PHOTO

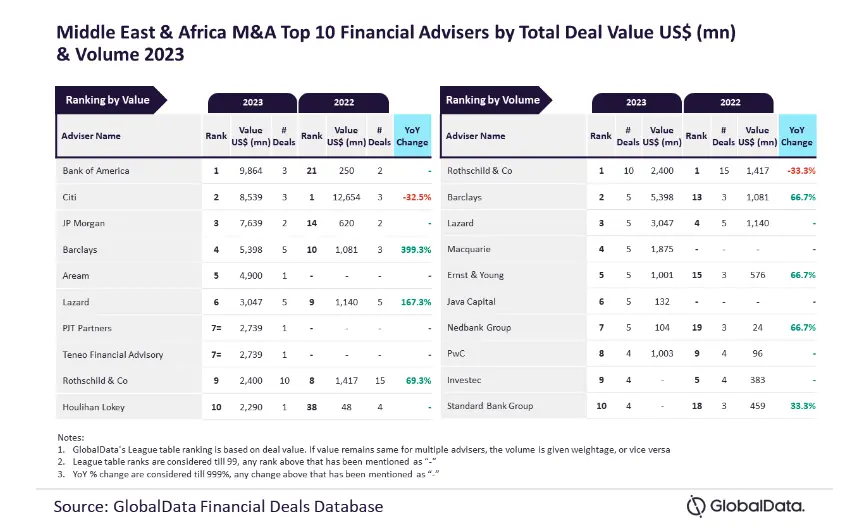

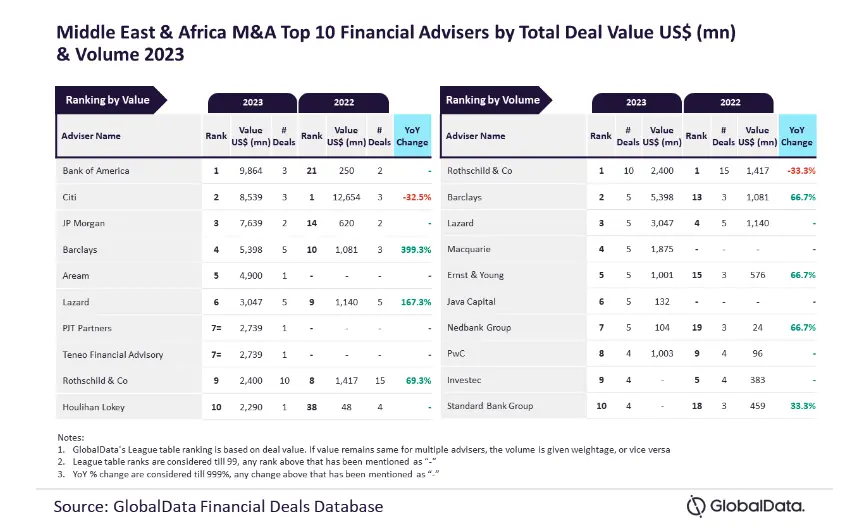

Bank of America and Rothschild & Co. were the top mergers and acquisitions (M&A) financial advisers in the Middle East & Africa region in 2023 by value and volume, respectively, according to GlobalData, a London-based data and analytics company.

Bank of America, which was at the 21st position by value in 2022, secured the top position in terms of value by advising on $9.9 billion worth of deals. Meanwhile, Rothschild & Co. led in terms of volume by advising on a total of 10 deals.

“Rothschild & Co was the top adviser by volume in 2022 and retained its leadership position by this metric in 2023 as well. In fact, it was the only adviser to hit the double-digit deal volume in 2023,” said Aurojyoti Bose, Lead Analyst at GlobalData.

Apart from leading by volume, Rothschild & Co also occupied the ninth position by value during the year.

Citi took the second position in terms of value by advising on $8.5 billion worth of deals, followed by JP Morgan with $7.6 billion, Barclays with $5.4 billion and Aream with $4.9 billion.

Meanwhile, Barclays occupied the second position in terms of volume with five deals, followed by Lazard, Macquarie and Ernst & Young, each with five deals.

(Editing by Seban Scaria seban.scaria@lseg.com)