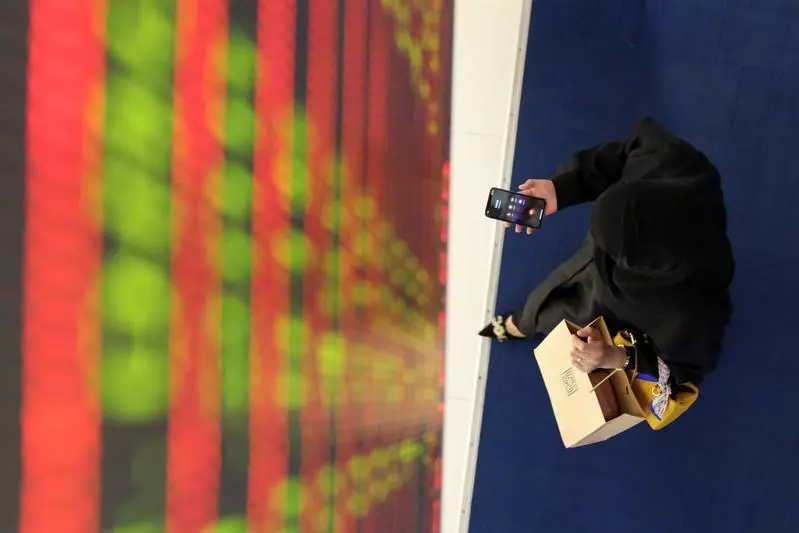

PHOTO

DUBAI - Here are some factors that may affect Middle East stock markets on Tuesday. Reuters has not verified the press reports and does not vouch for their accuracy.

INTERNATIONAL/REGIONAL

* GLOBAL MARKETS-Asia stocks tick up from one-year low, China gains on RRR cut

* Oil extends gains on easing Omicron fears, Iran delay

* PRECIOUS-Gold flat on firmer dollar, U.S. bond yields

* MIDEAST STOCKS-Abu Dhabi hits record peak; STC weighs on Saudi index

* EXCLUSIVE-Uber in talks with Mideast unit over outside investment - sources

EGYPT

* Egypt's central bank sells $1 bln in 1-year dollar T-bills

SAUDI ARABIA

* Omani, Saudi firms sign $30 bln in MoUs amid Saudi crown prince's visit

* BlackRock, Saudi asset manager Hassana sign deal for Aramco's gas pipelines

* Saudi ACWA power to sign a $7 bln green hydrogen deal with Omanoil, Air Products

* Alkhorayef Water Renews Islamic Credit Facility Agreement With Arab National Bank

* Saudi Exchange Announces Listing Shares Of Saudi Tadawul Group Holding On Dec 8

* ACWA Power signs MoU with Natixis to finance up to $2 bln of projects

OMAN

* Oman's OQ signs MoUs with Saudi Sabic, Aramco Trading Co

QATAR

* Erdogan's visit to Qatar to yield deals but no MbS meeting

* Qatar Energy Announces Long-Term LNG Supply Agreement With China's Guangdong Energy Group

UNITED ARAB EMIRATES

* UAE's ADNOC sets January Murban crude OSP at $82.03/bbl

* POLL-Dubai property prices to get boost next year from foreign demand

(Compiled by Dubai newsroom) ((dubai.newsroom@thomsonreuters.com))