PHOTO

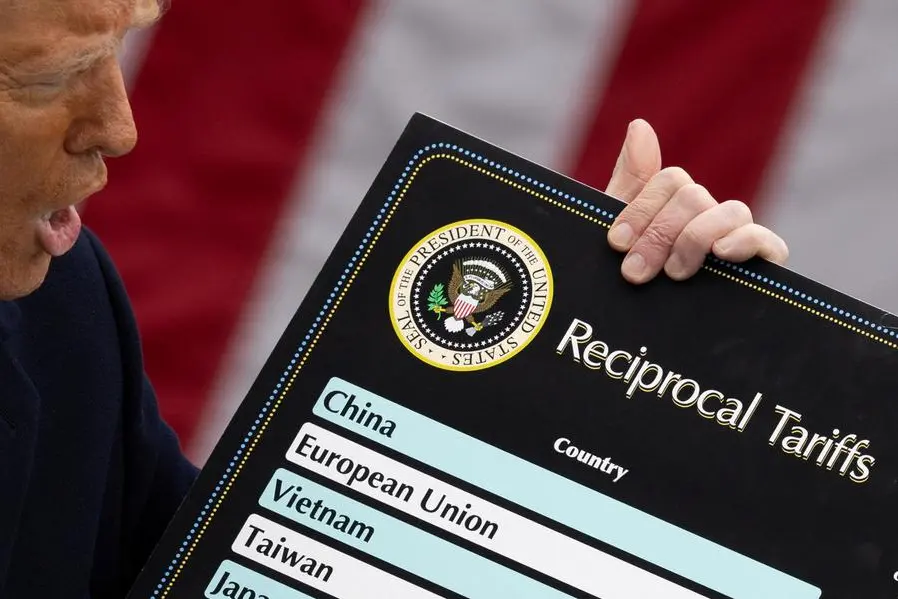

The Trump administration has exacerbated global trade tensions by issuing an executive order to impose a sweeping 10% tariff on all imports entering the United States, effective April 5, 2025. Additionally, reciprocal tariffs ranging from 11% to 50% were announced for 57 countries accused of discriminatory trade practices, set to take effect on April 9. Goods compliant with the United States-Mexico-Canada Agreement (USMCA) are exempt from these tariffs; however, non-compliant imports from Canada and Mexico remain subject to a separate 25% tax imposed in March. China faces one of the steepest tariff rates at 34%, which will rise to an effective rate of 54% on April 9, making it one of the most targeted nations in this trade war. Economists state that this is the most significant shift in US trade policy since the 1930s Tariff Act and warn that the ramifications of these tariffs could lead to a rise in consumer prices of over 2%, disrupt supply chains, significantly impact businesses, and increase the likelihood of a recession and global economic slowdown.

International markets are reeling from US President Donald Trump's tariffs. Asian stock markets from Shanghai to Tokyo and Sydney to Hong Kong plummeted to levels not seen in decades. The European markets also declined, with banks and defense firms experiencing the most significant drops. Some of the stocks of the "magnificent seven," including Nvidia, Amazon, Apple, Microsoft, Meta, Tesla, and Alphabet, plunged as Trump announced further taxes on China. Some technology experts stated that Apple has the most significant exposure to American tariffs on Chinese goods because most of the iPhones are assembled in China; though Apple secured exemptions to the US tariffs on China during Trump's first term, analysts are skeptical if Apple can secure waivers this time despite Apple's announcement to invest more than $500 billion in the US over the next four years.

International markets are reeling from US President Donald Trump's tariffs

The global slump is the result of new tariffs announced, ranging from 10% to 50% in most countries. Global stock markets have lost trillions of dollars in value since the Trump administration announced sweeping 10% import taxes on all goods entering the United States from every country, with key partners such as China, the European Union, and Vietnam facing higher tariffs. Generally, what happens to the stock market does not directly affect the economy because it represents investor sentiment and future expectations rather than current economic conditions. However, significant drops in stock market values can indirectly affect the economy by influencing consumer confidence, business investment, and financial stability. The economy is said to be in recession when the total of everything a country spends or exports shrinks for two consecutive, substantial three-month periods or experiences a significant decline across key indicators, such as GDP, employment, and industrial production, over several months. While this might not happen immediately, there are warning signs, and a significant risk exists that it could impact the US, UK, and EU markets, according to many economic analysts.

The Asian manufacturing hub that relies on US markets for exports ranging from textiles to cars will be the worst hit. The tariffs will affect developed countries, such as Japan and South Korea, with a 26% tariff, as well as emerging economies like Vietnam, which will face a 46% tariff levy. The list of trade wars includes Cambodia at 49%, Thailand at 36%, India at 26%, the EU at 20%, Bangladesh at 37%, and Singapore, New Zealand, and Australia at 10%, with China at the highest, at 54% in total. Asia is bearing the brunt of the new regime of higher taxes, and there is mounting concern among Asian economies that the trade war could trigger a slowdown or recession in the US economy, which could, in turn, harm Asian exports.

Tariff announcements are contributing to perceptions of inflation and recession. Goldman Sachs predicts a 45% chance that the US will fall into recession within the next 12 months. Many other Wall Street firms are also revising their forecast for a recession in the wake of Trump's tariffs announcements. JP Morgan has also issued a revised prediction, stating that there is a 60% chance that the US and global economies will enter a recession. Emerging economies will be affected in both the short and long term.

The Trump administration has clearly stated that it has no plans to pause the global tariffs despite the world's stock market experiencing turbulence. Trump further reiterates that an additional 50% tariffs will be imposed on Beijing if they do not withdraw the retaliatory levy by mid-April 2025. If these taxes are imposed, it means that some U.S. companies that are importing goods from China will face a total tariff of 104%.

The tariffs announced by the Trump administration have had an indelible impact, triggering chaos in global stock markets, disrupting supply chains, and leading to a steep decline in investor confidence. As nations and businesses grapple with navigating the unprecedented new tariff regime, the world is left in a state of economic instability that is predicted to be prolonged. The trade war will reshape geopolitical relationships, leaving policymakers and industries groping with the tectonic consequences.

2022 © All right reserved for Oman Establishment for Press, Publication and Advertising (OEPPA) Provided by SyndiGate Media Inc. (Syndigate.info).