PHOTO

Islamic insurer SALAMA has confirmed that it has obtained initial regulatory approval for a merger with Takaful Emarat and that it also in negotiations to acquire a stake in a third insurer, Aman.

The moves will elevate Salama to become one of the world’s top five largest Islamic insurers, the company said in a statement to Dubai Financial Market (DFM) today.

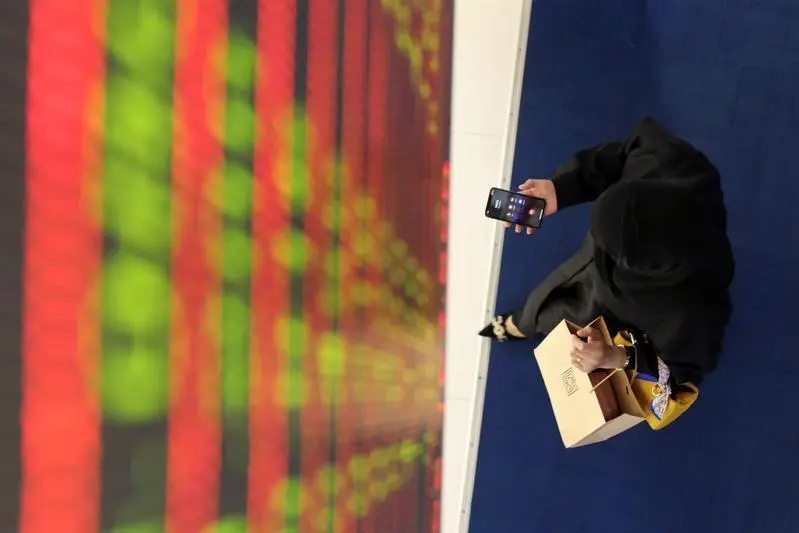

The DFM statement confirmed media reports yesterday (Sunday) and said Salama is working to fulfil legal and regulatory requirements as well as Securities & Commodity Authority (SCA) approval.

“The merger between Salama and Takaful Emarat is anticipated to be a non-cash transaction via the issuance of additional shares by Salama to Takaful Emarat shareholders to consummate the merger,” the statement said.

“The transaction is expected to be complementary and accretive to the shareholders. Salama expects significant merger synergies upon completion.”

The statement added: “Salama is currently the largest Takaful company in UAE. Upon completion of these transactions, Salama expects to extend its market-leading position in UAE and is expected to become one of the top five largest takaful companies in the world.”

In August, Takaful Emarat reported a loss of AED 5.88 million ($1.6 million) in its second quarter financial results, with auditor EY saying it had failed to meet its minimum capital requirements of AED 100 million, while Salama itself announced a capital reduction of $108 million.

Salama said it has also initiated negotiations with Dubai Islamic Insurance and Reinsurance Company PSC (Aman) to acquire a portion of Aman’s general, medical, and family takaful portfolios.

The transaction is subject to due diligence, further negotiations between the parties, and regulatory approvals, the company said.

S&P forecasted in August that there would be “further consolidation” for GCC Islamic insurers following the merger of Dar Al Takaful and Wataniya.

S&P’s report said GCC Islamic insurers would need to adjust premium rates amid intense competition.

(Writing by Imogen Lillywhite; editing by Seban Scaria)