PHOTO

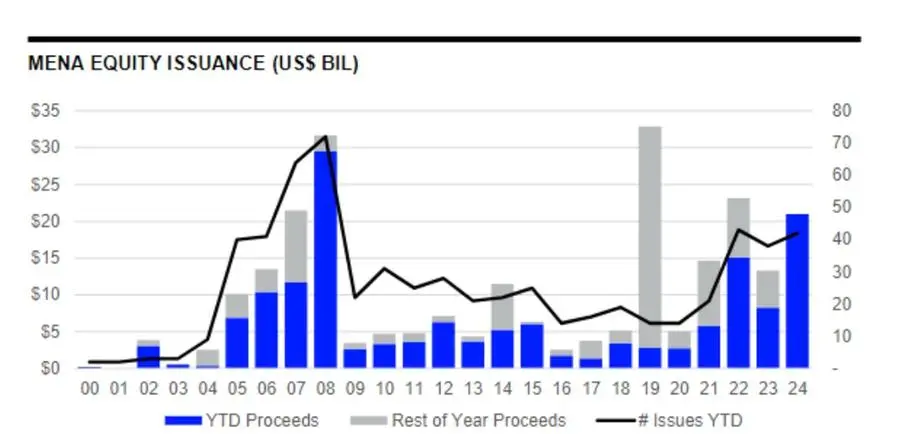

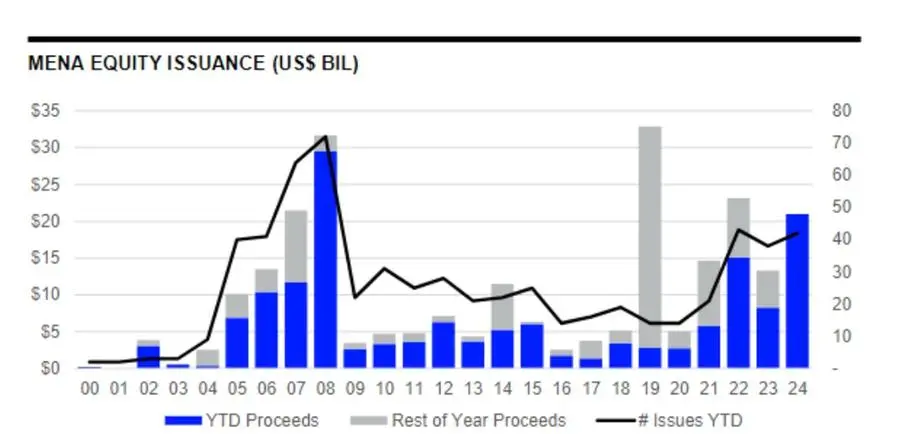

MENA equity capital markets (ECM) raised $21 billion in equity and equity-related issuances in the first nine months of 2024, boosted by a $12.3 billion stock sale by Saudi Arabia’s Aramco.

This marks a 154% increase from year ago levels and the highest first nine-month total in the region since 2008, data from the London Stock Exchange Group (LSEG) showed.

The number of issues increased 11% from last year.

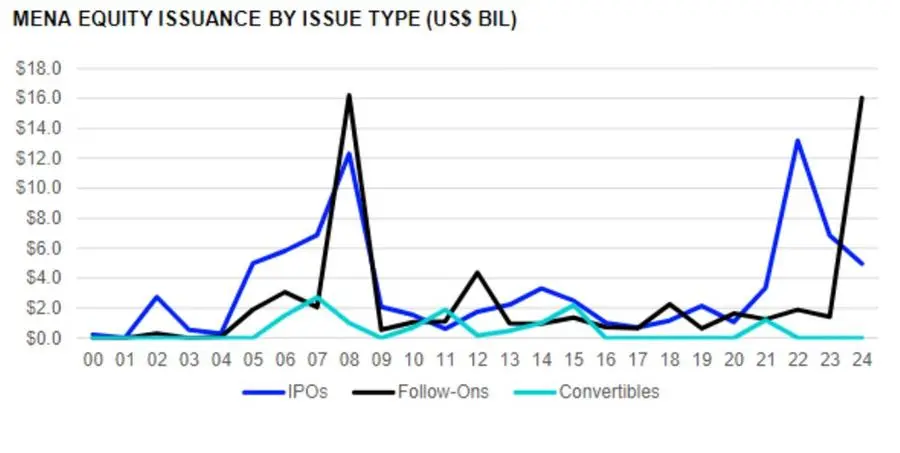

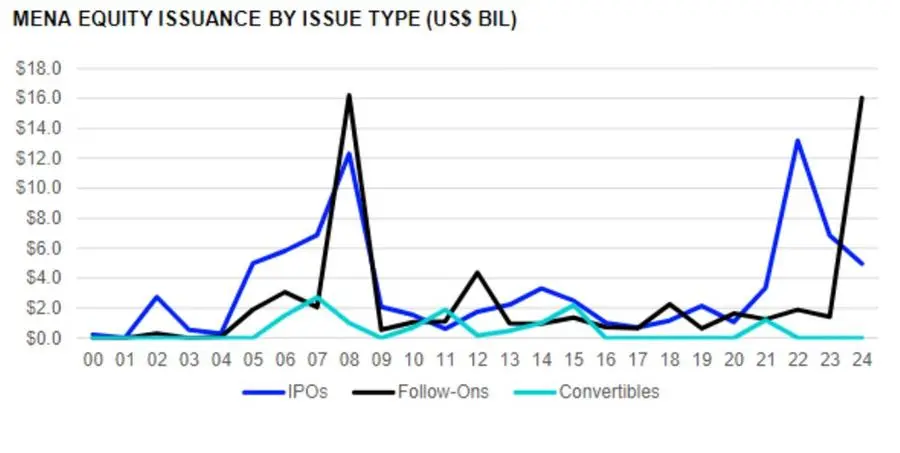

Initial public offerings (IPOs) accounted for 24% of activity, while follow-on issuance accounted for 76%.

There was a total of 30 IPOs during the first nine months of 2024, on par with last year’s level, and a total not exceeded during any January to September period since 2008.

They raised a combined $5.0 billion, 28% less than last year.

The UAE’s NMDC Energy, raised $876.7 million in its stock market debut on Abu Dhabi Securities Exchange in September, the largest IPO in the region during the first nine months of 2024.

Proceeds raised from follow-on offerings reached a 16-year high of $16 billion, largely boosted by a $12.3 billion stock sale by Saudi Arabia’s Aramco in June.

The energy & power sector was most active with issuers raising a combined $14.3 billion, accounting for 68% of total equity capital raisings in the region in the first nine months of 2024.

Retail followed, accounting for 12%.

Saudi Arabia led the table with the Aramco deal. Savola Group also had a follow-on sale for $1.75 billion. Dr. Soliman Abdel Kader Fakeeh Hospital Company completed an IPO netting $763.5 million.

The UAE had one follow-on issuance by ADNOC Drilling that raised $934 million. IPOs included those of Alef Education Consultancy LLC, Parkin Co. PJSC and Spinneys 1961 Holding Co. Plc.

EFG Hermes took first place in the MENA ECM underwriting league table during the first nine months of 2024, with a 9% market share with total proceeds topping $1.88 billion from eight issuances.

Riyadh Bank followed with 8% market share and total proceeds of $1.7 billion from two issuances.

(Writing by Brinda Darasha; editing by Seban Scaria)