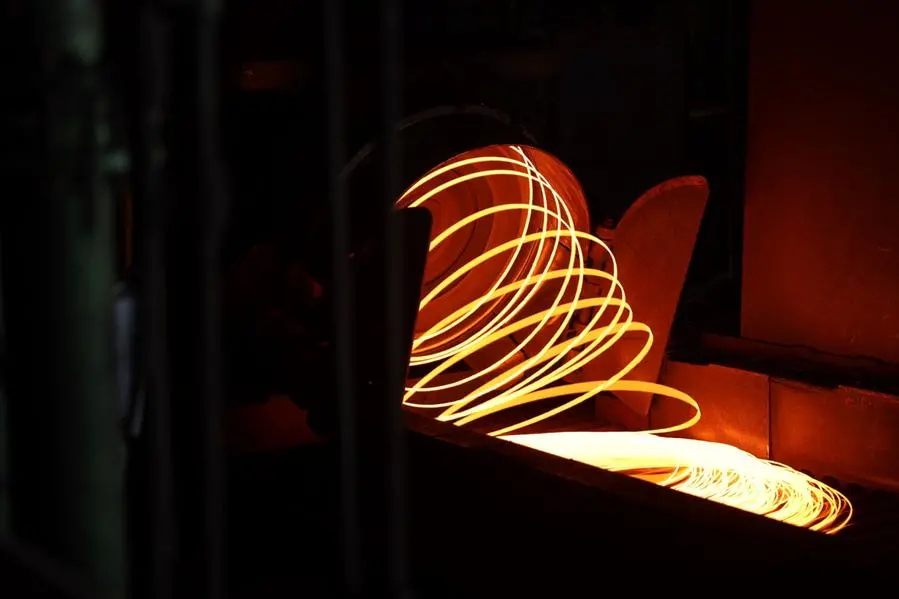

PHOTO

Emirates Steel Arkan, one of the largest publicly traded steel and building materials manufacturers in the region, has said that its full year (FY) 2023 net profit rose 18% to AED601.9 million ($164 million) compared to FY22.

This increase was driven by robust sales of value-added products in both domestic and international markets, the consistent enhancement of revenues and profits in the Building Materials division, coupled with increased operational efficiencies and revenue optimisation.

The group achieved a solid operational and financial performance in 2023 and recorded revenues of AED8.9 billion, despite a challenging and volatile global economic landscape and its impact on commodity prices.

EBITDA up 8pc

EBITDA in 2023 was AED1.26 billion, up by 8% on 2022. The EBITDA margin in 2023 was 14.2% versus 12.4% reported in 2022.

Revenue from the Steel division totalled AED8.03 billion during 2023 and profit from the division amounted to AED457 million, driven by the successful launch of new value-added products for both the domestic and export markets and by growth in construction activities in the UAE.

Revenue from the Building Materials division was AED871 million in 2023, with a profit of AED145 million.

Since December 31, 2022, the group has reduced its net bank debt by 94% from AED1.1 billion to AED63 million, resulting in a net bank debt to EBITDA ratio of 0.05 as of December 31, 2023.

Financial highlights for Q4 2023

The combined business experienced a record-breaking Q4 2023, achieving an EBITDA of AED379.7 million. EBITDA witnessed a 23% year-on-year increase during Q4 2023, with the EBITDA margin growing from 13.2% in Q4 2022 to 15.7% in Q4 2023. This growth was driven by enhanced steel sales in the UAE and a sustained improvement in the profitability of the Building Materials division.

In Q4 2023 the combined business recorded revenues of AED2.4 billion, a 4% growth compared to the same period in 2022. The growth in revenue was mainly driven by higher volumes of rebar sales to the domestic market. Net profit in Q4 2023 grew by 69% year-on-year, up to AED215 million.

Strategic highlights 2023

Implemented a new operating model that establishes two distinct business divisions: Emirates Steel and Building Materials. This strategic move aims to capitalise on the unique strengths of the two divisions.

The group continued to build the foundations for a new low-carbon emission iron hub – associated MoUs signed with Abu Dhabi Department of Economic Development, AD Ports Group, ITOCHU and JFE Steel.

The company signed a contract with Bahrain Steel Company (BSC), a global leader in high-grade iron-ore pellet (IOP) supply. The contract, valued at approximately $2 billion, will guarantee 5-years IOP supply to Emirates Steel Arkan.

The group is working on new value-added products, successfully marketed the innovative ES600 low-carbon high tensile rebar and delivered the first order of the new U-type sheet piles.

The company partnered with Abu Dhabi Future Energy Company (Masdar) on an innovative green hydrogen pilot project. This collaboration marks a historic milestone, positioning the Group as the first steel company in the Mena region and a global pioneer in adopting green hydrogen for sustainable steel production.

It partnered with renowned climate consulting firm A³&Co. to drive an innovative decarbonisation initiative at the Al Ain Cement Factory.

Emirates Steel Arkan participated in COP28, where it showcased innovative low-carbon solutions in steel and building materials, fostering collaboration with stakeholders to drive collective actions for decarbonising these sectors and contributing to sustainable growth in line with the UAE’s climate goals.

Resiliency and efficiency

Hamad Al Hammadi, Chairman, Emirates Steel Arkan, said: “The group’s robust performance in 2023 demonstrates our resilience and efficiency amidst challenging market conditions. As the largest steel and building materials company in the UAE, we remain confident in sustaining competitiveness, seizing growth opportunities, and delivering substantial value for our shareholders.

“The strength of our business across the value chain demonstrates our aptitude to be among the leading contributors to ‘Operation 300 billion’, the UAE’s industrial strategy, and contribute to the country’s increasingly diversified economy.”

Eng Saeed Ghumran Al Remeithi, Director and Group Chief Executive Officer, Emirates Steel Arkan, said: “Emirates Steel Arkan’s financial results for 2023 mark a continuation of our strong performance. During this time, we remained committed to prioritising the safety of our people, achieving operational excellence, effective cost management, and fostering customer relationships.”

"As we look to 2024, our strategic focus revolves around boosting output, reducing costs, and surpassing our production targets. With a robust financial position, reduced debt and a commitment to sustainability, we approach the future with confidence, navigating emerging opportunities and actively contributing to positive climate actions in the UAE and beyond.

Copyright 2022 Al Hilal Publishing and Marketing Group Provided by SyndiGate Media Inc. (Syndigate.info).