PHOTO

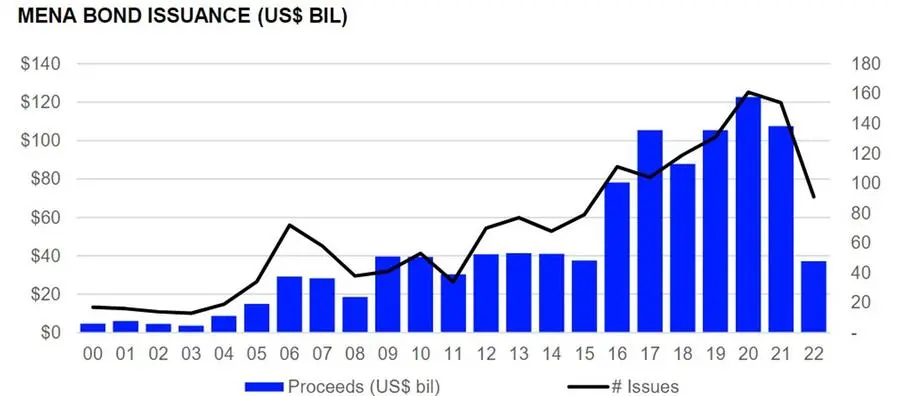

MENA debt issuance amounted to $37.3 billion in 2022, plummeting 65% from the value recorded in the year-earlier period, according to data from Refinitiv. This is the lowest full-year total since 2011.

The UAE was the most active issuer nation during 2022, accounting for 42% of total bond proceeds. Saudi Arabia was the second largest issuer of debt (40%), followed by Qatar (10%) and Bahrain (3%).

Financial issuers accounted for 67% of proceeds raised during the year, while Government & Agency issuers accounted for 25%. Saudi Arabia's GACI First Investment Co. was the largest issuer from the Financial sector, raising $2.87 billion.

The Saudi government was overall the biggest debt issuer, raising $5 billion, while the UAE followed with $3 billion.

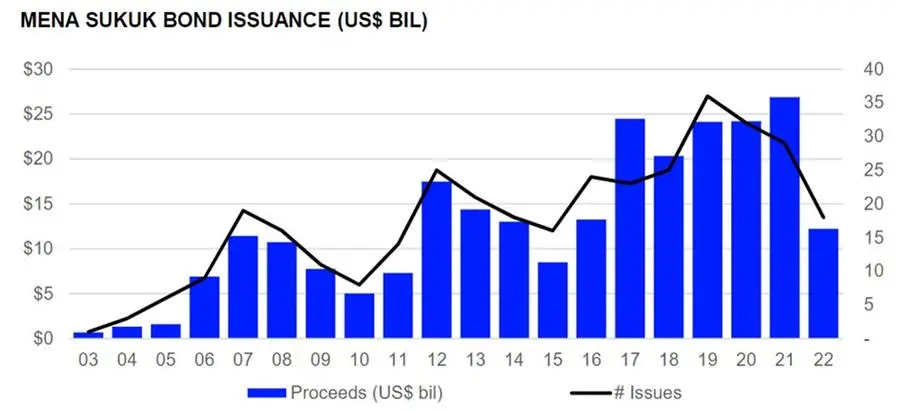

Islamic bonds raised $12.2 billion during 2022, a 55% decline from 2021 and the lowest annual total in seven years. Sukuk accounted for one-third of total bond proceeds raised in the region during 2022, compared to one quarter in 2021, Refnitiv data showed.

The top issuer of Islamic bonds was the Saudi government, which raised $2.5 billion in 2022. IsDB Trust Services accounted for the biggest sukuk issue from the Financial sector, raising $1.6 billion.

HSBC took the top spot in the MENA bond bookrunner ranking during 2022, with $5.7 billion of related proceeds, or a 15% market share. Last year's league table topper Standard Chartered PLC followed with $5.1 billion.

HSBC also ranked first in the 2022 MENA Islamic bonds league table with $1.61 billion of proceeds, while last year's league table topper Standard Chartered PLC again was second with $1.3 billion.

(Reporting by Brinda Darasha; editing by Seban Scaria)