PHOTO

Saudi Arabia’s investment holding firm Savola Group expects its outstanding debt to reduce to SAR 2.64 billion ($703mln) after its rights issue, with its total equity increasing from SAR 9.53 billion to SAR 15.5 billion.

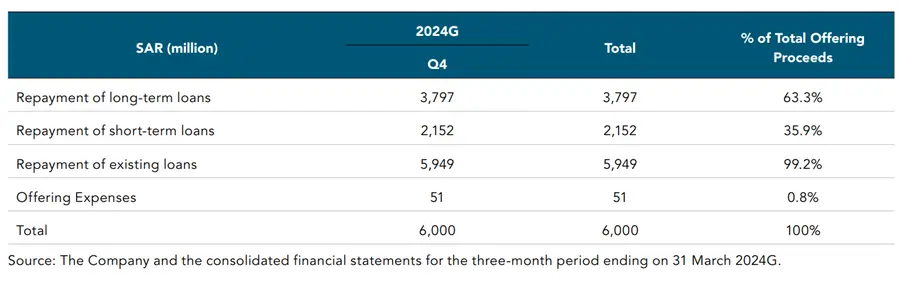

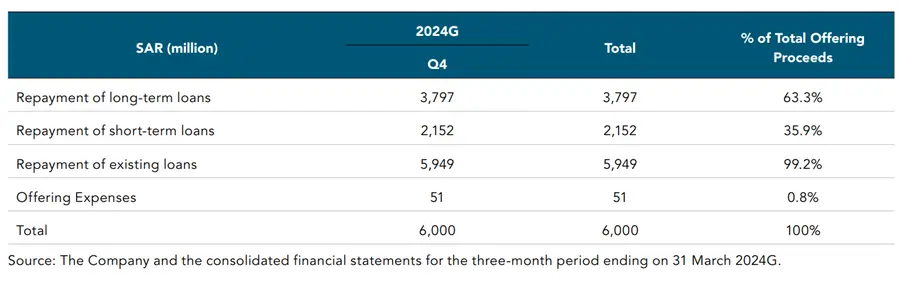

The industrial company for the food and retail sectors announced a 6 billion Saudi riyals ($1.6 billion) rights issue to pay down its debt and further investments in the growth of its portfolio companies.

Savola’s loans and borrowing reached SAR 8.6 billion at the end of 31 December 2023, comprising unsecured bank loans, both short and long-term, contributing to 87% of the total, it said in a prospectus.

The rights issue will also enable Savola to distribute its entire stake in Almarai (34.52%) to its eligible shareholders after the planned capital reduction.

Last week, the company said the rights issue will increase its capital from SAR 5.34 billion to SAR 11.34 billion, with the number of shares increasing by 600 million to 1.13 billion shares.

The increase will be at an average of 1.1236 shares per owned share, at an offer price of SAR 10 apiece and is subject to the completion of regulatory requirements and the company’s Extraordinary General Assembly (EGM), which is expected to take place on August 25.

Trading and subscription for the rights issue will commence at the same time, three working days from the approval of the capital increase by the EGM, Savola said.

(Reporting by Bindu Rai, editing by Seban Scaria)