PHOTO

Emerging markets should be able to weather a trade war, though an increased probability of a US recession does pose greater risks.

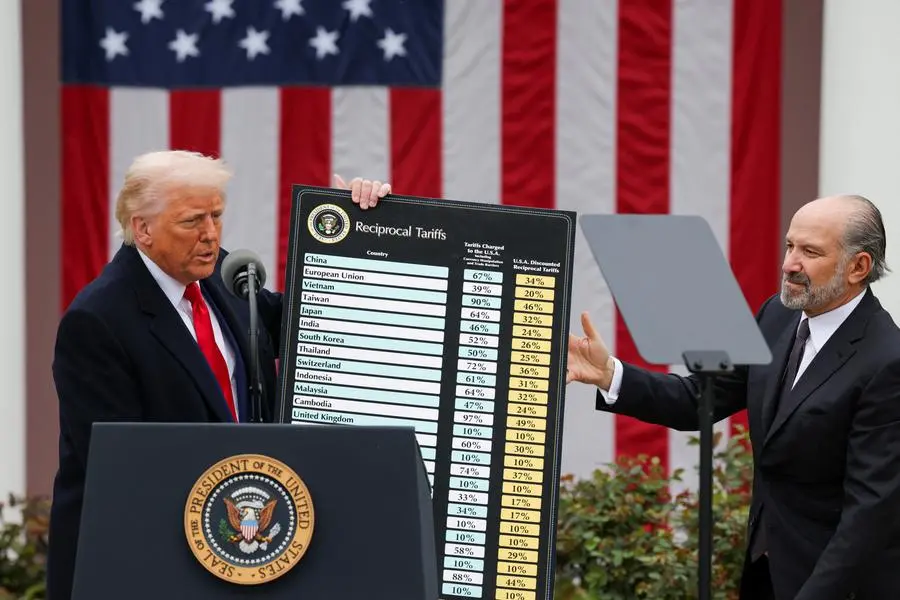

Investors in the asset class are grappling with the potential consequences of US president Donald Trump's tariffs policies, including his so-called reciprocal tariffs, which he announced on April 2.

"I believe that EM in general will outperform developed economies from a growth basis, as I don’t see any meaningful sovereign defaults this year and still expect the EM corporate default rate to be around 2.5%–3%," said Uday Patnaik, head of EM debt at LGIM.

"Emerging markets have strong buffers this time around, including FX reserves, significant multilateral support, aggregate current account surpluses, more flexible exchange rates and so on," he said.

"That’s not to say that spreads wouldn’t widen, as they have been doing particularly in the last few days. But I do think emerging markets will be able to muddle through better than previously, and that large EMs like China and India have room for monetary and fiscal stimulus."

Kaan Nazli, senior economist and portfolio manager for the emerging markets debt team at Neuberger Berman, said the growth outlook both for the US and globally is uncertain, but the EM asset class has so far coped relatively well. "The moves in EM credit have been sizeable yet more modest in comparison to developed market fixed-income asset classes, likely reflecting light positioning after three years of consecutive outflows."

Some of the riskiest corners of the asset class have fared worst. Ivory Coast's US$1.75bn 8.075% April 2036s, which priced in late March at 97.506, are currently bid at 90.25, according to LSEG. Kenya's US$1.5bn 9.5% March 2036s were reoffered at 97.195 in late February; now they are bid at 84.125.

Sergey Dergachev, functional head of EM corporate debt at Union Investment Privatfonds, said that despite valuations becoming more attractive, he was wary of buying. He needed to see if and which EM countries might be able to negotiate better tariffs terms with the US, but even if they do, the most important relationship in determining market sentiment will be between Washington and Beijing.

The oil price will also be important, with Dergachev saying that the "key red line" will be if it falls below US$60 a barrel for a considerable time. Brent futures are currently in the mid-60s. A final factor to weigh up will be the Federal Reserve's response.

"The situation is very volatile and dynamic in my view, and apart from some Chinese new issues – the Chinese corporate debt market has its unique story and drivers – most other EM new issue markets are on pause at the moment," Dergachev said.

Nazli said the primary market needed to see "some high-quality investment-grades coming", as had been the case in the immediate aftermath of the Covid pandemic.

South Korean steel manufacturer Posco Holdings has signalled its intention to issue on Wednesday. The company is considering a US dollar benchmark five and/or 10-year 144A/Reg S deal.

Trump imposed a 25% tariff on steel and aluminium last month, which is already in effect. Reuters reports that the European Union is considering 25% counter-tariffs on some US imports in response.

Still, there are certain things in Posco's favour. It held an extensive roadshow last week; it is also seeking to issue a green bond. Although labelled bonds in the US market are under a certain amount of scrutiny, the dwindling supply of sustainable debt in the currency has left asset owners and global funds "crying out" for US dollar-denominated debt, according to a senior ESG banker.

Source: IFR