PHOTO

Emerging markets got a boost from broad gains in global tech-related stocks on Thursday, while investors assessed a survey on inflation expectations in South Africa and awaited economic data out of India.

MSCI's index tracking bourses in developing economies rose 1.3%, with tech-focused indexes in Hong Kong rising nearly 1%, and those in Korea and Taiwan jumping over 2% each.

Investor sentiment got a boost from a report that said the U.S. government was considering allowing Nvidia to export advanced chips to Saudi Arabia. Some of the AI-bellwether's suppliers are based in Korea and Taiwan.

Still, the MSCI EM index is not far from lows seen over a month ago, and is on track for its first quarterly drop in a year as concerns around global growth dampened risk taking ahead of a U.S. Federal Reserve interest rate cut expected later in the month.

Shilan Shah, deputy chief emerging markets economist at Capital Economics said, "while (the Fed's upcoming monetary easing cycle) is likely to give some central banks a green light to lower interest rates, EM rate decisions have been driven increasingly by domestic rather than external developments.

"A potential increase in capital flows will be positive for those EMs with balance of payments problems, although these are comparatively rare now."

Reflecting a weak demand outlook from China, the International Energy Agency cut its 2024 oil demand growth forecast, just days after the Organisation of Petroleum Exporting Countries trimmed its forecast for the current year and the next.

Currencies of top crude importers Turkey and India were muted against the dollar, while the Philippine peso slipped 0.3%.

In south Asia, traders await inflation data out of India, due at 1200 GMT, with economists expecting price-growth to slow.

The main equities index rose 1.3%, while yield on benchmark bonds were steady.

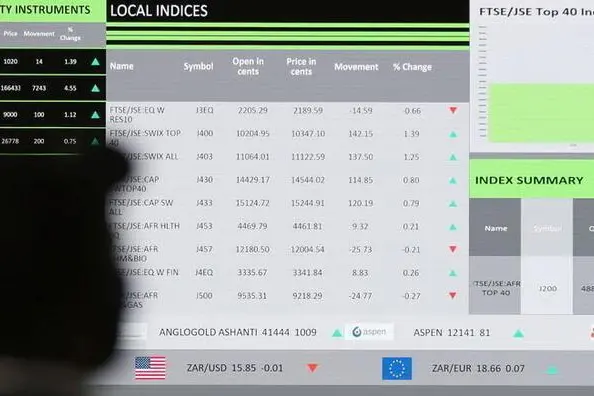

Meanwhile, South Africa's rand dropped 0.5% after a central bank survey showed inflation expectations fell further in the third quarter, with expectations pinned on the central bank to lower borrowing costs for the first time in more than four years next week.

In central and eastern Europe, Poland's zloty dipped 0.2%, while the Serbian dinar was muted ahead of a local central bank interest rate decision with expectations for a 25 basis point cut

Hungary's forint slipped 0.1%. The National Bank of Hungary said expected rate cuts by major central banks could create space to ease monetary conditions further in emerging markets, minutes from its August policy meet showed.

Attention was also on the European Central Bank's monetary policy decision later in the day, with expectations high for a quarter point reduction.

(Reporting by Johann M Cherian in Bengaluru; Editing by Alison Williams)