The global market for electric vehicles (EVs) experienced remarkable growth, delivering approximately 1.6 million battery EVs in the second quarter of 2023. This figure represents an 80% increase compared to the previous year. With this surge, the EV industry is on track for an annual production rate of 6.4 million units, constituting about 8% of the global annual production of passenger cars.

As EV adoption continues to rise, the world is entering a completely new phase marked by peak oil demand. This pivotal moment could occur within the next 4-5 years, driving a surging demand for essential industrial metals.

So far, the technological advancement in EVs has been driven by lithium-ion batteries containing lithium, cobalt and nickel. In addition, EVs have a higher degree of electrical wiring increasing the demand for copper relative to old internal combustion engines. China-based CATL, the world’s leading battery manufacturer, has made significant breakthroughs in lithium iron phosphate (LFP) batteries which are cheaper to manufacture and cut nickel and cobalt out of the manufacturing process which have a more uncertain production outlook as these metals are predominantly mined in unstable countries.

Outlook for Metals

If CATL succeeds in commercializing and innovating LFP batteries to the extent they outcompete lithium-ion batteries, then the outlook for nickel and cobalt will look less positive. The outlook for lithium and copper is intact, so of all industrial metals, those two are going to be the “steel and oil” of the future economy. One downside to LFP batteries is that they use phosphate which is a chemical that is used in fertilizer production and thus one risk is higher fertilizer and food prices in the future.

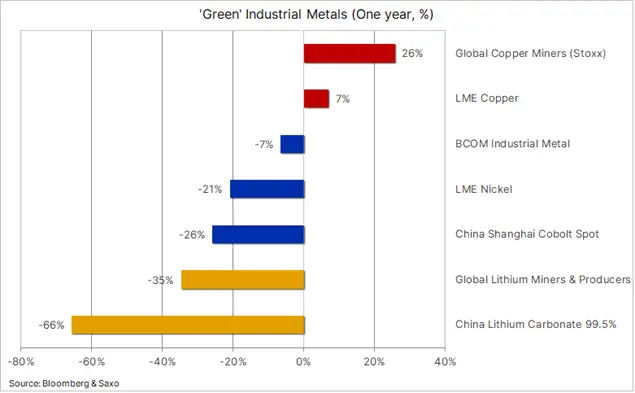

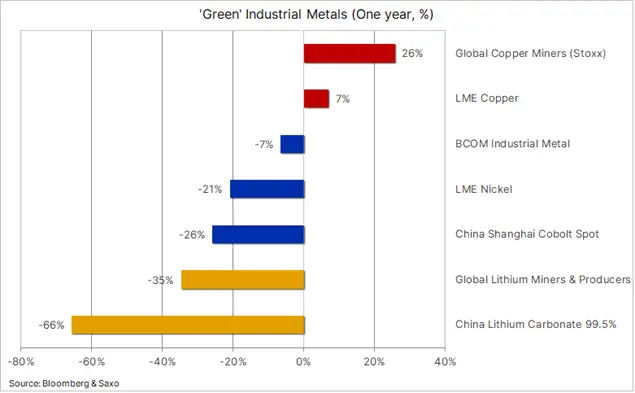

While the demand outlook for lithium and copper in the coming years looks set to remain strong as the electrification gathers momentum, it is also clear that the supply outlook combined with the variety of usage will play an important role in setting the price of these two sought-after metals. During the past year, the STOXX Global Copper Miners Index has rallied by 26% while the Stoxx Global Lithium Miners & Producers Index has dropped by 35%, the divergence being driven by a 7% rise in the LME copper price and slump in Lithium prices with the price of China Lithium Carbonate 99.5% spot having lost around 66% of its value during the past year.

The current oversupply of lithium, which is also seen in cobalt, down 26% during the past year in Shanghai, will likely lead to a period of industry consolidation, but with demand continuing to rise in the coming years, a prolonged period of oversupply is unlikely to exist beyond 2024.

Copper's promising outlook

Often referred to as the "king of green metals," copper's outlook is particularly promising. Current price levels are unlikely to be high enough to support the need for increased production in the coming years. According to McKinsey, global electrification is expected to increase annual copper demand to 36.6 million tonnes by 2031 compared to the current demand of around 25 million tonnes with mine production at approximately 22 million tonnes last year. S&P Global Market Intelligence goes even further saying that global copper demand will nearly double to 50 million tonnes by 2035.

Copper has stood out among its peers during what has been a challenging year for industrial metal., This is notable considering the current weaknesses in China and global manufacturing PMI, as well as concerns about the Chinese property sector. Copper’s resilience in the face of these headwinds can be attributed to its increasing green transition demand towards batteries, electrical traction motors, energy storage and grid upgrades.

Against the prospect of a significant rise in demand, the lack of big mining projects to ensure a steady flow of future supply continues to be a worry that is receiving increased attention from long-term focused investors as it supports our structural long-term bullish outlook, driven by rising demand for green transformation metals and mining companies facing rising cash costs driven by higher input prices due to higher diesel and labour costs, lower ore grades, rising regulatory costs and government intervention, and not least climate change causing disruptions from flooding to droughts.