PHOTO

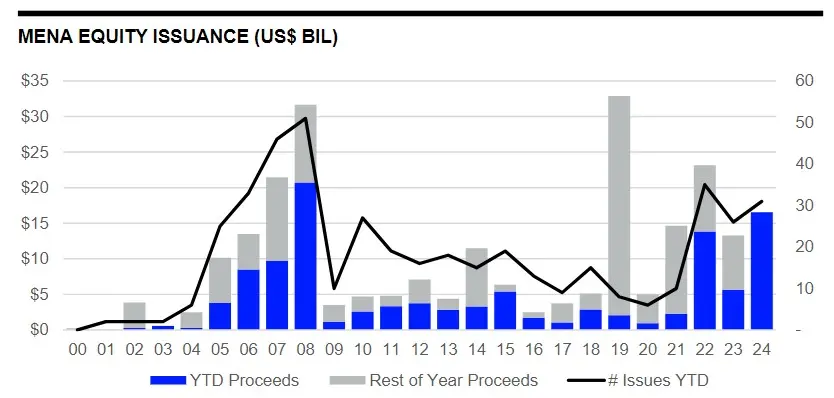

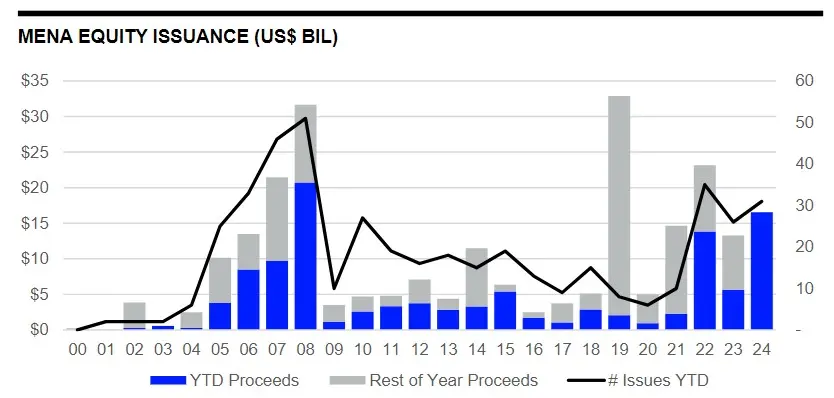

MENA equity and equity-related issuance totalled $16.5 billion during the first half of 2024, almost three-times 2023 levels, and the highest first half total in the region since 2008, according to LSEG's Deals Intelligence.

The number of issues increased 19% from H1 2023.

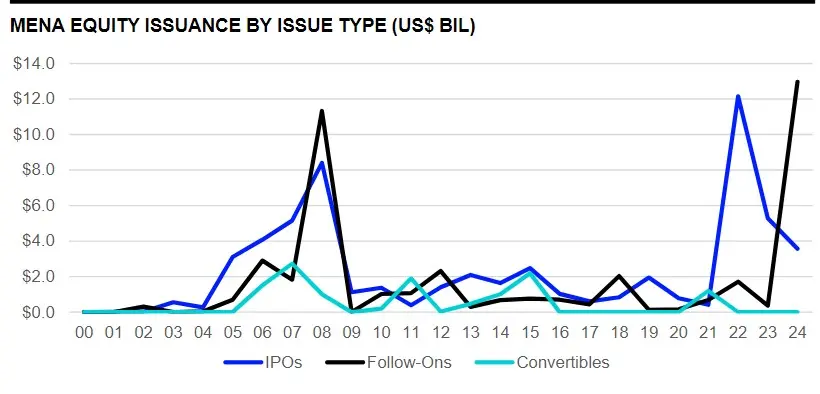

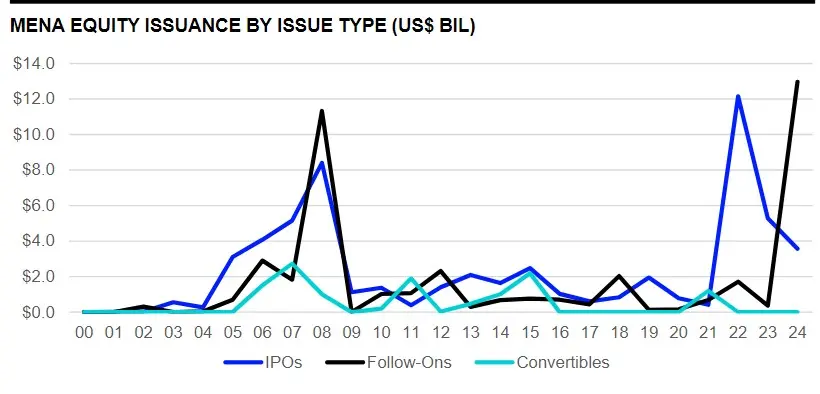

IPOs accounted for 22% of activity, while follow-on issuance accounted for 78%.

A total of 23 IPOs were recorded during H1, the highest first half total since 2008. They raised a combined $3.6 billion, 32% less than last year.

Saudi healthcare provider, Dr Soliman Abdul Kader Fakeeh Hospital Co, raised $763.5 million in its Tadawul stock market debut in May, the largest IPO in the region during the period under review.

Abu Dhabi's Alef Education Consultancy followed, raising $514.65 million.

Proceeds raised from follow-on offerings totalled $13 billion, an all-time first half high in the region following an $11.2 billion stock sale by Saudi Arabia’s Aramco in June.

ADNOC Drilling Co. raised $934.49 million in the second biggest follow-on offering.

The energy & power sector was most active with issuers raising $12.3 billion, accounting for 74% of total equity capital raisings in the region in H1.

Consumer Products & Services followed, accounting for 8%.

EFG Hermes took first place in the MENA ECM underwriting league table during the first half of 2024, with a 10.9% market share

(Writing by Brinda Darasha; editing by Seban Scaria)