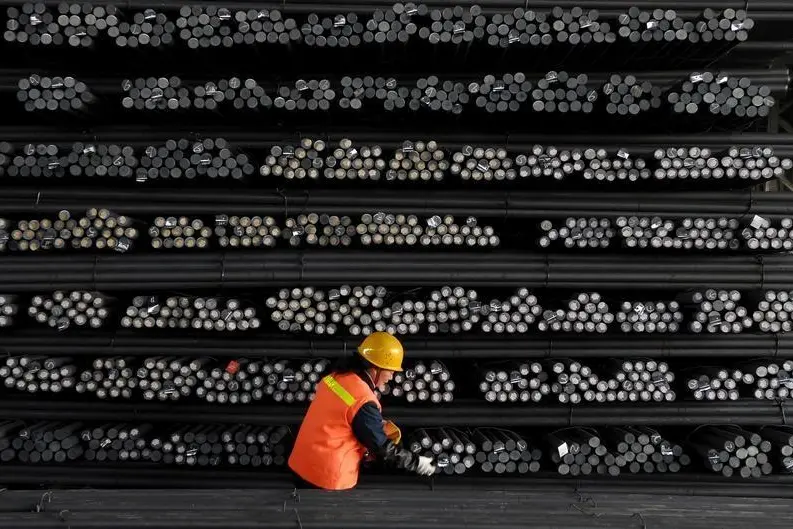

PHOTO

By Francesco Guarascio

TOKYO, May 14 (Reuters) - The Group of Seven nations will take steps to tackle a global glut in steel that many blame on overcapacity at Chinese producers of the material used in construction and cars, according to a draft text obtained by Reuters.

If adopted at the G7 summit in Japan later this month, it will likely add to pressure on China, which accounts for about half of global steel output, to take steps after production hit a record high earlier this year. Steel mills from Australia to the U.K. are under threat of closure because of the glut.

"We recognise the negative impact of global excess capacity across industrial sectors, especially steel, on our economies, trade and workers," the draft text says.

"We are committed to moving quickly in taking steps to address this issue by enhancing market function, including through coordinated actions that identify and seek to eliminate such subsidies and support, and by encouraging adjustment."

G7 leaders will meet on May 26-27 in Ise-Shima near Nagoya, a major car production and steel manufacturing centre.

China's steel output hit a record in March as rising prices and better margins prompted mills that had been shut or suspended to resume production.

urn:newsml:reuters.com:*:nL3N17M02W

Chinese prices have since plummeted, with Chinese steel futures posting their biggest weekly fall since 2009 on Friday.

urn:newsml:reuters.com:*:nL3N18A2WH

Last month, China and other major steel producers failed to agree on measures to tackle the overcapacity crisis, prompting the United States, European Union and others to call for urgent action.

China plans to shed as much as 150 million tonnes of domestic crude steel capacity in the next five years in a bid to help tackle the capacity overhangs that have saddled domestic firms with losses and debts.

France and Germany urged fellow EU members on Friday to tighten trade defences to protect the bloc's companies against floods of cheap imports, including steel products from China.

urn:newsml:reuters.com:*:nL5N18A5II

Cheap Chinese steel exports have been cited as one reason for Tata Steel's

TISC.NS

decision to sell its British steel operations. Australian steel and mining company Arrium

ARI.AX

has gone into administration, while in Germany steelworkers have taken to the streets because of the threat of job cuts.

Chinese officials have said that they are already taking sufficient steps to curb capacity, while state news said blaming China for the global steel crisis is an excuse for protectionism that would be counter-productive.

Some European countries are opposed to the wording of the G7 draft text because of fears about retaliation from China, according to a source.

China is not the only concern, with Japan threatening to take action against India at the World Trade Organisation after it set minimum prices for imported steel. Japan and South Korea have also been criticised for exporting steel products cheaper than those sold domestically.

"In particular, we are concerned about subsidies and other support by governments and government-supported institutions that distort the market and contribute to global excess capacity, including such supports granted to overseas expansion of the capacity," the G7 text says.

(Reporting by Francesco Guarascio; Writing by Aaron Sheldrick) ((aaron.sheldrick@thomsonreuters.com; 81-3-6441-1320; Reuters Messaging: aaron.sheldrick.thomsonreuters.com@reuters.net))

TOKYO, May 14 (Reuters) - The Group of Seven nations will take steps to tackle a global glut in steel that many blame on overcapacity at Chinese producers of the material used in construction and cars, according to a draft text obtained by Reuters.

If adopted at the G7 summit in Japan later this month, it will likely add to pressure on China, which accounts for about half of global steel output, to take steps after production hit a record high earlier this year. Steel mills from Australia to the U.K. are under threat of closure because of the glut.

"We recognise the negative impact of global excess capacity across industrial sectors, especially steel, on our economies, trade and workers," the draft text says.

"We are committed to moving quickly in taking steps to address this issue by enhancing market function, including through coordinated actions that identify and seek to eliminate such subsidies and support, and by encouraging adjustment."

G7 leaders will meet on May 26-27 in Ise-Shima near Nagoya, a major car production and steel manufacturing centre.

China's steel output hit a record in March as rising prices and better margins prompted mills that had been shut or suspended to resume production.

Chinese prices have since plummeted, with Chinese steel futures posting their biggest weekly fall since 2009 on Friday.

Last month, China and other major steel producers failed to agree on measures to tackle the overcapacity crisis, prompting the United States, European Union and others to call for urgent action.

China plans to shed as much as 150 million tonnes of domestic crude steel capacity in the next five years in a bid to help tackle the capacity overhangs that have saddled domestic firms with losses and debts.

France and Germany urged fellow EU members on Friday to tighten trade defences to protect the bloc's companies against floods of cheap imports, including steel products from China.

Cheap Chinese steel exports have been cited as one reason for Tata Steel's

Chinese officials have said that they are already taking sufficient steps to curb capacity, while state news said blaming China for the global steel crisis is an excuse for protectionism that would be counter-productive.

Some European countries are opposed to the wording of the G7 draft text because of fears about retaliation from China, according to a source.

China is not the only concern, with Japan threatening to take action against India at the World Trade Organisation after it set minimum prices for imported steel. Japan and South Korea have also been criticised for exporting steel products cheaper than those sold domestically.

"In particular, we are concerned about subsidies and other support by governments and government-supported institutions that distort the market and contribute to global excess capacity, including such supports granted to overseas expansion of the capacity," the G7 text says.

(Reporting by Francesco Guarascio; Writing by Aaron Sheldrick) ((aaron.sheldrick@thomsonreuters.com; 81-3-6441-1320; Reuters Messaging: aaron.sheldrick.thomsonreuters.com@reuters.net))