PHOTO

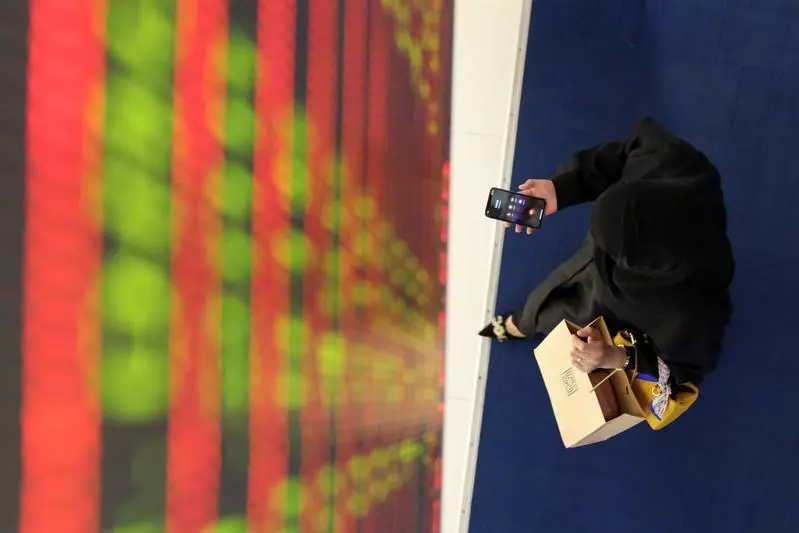

DUBAI - Here are some factors that may affect Middle East stock markets on Monday. Reuters has not verified the press reports and does not vouch for their accuracy.

INTERNATIONAL/REGIONAL

* GLOBAL MARKETS-Chinese and HK shares fall as China Q3 GDP misses estimates

* Oil prices climb to highest in years as COVID recovery, power generators stoke demand

* PRECIOUS-Gold ticks higher as U.S. bond yields, dollar ease

* MIDEAST STOCKS-Saudi index hits multi-year peak as Gulf bourses end higher

* Lebanon's Maronite patriarch says judges must be left to work

* Syrian government, opposition agree to redraft constitution -envoy

* Iraq says oil price above $80 is 'a positive indicator' - spokesman

* Sudan protest calls for military coup as political crisis deepens

* Saudi Arabia advises citizens not to travel to Lebanon - ministry

EGYPT

* Egypt says will impose coronavirus restrictions on public employees after Nov 15

* Egypt remittances from workers abroad down 3% to $2.79 bln in July 2021- MENA

* Egypt's arrears to foreign oil firms down to $845 mln by end of FY 2020-21 - minister

* Egypt's oil minister says foreign investments down 26% to $5.4 bln in 2020-21

SAUDI ARABIA

* MEDIA-Uber, Careem said to face $100 mln bill in Saudi tax squeeze- Bloomberg News

* Saudi Arabia starts operating airports at full capacity

UNITED ARAB EMIRATES

* UAE's daily COVID-19 cases fall below 100

* BRIEF-IHC Unit Multiply Group Acquires 100% Ownership Of Viola Communications

* FTSE adds ADNOC Drilling to three of its global equity indices -statement

QATAR

* U.S. Secretary of State Blinken discusses Afghanistan with Qatar

* Qatargas says it starts construction of four new LNG mega-trains

* BRIEF-Qatar Islamic Bank 9-Month Profit Up 13.9%

BAHRAIN

* BRIEF-Bahrain's BBK Closes $150 Million 2-Year Club Loan Facility

(Compiled by Dubai newsroom) ((dubai.newsroom@thomsonreuters.com))