PHOTO

The odds are very high that 2023 will be about recent trends cooling off on many levels. In economic terms, both growth and inflation rates are likely to slow, as monetary policy normalization takes its toll and some of the pandemic-related constraints in the economy ease. Given that inflation rates usually lag, we could still use the ‘stagflation’, a situation in which economic stagnation and inflation go hand in hand, label for the year ahead. Yet, at face value, there will likely be more ‘stag’ and less ‘flation’, as inflation rates should fall more than growth rates.

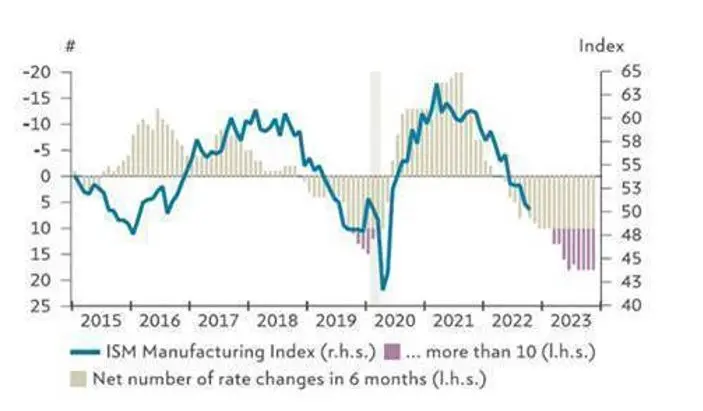

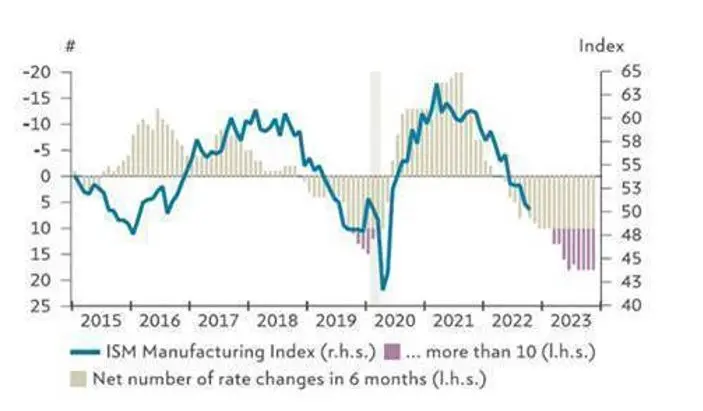

We expect the world economy to grow by merely 2% in 2023 after a solid 3.3% in 2022. This does not signal a global recession yet, but a major slowdown is likely, as suggested by the leading global economic indicators. Central bank policy has quite long lead times until it has an effect on economic activity, but it defies the widespread opinion that central banks cannot steer the economy any longer. In fact, the importance of central bank policy has rather increased lately, and our expectation is that economic growth will decrease further in 2023 before central banks backpedal, which in turn should lead to stronger growth in 2024 again.

Why do we not expect a global recession? First, we still see strong employment trends in many industrialised countries, which are keeping these consumption-heavy economies afloat. Second, the regional dynamics are likely to stay very divergent. This reduces the odds of a synchronized global recession, since, for example, a recovery in Asia could compensate for some softening in the US on a global scale.

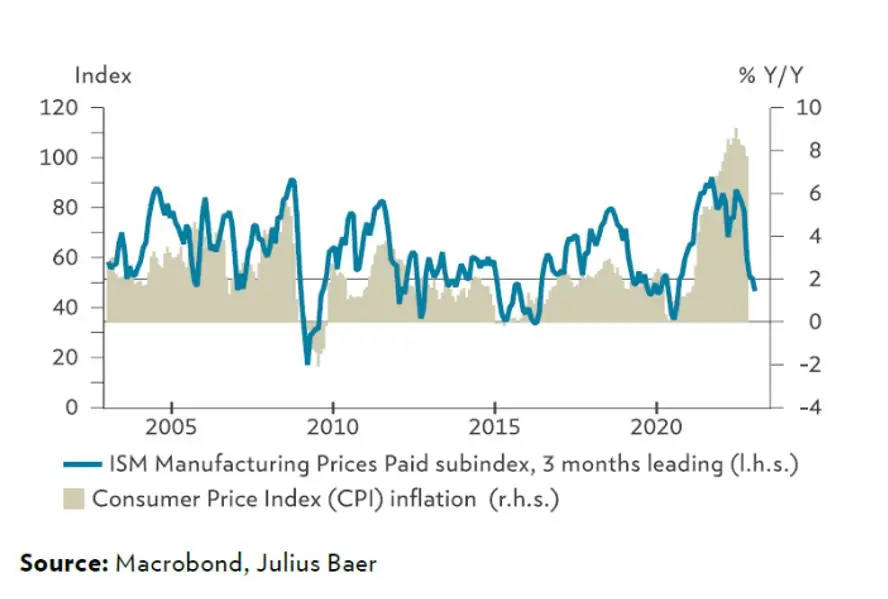

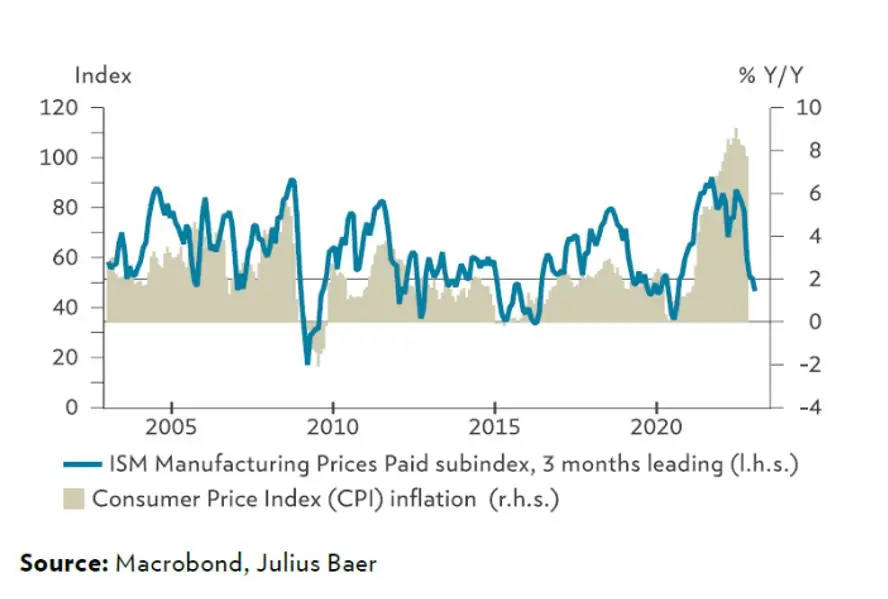

Most importantly, the sky-rocketing inflation rates in recent quarters should be over soon. On a global level, we expect the inflation rate to cool off from 8% in 2022 to 5% in 2023. While this is still a high number, we expect most of the pressure to be frontloaded, i.e., it should be present rather early in the year, which means that most of the inflation pressure will start to abate sometime during the first half of 2023. The reasons for this are that commodity prices should come down again, supply-chain bottlenecks should ease, and the demand that was pumped up after the pandemic should normalise. And finally, the high levels of prices in 2022 should help inflation rates to ease further.

Unless another completely unexpected external shock hits the system, inflation pressure should ease markedly in the first half of the year and keep softening at a slower pace through the remainder of the year.

Looking back at 2022, this has been one of the most challenging years ever for thematic investing strategies, such as Next Generation. Our themes have faced a perfect storm of rising risk aversion and a shift in investment styles from growth to value amid rising interest rates. Due to the focus on profitable growth companies, our themes have been partly shielded. Non profitable growth companies have lost up to 90% of their value.

Capturing yields

Against this backdrop, we suggest capturing attractive yields in quality areas, such as high-investment-grade bonds and quality stocks. At the same time, investors should watch out for cyclical opportunities, as markets may start to price in an economic recovery into 2024 as the year proceeds. While not all cyclical assets may be at a rewarding risk/return juncture yet, some of them may get there eventually. For example, we have highlighted some commodity-backed emerging market currencies, copper within commodities, and selected cyclical equities. Our technical analysis adds opportunities in industrials overall, as well as in financials, healthcare, and biotechnology. In the currency space, both fundamental and technical analyses suggest an end to one of the longest USD bull markets in history. Yet given the uncertainties around the timing, investors may want to wait for further evidence in terms of yield differentials and currency weakness before outright positioning themselves against the USD. When it comes to thematic investing, the sharp repricing of structural growth stocks this year offers investors an opportunity to prepare and position themselves for the next cycle.

We highlight Energy Transition, Future Cities, and Shifting Lifestyles as our preferred themes heading into 2023.

- Energy Transition: The growth outlook for both the Clean Energy and Future Mobility subthemes is very compelling, while cost inflation can be contained. Valuations remain reasonable.

- Future Cities: Continued public and private investments in Digital Infrastructure and the Circular Economy bode well for future growth, somewhat independent of the cyclical outlook.

- Shifting Lifestyles: The pandemic premium has disappeared from Digital Health and Genomics, and the focus should shift to chronic diseases. The Healthy Living trend persists.