PHOTO

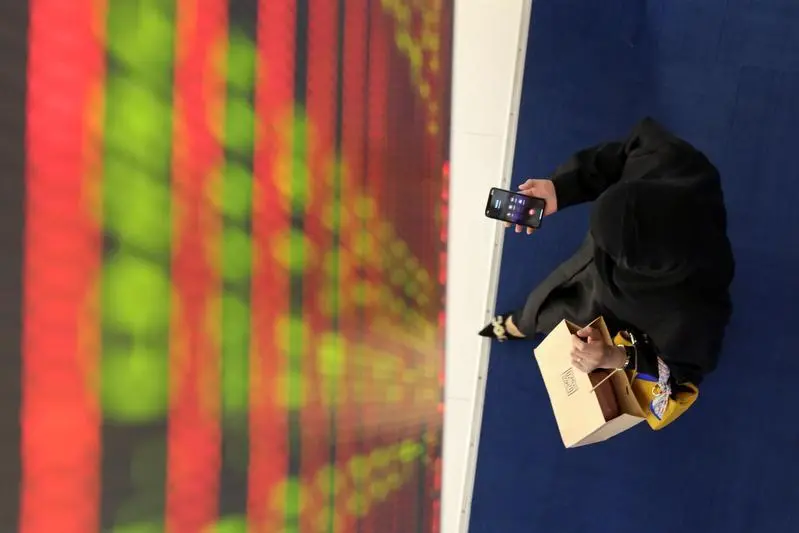

Drake & Scull, the Dubai-based contractor which has spent the last five years in the stock market wilderness during a protracted court restructuring process, is holding a general assembly on March 27 to seek shareholders’ approval for resuming trading on Dubai Financial Market (DFM).

It is seeking shareholders’ approval to hike the share capital by up to 600 million UAE dirhams by issuing new shares equivalent to up to 2.40 billion shares with a nominal value of AED 1 and at a discounted issuance price of AED 0.75, Reuters reported.

The company is returning at the right time, an analyst told Zawya, as physical market demand for its services is high, due to infrastructure requirements in the region.

Bhavik Mehta, Century Financial’s deputy head of research for investment products, said the collapse of Arabtec in 2020 following the exit of Drake & Scull (DSI) in 2019 had created a crisis in the contracting industry. Spiralling losses had forced Arabtec to undergo restructuring.

“New players have entered the market from Saudi Arabia since, but the market is still large,” he said.

“We have all seen what’s happening with oil prices and the energy markets – there is a lot of traction, a lot of activity for the physical markets,” he said.

Mehta said the fact that the latest restructuring is approved by the Dubai Courts is ‘very positive’ for DSI.

“Things are moving in the right direction, as far as the entire restructure is going,” he said.

Ajman Bank remains the firm’s number one investor, holding 13% of its shares, according to the latest information from DFM.

Its former strategic shareholder, UAE-based Tabarak Investment, exited some time back, Mehta said. DFM records show Tabarak as an ‘associated group’ of DFM-listed Takaful Emarat.

Names including USA-based The Vanguard Group and BlackRock Institutional Trust Company and BlackRock Advisors (UK) Limited hold minor stakes according to LSEG data.

Restructuring has been approved, Mehta said, but investors will want to see how it pans out, along with how the firm handles its debts.

In a statement released this week, DSI said it received approval from DFM and the SCA to resume trading company shares and increase capital, following a prerequisite step of increasing company share capital by no less than AED 300 million ($81.7 million), with the resumption to be approved at its General Assembly.

Shafiq Abdelhamid, chairman of Drake & Scull, said ‘strong subscription’ in the new additional share capital increase is a key step to restructuring which enables the writing-off of 90% of the company’s debt, and encouraged shareholders to attend to vote.

Mehta described DSI’s share offer as ‘lucrative’ but said analysts would be watching to see if big institutional investors take an interest as the company returns to the market.

(Reporting by Imogen Lillywhite; editing by Seban Scaria)