PHOTO

The value of announced M&A transactions with any MENA involvement reached $69.7 billion during the first nine months of 2022, 17% less than the value recorded during the same period in 2021.

Despite the decline in value, the number of deal announcements in the region increased 5% from last year to the highest first nine-month total since our records began in 1980, accroding to global data provider Refinitiv.

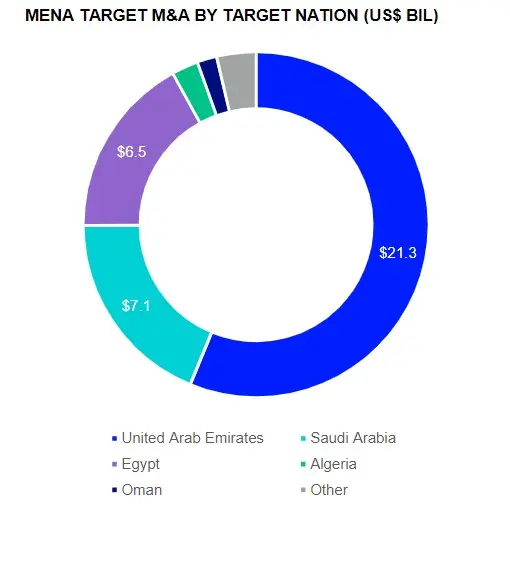

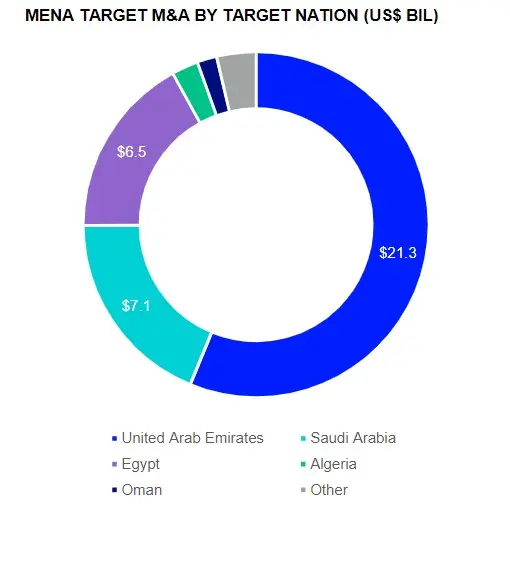

Deals involving a MENA target totalled $37 billion during the first nine months of 2022, down 38% from the same period last year and a four-year low. The number of deals declined 1% from last year but marked the second highest first nine-month deal count of all time.

The top deal with MENA involvement included Dubai-based port operator DP World and Caisse de dépôt et placement du Québec (CDPQ), a global investment group, announcing a $5 billion investment in three of DP World’s flagship assets in the UAE.

In May, Emirates Telecommunications Group (Etisalat), now known as E&, said that its Atlas 2022 Holdings unit has acquired 2,766 million shares in Vodafone for $4.4 billion.

Inbound deals involving a non-MENA acquiror declined 73% from last year’s all-time recordto $10.0 billion, Refinitiv said.

Domestic deals increased 14% in value to $28 billion, as the number of transactions exceeded 400 for the first time during any first nine-month period since our records began.

The UAE was the most targeted nation, followed by Saudi Arabia and Egypt.

MENA outbound M&A totalled $27.9 billion, up 70% compared to the value recorded during the same period in 2021 and a 13-year high.

Citi topped the any MENA involvement announced M&A financial advisor league table during the first nine months of 2022.

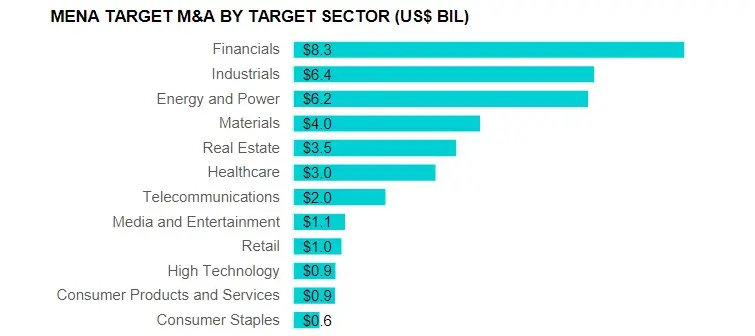

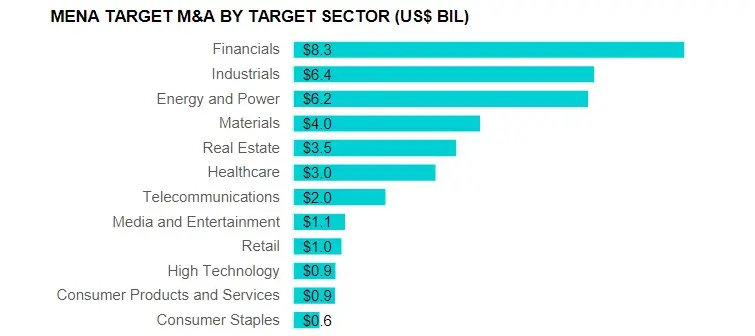

The financial sector was most active, with deals targeting financial companies accounting for 22% of MENA target M&A during the first nine months of 2022, followed by Industrials with 17%.

(Reporting by Seban Scaria; editing by Daniel Luiz)