, due to many opportunities opening up for Overseas Filipinos, they are in a better position to prepare for their future and real estate investment is their top choice.”

Now on its seventh edition, PPIE draws thousands of attendees who are keen to meet with the most reputable property developers, banks, , government-backed financial, investment and savings institutions, money remittance centres and service providers.

Individuals, who are interested to attend, can register for free at http://events.ppie.ae/register/ in order to gain access to the event.

PPIE is sponsored by Greenfield Development Corporation and Ayala Land. It is participated by Federal Land, Inc., SM Development Corporation, Sta. Lucia Land Inc., Green Circle Realty Sales, Inc., AboitizLand, Inc., Robinsons Land Corporation, LBC, RAKBANK, Cebuana Lhuillier, ekar, Al Habtoor Motors – Mitsubishi, Gold’s Gym, Philippine Airlines, Sharaf Exchange LLC, and Vision and Style Optical LLC (exhibitors); as well as supported by The Filipino Times, Tag 91.1 and The Filipino Channel (media partners).

-Ends-

About PPIE

The biggest, longest running and most trusted Philippine business and investment forum in the Middle East is now on its seventh edition. The past six editions of PPIE made a history in the UAE and in the region by bringing in more than 21,000 quality visitors.

This event has been continuously attended by the leading most reputable property developers; banks; insurance companies; government-backed financial, investment & savings institution; money remittance centers; and services providers.

To know more about PPIE 2019, visit www.ppie.ae , or contact:

Angeline Rivera

New Perspective Media Group

angeline@newperspectivemedia.com

+971 4 244 9642

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.