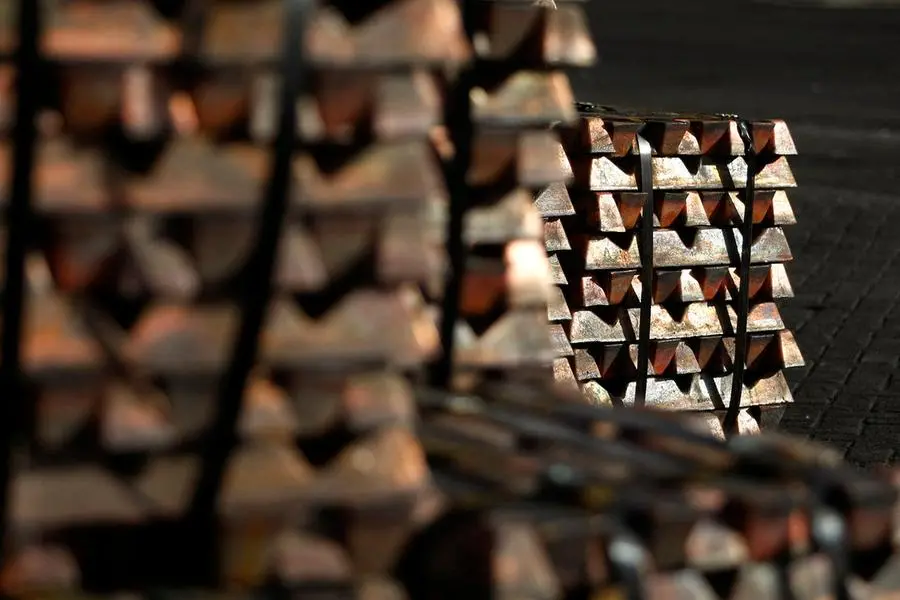

PHOTO

London copper rose on Friday and was set for its first weekly gain in seven on the back of a softer dollar, hopes of U.S. rate cuts as well as stimulus measures and improving physical demand in top consumer China.

Three-month copper on the London Metal Exchange (LME) rose 0.7% to $9,947.50 per metric ton by 0754 GMT. The contract has risen 3.7% so far in the week, set for its first weekly gain since the week ended May 17.

The dollar eased this week on rising hopes that the U.S. Federal Reserve will cut rates, making the greenback-priced metals cheaper to holders of other currencies.

"We maintain the view that a decline in the U.S. dollar strength in the second half of 2024 will add support to base metal prices. However, a delayed Fed rate cut could limit the upside for base metal prices," BMI analysts said in a note.

"Growing hopes of further stimulus measures (in China) are expected to boost sentiment in the short term, offering support to prices," BMI said, adding that it balanced out the weak manufacturing data in June.

Last week, LME copper fell to a more-than-two-month low of $9,495.50 a ton, triggering a rebound in Chinese physical demand after consumption was hurt by a rally that pushed prices to a record above $11,100 in May.

As a result, the discount to import copper into China has tightened to $2 a ton from a $20 discount in May.

Capping further gains in prices were weak macroeconomic data globally and physical copper demand remaining price-sensitive, especially around $10,000.

The most-traded August copper contract on the Shanghai Futures Exchange (SHFE) closed up 0.4% at 80,370 yuan ($11,059.74) a ton.

LME aluminium edged up 0.2% at $2,528.50 a ton, nickel rose 0.8% to $17,360, zinc edged up 0.6% at $3,003.50, lead increased 0.1% to $2,228.50 and tin climbed 0.7% to $33,390.

SHFE aluminium fell 0.9% to 20,300 yuan a ton, nickel eased 0.2% to 138,090 yuan, tin slipped 0.2% to 275,340 yuan, zinc edged down 0.2% at 24,655 yuan, while lead climbed 0.8% to 19,660 yuan.

(Reporting by Mai Nguyen in Hanoi; Editing by Janane Venkatraman, Subhranshu Sahu and Savio D'Souza )