PHOTO

NEW YORK, Aug 16 (Reuters) - President Donald Trump has repeatedly called for a weaker U.S. dollar in a bid to help U.S. exporters, but his recent trade policies, including the imposition of import tariffs on some Turkish goods, have had the opposite effect of strengthening the greenback.

The dollar this week rose to a 13-month high against a basket of currencies, getting an extra boost as emerging markets have sold off on concern about contagion from Turkey and investors sought a safehaven in the U.S. currency.

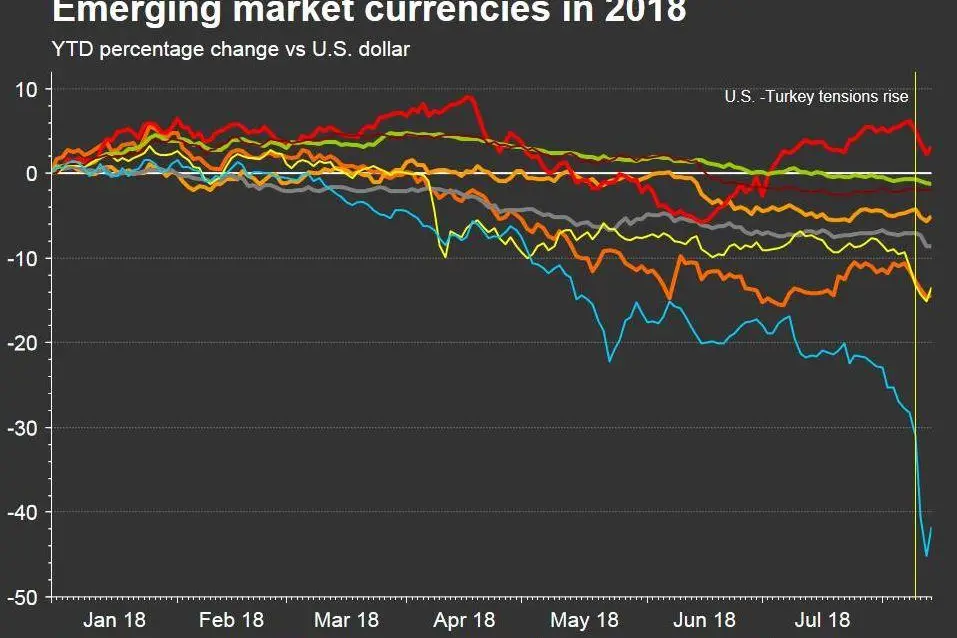

On August 10, Trump intensified the spat with Turkey over the detention in Turkey of U.S. evangelical pastor Andrew Brunson on terrorism charges by imposing higher tariffs on metal imports. The move sent the Turkish lira to a record low against the dollar and spurred declines in other emerging market currencies.

The U.S. dollar has risen against major currencies for several months, with the dollar index .DXY up nearly 8 percent over the last four months. On Wednesday, the index hit a fresh 13-month high.

"In a lot of ways some of his actions have amplified this risk-off type of environment, which has ultimately helped the U.S. dollar strengthen in the near-term," said Charles Tomes, senior investment analyst and trader at Manulife Asset Management in Boston.

Robust U.S. economic data this year, even as Europe and other major economies have lost some steam, has helped keep the U.S. Federal Reserve on track to raise interest rates twice more this year, which should boost the appeal of the dollar further.

“I think the dollar is strengthening as a result of diverging monetary policies," said Oliver Pursche, Chief Market Strategist Of Bruderman Brothers In New York. "It's fairly clear that the Fed is almost certain to hike in September and very likely to hike in December again, whereas other central banks are maintaining a status quo."

Some analysts said that U.S. tax cuts passed last year by Congress which are boosting corporate earnings and economic growth have reinforced the reasons for raising interest rates. The $1.5 trillion tax cut and the $1.3 trillion spending bill enacted in March, have pushed forecasts for the fiscal deficit higher. The U.S. economy grew at its fastest pace in nearly four years in the second quarter. urn:newsml:reuters.com:*:nLNSRIEEHE

"So now you have economic data warranting the Fed rate hiking cycle and expectations for other central banks pushed out a little bit," said Tomes.

The administration's move to impose import tariffs against China, Europe, Mexico and Canada is also expected to contribute to inflation, which tends to ramp up bets on a swifter pace of Fed rate hikes and, in turn, a stronger dollar.

Investors have also shown a preference for the greenback based on the expectation that the it will gain at the expense of emerging market currencies which are dependent on commodity exports.

"When the dollar turned in the second quarter we had a really weak EM market," Said Haidar, founder and chief investment officer, at New York hedge fund Haidar Capital Management, said.

"You now have another huge selloff in EM, which has been exacerbated by Trump's willingness to jam on more and more sanctions when countries are having trouble in the market – like adding to the sanctions on Turkey," Haidar said.

MSCI's emerging market currency index .MIEM00000CUS hit its lowest level since May 2017 on Wednesday as many major emerging currencies extended their selloff in the wake of Turkey's currency crisis.