PHOTO

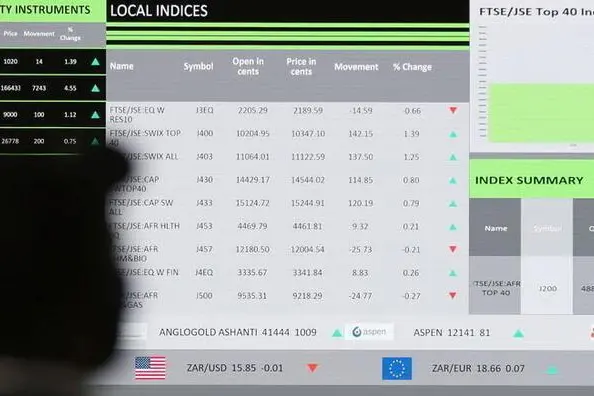

The Johannesburg Stock Exchange (JSE) announced a stable set of results for the first half of its financial year, with a Net Profit After Tax of R493m translating into headline earnings per share of 606 cents.

The group continues to be cash generative, with net cash generated from operations of R502.6m (2023: R487.9m), up 3%. Notably, these results have been achieved despite a challenging macro-economic, political and trading environment.

The JSE reported a 4.2% growth in operating income underpinned by increasingly diversified revenue streams. This solid financial performance is credited to the strong results of the JSE’s diversified business segments and asset classes.

Their year-on-year (Y-o-Y) growth offset the 12% decline in equity value traded (the JSE’s largest market segment). JSE Investor Services (JIS) grew by 28.9%, commodity derivatives revenue by 24.7%, and revenue from bonds and interest rate trading by 7.8%.

“These results reflect our segment and asset-class diversification as well as strategic progress in growing non-trading income, which now represents 39% of total operating income,” says Leila Fourie, the group chief executive officer at the JSE.

Business evolution and transformation

“We are pleased with the progress we have made as we continue to structurally improve our performance over time through innovation and collaboration. The JSE continues to pursue innovation with an emphasis on data, sustainability and advances in technology,” says Fourie.

Over the period, the JSE saw continued growth in sustainability products with eight new sustainability bonds listed, bringing the total to 76 listed sustainability bonds; as well as 100% growth in the number of Actively Managed Exchange Traded Funds (AMETFs).

Additionally, the exchange is on track to complete its core market data-to-the-cloud transition by the end of the year, in line with its Information Services growth strategy. The exchange has expanded its analytics-as-a-service capabilities to global exchanges and their ecosystems, as well as delivered Colo 2.0, a cloud-based colocation service that offers brokers lower trading latency. Moreover, there has been good progression in the development of the central clearing for the bond electronic trading platform (ETP) through JSE Clear.

Looking ahead

The JSE’s businesses remain resilient despite the fluid environment. The JSE Investor Services and Information Services businesses have delivered expected growth on the back of management focus and investment.

“After a slow start to 2024, value traded in our equity market started to recover in the second quarter with the trend extending into July. Higher trading activity has been reflective of positive market sentiment stemming from the outcome of the National Elections and the formation of the Government of National Unity (GNU),” says Fourie.

“We remain on track to deliver on our group’s strategy to position the JSE as a diversified and sustainable exchange, through next-generation technology, expanding our range of products and services, entering new markets, providing fair and transparent regulation, and strengthening our operational capabilities,” concludes Fourie.

All rights reserved. © 2022. Bizcommunity.com Provided by SyndiGate Media Inc. (Syndigate.info).