PHOTO

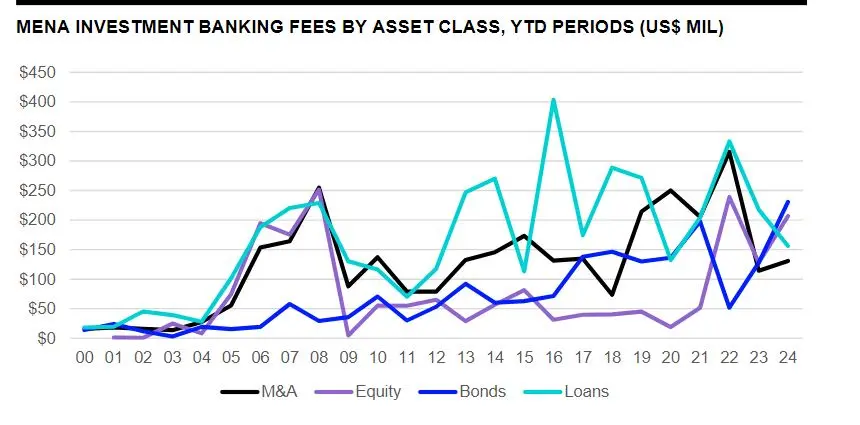

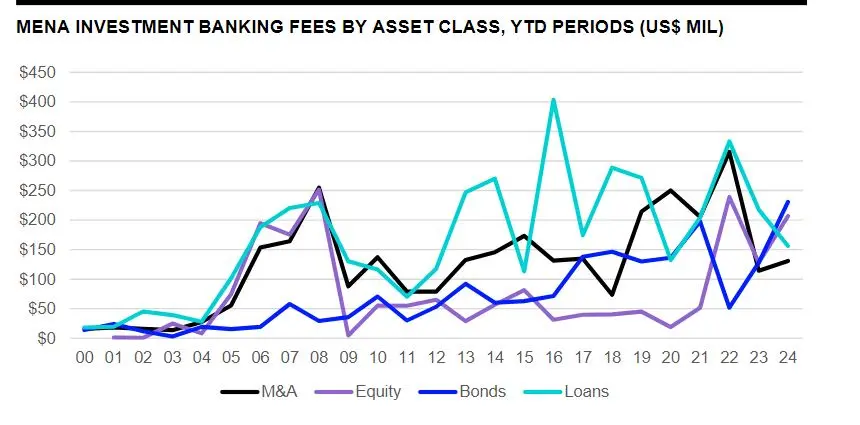

An estimated $724.5 million worth of investment banking fees were generated in the Middle East & North Africa (MENA) during the first six months of 2024, 23% more than the value recorded a year ago.

According to LSEG estimates the fees generated was the third highest first half total in the region since its records began in 2000.

Debt capital markets underwriting fees increased 81% to $230.9 million, the highest first half debt capital markets fee total in the region since LSEG records began in 2000.

Equity capital markets underwriting fees increased 62% year-on-year to $206.7 million.

Advisory fees earned from completed M&A transactions totalled $130.7 million, a 14% increase from previous year levels. The value of announced M&A transactions with any Middle East or North African involvement reached $46.6 billion during the first six months of 2024, up 48% compared to year ago

Syndicated lending fees declined 28% to a four-year low of US$156.4 million.

Forty-seven percent of all MENA fees were generated in Saudi Arabia in the first half of 2024, followed by the UAE (36%). Saudi Arabia generated $343.8 million in investment banking fees, followed by UAE ($262.8 million), Kuwait ($31.3 million) and Qatar ($29.2 million)

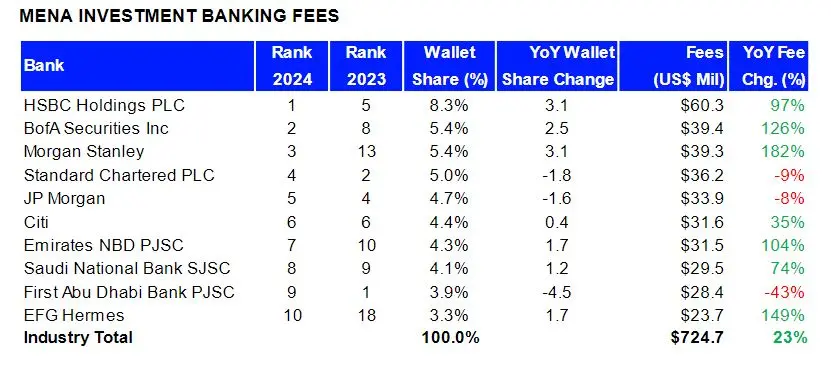

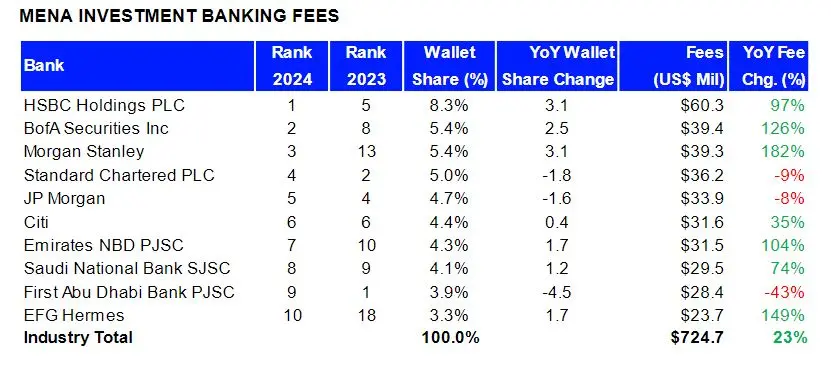

HSBC earned the most investment banking fees in the region during the first half of 2024, a total of $60.3 million or an 8.3% share of the total fee pool. This was followed by BofA Securities Inc ($39.4 million), Morgan Stanley ($39.3 million) and Standard Chartered ($36.2 million).

(Writing by Seban Scaria; editing by Daniel Luiz) seban.scaria@lseg.com