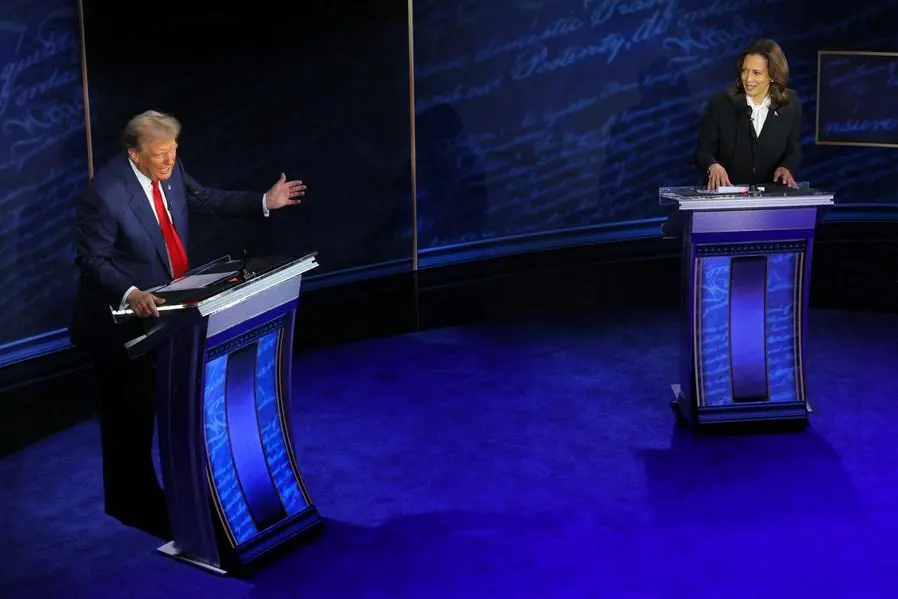

PHOTO

U.S. stock futures slipped and the dollar edged lower in early Asian trading on Wednesday as Republican Donald Trump and Democratic Vice President Kamala Harris faced each other for the first time, with some analysts saying Harris put in a slightly stronger performance.

Online prediction market PredictIt's 2024 presidential general election market showed Harris' odds at improving to 56% from 52% immediately before the debate, while Trump's odds slipped to 48% from 51%.

Stock futures eased during the debate and after it concluded, with the S&P 500 E-minis down 0.5% and Nasdaq 100 E-minis off 0.65%.

The dollar index, which measures the U.S. currency's strength against six major peers, slipped 0.23%.

COMMENTS:

QUINCY KROSBY, CHIEF GLOBAL STRATEGIST FOR LPL FINANCIAL

“It was light on specifics from either side and I think that those who adhere to Trump are going to believe that he won the debate and those who are loyal to Democrats will think that she won the debate.

"The question is: what about independents, what about undecideds? It’s difficult to see how they could have made up their minds based on tonight’s debate, other than the possibility of the overall performance, as opposed to specifics. For both sides, they were light on specifics.”

“If style matters and being calm and prosecuting your case for why temperamentally you should be president, then we will see the results in the market. Either the market will be favoring what we know, not from tonight, from the Trump portfolio, vs the Kamala Harris portfolio. This will manifest itself in the market tomorrow. Otherwise, we will go back to square one where we were at 4 p.m. Eastern Time when the market closed.”

ERIC BEYRICH, PORTFOLIO MANAGER, SOUND INCOME STRATEGIES, WESTCHESTER, NYC

"Neither one of them made strong economic points, but overall Harris came out of this better than Trump. I didn’t hear anything reassuring from either candidate. If anything I think they introduced greater uncertainty. Markets really don’t want strident statements; they want clarity.

"He didn’t give us clarity, and she revealed she’s much further to left than she has presented herself previously, as seen in her comments about health care being a fundamental right. I don't think that will be welcomed by markets, or that they'll be very happy about what it says about her policies more broadly. What the market would like to see are some rational economic policies, and there wasn't much to give them comfort on that in this debate."

SHIER LEE LIM, LEAD FX & MACRO STRATEGIST FOR APAC AT CONVERA

"The Harris-Trump debate does not seem to be having a major impact on markets so far, which aligns with the relatively low volatility expectations heading into the event. Option markets were only pricing in 73bp breakevens for USD/JPY and about 1.1% for the S&P 500 around the debate, which appears low considering the debate's timing just before Wednesday's U.S. CPI release.

"That said, the debate could still prove to be a significant catalyst for shifting election probabilities. Betting markets currently give Trump a slight edge in the overall election, with platforms like Polymarket showing Trump with a 52% chance compared to 45% for Harris. However, the race appears tight, with some variation across prediction markets."

"The election outcome could have meaningful implications for fiscal policy and financial markets. Republicans are reportedly considering tax cuts offset by tariffs, while Democrats may pursue corporate and wealth tax hikes to fund spending increases."

BRIAN NICK, HEAD OF PORTFOLIO STRATEGY, NEWEDGE WEALTH, STAMFORD, CT.

"They didn't discuss much that was relevant to investors in any detail. The next president is going to have to deal with taxes and they haven’t even dealt with it. In terms of legislation facing the next president, that is the biggest one for markets and investors.

"Some of the issues that I still have questions about -- like Donald Trump's views on removing some of the Federal Reserve's independence -- didn't arise. But overall there wasn't much of substance that was market moving. And I'm not surprised to not see much of a market reaction."

SONU VARGHESE, GLOBAL MACRO STRATEGIST, CARSON GROUP

"I think the debate is not going to change many minds, as voters remain closely divided. The only indication is that Harris moved ahead in prediction markets but that still keeps the race very close,"

"There wasn’t much substantive discussion of policy. Neither candidate advocated for vastly different economic policies than currently in place. Ultimately, a lot of economic policies that we see implemented next year will depend on the makeup of the Senate and the House, and negotiations related to the extension of the Tax Cut and Jobs Act (which former President Trump signed into law in 2017)."

SHOKI OMORI, CHIEF JAPAN DESK STRATEGIST, MIZUHO SECURITIES

"Harris started off quite nervously, but then she gained confidence and set out her economic policies very clearly. That gave some relief to the market," weakening the dollar, "although it's hard to say at this point what the direction for the dollar will be" in the event of a Harris or Trump presidency.

GREGORY FARANELLO, HEAD OF U.S. RATES, AMERIVET SECURITIES

"Net net, I thought Vice President Harris, definitely did well. She held her own. But you know, we still didn't learn anything new other than he said, she said,"

"There was no major knockout blow. We'll have to see what the polls bring in the days ahead but you know it's going to be a tight election and the market is going to be probably focused more on monetary policy short term than the election."

STEVE SOSNICK, CHIEF MARKET STRATEGIST, INTERACTIVE BROKERS, GREENWICH, CT.

"It’s all been fairly general during the debate. They have talked about chips and energy and solar, but not really any specific details. There hasn’t been anything for markets to sink their teeth into."

"Because the margin is so narrow, I think markets don't know what to make of the whole campaign at this stage. It does appear that Harris is outpointing Trump, but I don't know that the markets have voted yet. And I don't know if the people who need to be convinced are watching. We may see more of a reaction when the top soundbites from this debate start rippling out and being discussed in the next few days."

VASU MENON, MANAGING DIRECTOR OF INVESTMENT STRATEGY, OCBC SINGAPORE

"Today’s debate is not going to move the needle. Neither came our clear winner. How the economy performs in the coming weeks as seen in the data, especially jobs data, and what they each say at their campaign trail in the run up to November 5 will decide the final outcome.

"Harris comes through with better policies for the middle class while Trump has positioned himself as the strong leader American needs to stand up to countries that have taken it for granted. The question is will Americans vote based on policies or rhetoric. The jury is still out and investors will be left guessing and that only means more market volatility in the run up to U.S. elections in November."

ROB CARNELL, ING'S REGIONAL HEAD OF RESEARCH FOR ASIA-PACIFIC

"I don't think there's a lot for markets here... there doesn't seem to be a lot that seems to be particularly economic right now. I think Harris seems to be managing Trump quite well."

"You'd expect if he (Trump) was doing better, that you'd see a strong dollar coming out of this. So I suppose that's the way the market is looking at it. It's a slight lean towards Harris."

KEN CHEUNG, DIRECTOR, FX STRATEGY, MIZUHO SECURITIES ASIA, HONG KONG

"Some of the U.S. dollar movement is driven by the debate performance. I think the interpretation, for the Chinese yuan, is that it is very sensitive to Trump's policy on the tariff side."

JACK ABLIN, CHIEF INVESTMENT OFFICER AT CRESSET CAPITAL.

"This debate doesn't seem to be changing the fact that it's going to be a very close election."

"They're covering all the issues; the moderators are doing a good job of managing the debate and voters are getting a pretty good depiction of the policies and temperaments of both candidates."

"But perception is reality and if people don't feel their lives are improving, that will shape their behavior in November."

KARL SCHAMOTTA, CHIEF MARKET STRATEGIST, AT CORPAY IN TORONTO

"No knockout blow has been landed, but the dollar is edging lower as Kamala Harris opens a marginal lead over Donald Trump in prediction markets."

"Currencies that might find themselves on the front line in another trade war - the Mexican peso, Canadian dollar and Chinese renminbi - are advancing amid muted volumes."

(Reporting by Saqib Iqbal Ahmed, Suzanne McGee, Tom Westbrook, Ankur Banerjee Compiled and edited by Ira Iosebashvili and Shri Navaratnam)