PHOTO

SINGAPORE - Asian share markets scaled new highs on Friday as investors sized up U.S. rate cuts for September and the mood was upbeat, while the euro hit a three-week peak ahead of French elections.

Sterling was firm at $1.2762 as Britain's Labour Party was set for a landslide poll victory that will sweep it to power after 14 years of Conservative rule. Elsewhere, the dollar was slightly weaker and Treasury yields marginally higher in Tokyo, as trade resumed after the U.S. Independence Day holiday.

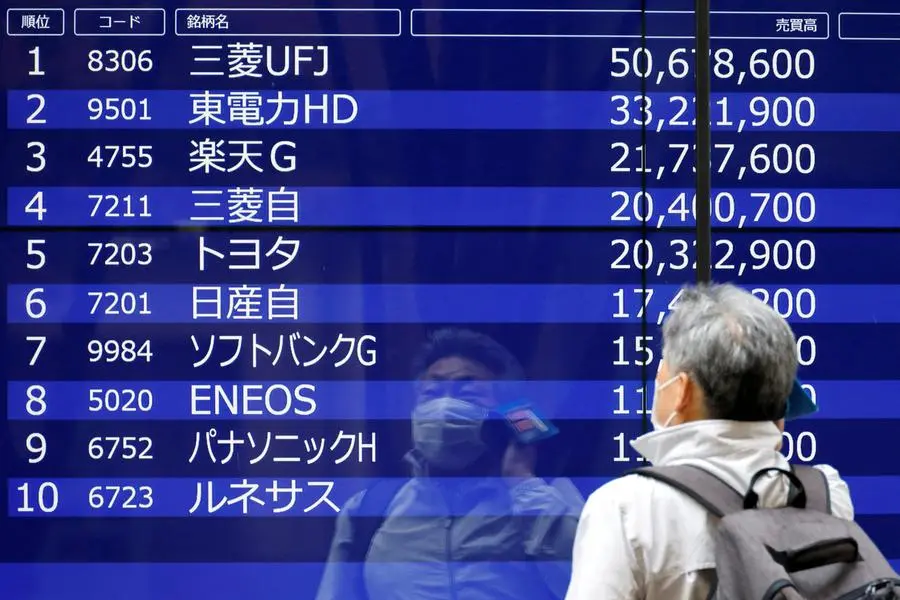

Japan's Nikkei and broader Topix both nudged up to record levels, as did Taiwan's benchmark, before retreating slightly.

MSCI's broadest index of Asia-Pacific shares outside Japan touched a two-year high with Samsung's estimate of a more than 15-fold rise in second-quarter profit helping South Korea's KOSPI to a two-year peak as well.

Singapore's bank and property heavy Straits Times index retreated after sharp gains lifted it to a two-year peak.

"Global liquidity remains flush and with the S&P (500) printing a ridiculous number of records these days...at some point valuations elsewhere will make a compelling enough case," said Vishnu Varathan, chief economist at Mizuho in Singapore.

He noted artificial intelligence demand had driven chipmaker rallies in Taiwan and South Korea, that interest-rate settings were fuelling record profits for Singapore's big banks and that a weak yen had been a tailwind for Japanese equities.

Japanese household spending unexpectedly fell in May, government data showed on Friday, complicating the interest rate outlook especially as one of the factors behind the drop has been how the weak yen has curbed consumers' purchasing power.

The yen rose slightly to 160.75 per dollar. FTSE futures ticked 0.2% higher on Friday and S&P 500 futures were up ever so slightly to suggest a fresh record for the cash index may be in store later in the day.

JOBS IN FOCUS

Employment data in the U.S. headlines the economic calendar on Friday. A slowdown in hiring and small uptick in unemployment is forecast, which would leave open the door for U.S. rate cuts.

A run of subdued data, with the U.S. ISM measure of services activity sliding to its lowest since mid-2020 earlier in the week, had markets lifting the probability of a rate cut in September to 73% and pricing 47 basis points of cuts this year.

Two-year U.S. Treasury yields were steady at 4.70% in Asia and benchmark 10-year yields were up 1.4 bps to 4.36%. A television interview with Joe Biden also airs in the New York evening and will be closely watched as he seeks to get his campaign back on track following an underwhelming showing at last week's presidential debate.

In currency markets, the euro rose to $1.0817 as polls point to France's far right National Party falling short of an absolute majority at Sunday's parliamentary election runoff.

"If the polls eventually prove accurate, this would mean the more extreme policies of fiscal expansion and immigration curbs are unlikely to pass," said MUFG analyst Michael Wan.

The Australian dollar notched a six-month high of $0.6739 as yield spreads swung in its favour, underpinned by wagers that the next move in Aussie rates might be up given inflation is proving stubborn.

In commodity trade, a weaker dollar has gold on course for its largest weekly rise in a month, up 1.6% to $2,363 an ounce. Oil is its most expensive since April with Brent crude futures holding above $87 a barrel following a bigger-than-expected drop in U.S. crude stocks, which suggest firm demand as the U.S. summer driving season gets under way.

Bitcoin was down 7% and at a four-month low below $55,000.

(Editing by Stephen Coates)