PHOTO

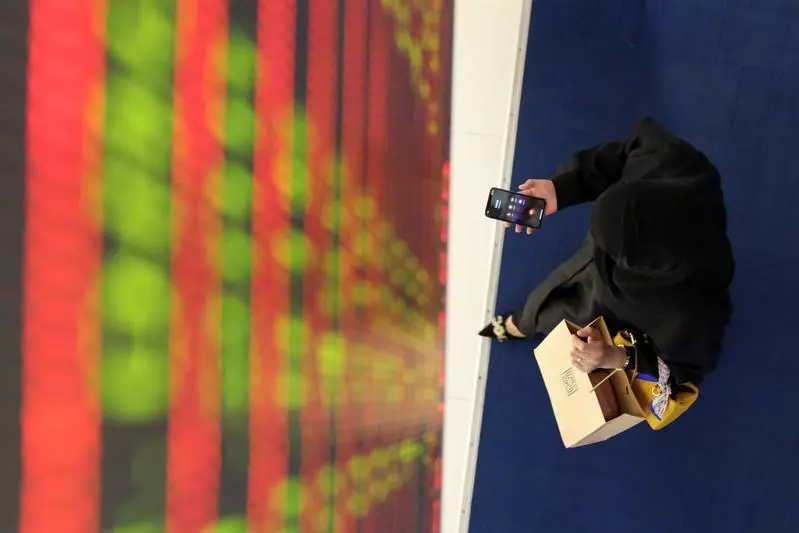

Banking and finance, real estate and Adnoc entities stocks are expected to perform well this year on the back of strong dividends they have been paying to the shareholders.

Anita Gupta, head of equity strategy wealth management at Emirates NBD, said the UAE equity market is about dividend yields and this trend is likely to continue this year.

“We expect 2024 to be a good year for banks. We may not see astronomical growth that we saw in 2023, but we do expect dividend payout to be maintained in 2024, which is very good for Dubai and Abu Dhabi banks,” she said.

While speaking on the sidelines of the launch of the 2024 outlook report in Dubai on Monday, she said most of the IPOs over the last three years paid dividends of over four per cent. “That is again key to maintaining their growth upside. Last year, banks did exceptionally well and we saw their earnings on average have gone up 20-30 per cent and some have doubled their earnings. Banks also increased their dividends as net interest margins improved, and they wrote back provisions as the economy is strong.”

Gupta said the other sector that they stay convinced are Adnoc-backed companies listed on the Abu Dhabi bourse.

“They are strong dividend payers and diversification away from just real estate and banking sectors. That is again going to do well. Thirdly, real estate companies are going to have a good year because deliveries are strong in 2024 so we expect real estate developers in Dubai and Abu Dhabi to pay good dividends. That is positive for real estate companies,” Gupta told Khaleej Times in an interview on Monday.

46% returns

In the last three years, 19 IPOs came up in the UAE across different sectors such as retail, energy, education, healthcare and privatization of government entities of Dubai.

“Average return from listing in the last 3 years has been 46 per cent and that is quite a contrast to the rest of the world. For example, Indian IPOs have done well in the first year of listing and most of them went up by 25 per cent at least and then fell subsequently. What sustained the UAE companies is very definitely the dividend yield. Any company that has increased the dividends, they have done better,” she said.

UAE, Dubai GDP

Emirates NBD Research said the UAE and Dubai’s real GDP growth is expected to grow faster next year, driven by non-oil sectors.

Dubai’s largest bank expects the UAE economy to expand at a slightly slower pace at 3.3 per cent in 2024, but the pace will pick up to 4.0 per cent in 2025, led by a 4.7 per cent expansion of the non-oil sectors.

Similarly, Dubai’s economy will expand at 4.0 per cent in 2024, the same as last year. But the growth will pick up to 4.5 per cent next year.

Copyright © 2022 Khaleej Times. All Rights Reserved. Provided by SyndiGate Media Inc. (Syndigate.info).