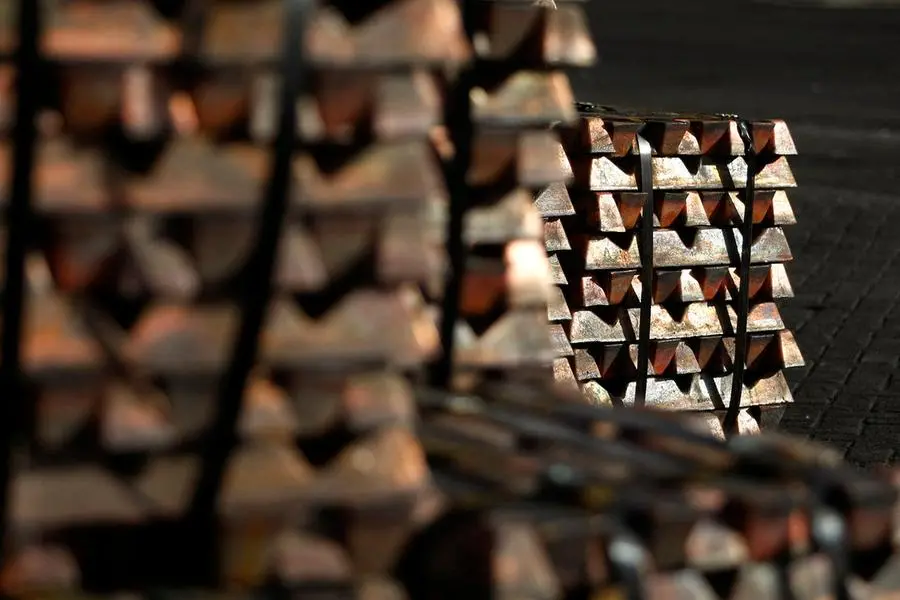

PHOTO

Copper prices rebounded on Thursday on optimism that central bank rate cuts will help economic growth though gains were capped by worries about sluggish demand.

Three-month copper on the London Metal Exchange gained 1.2% to $10,043 per metric ton in official open-outcry trading.

Copper dipped in the previous session, having shed nearly 10% since hitting a record high above $11,100 on May 20.

Metals joined wider financial markets in gains after the European Central Bank cut interest rates for the first time in nearly five years.

"The ECB is in focus and we've seen quite a significant slump in copper ... Some buyers will come back into the market after we dipped below $10,000," said Ole Hansen, head of commodity strategy at Saxo Bank in Copenhagen.

"The demand outlook in China, however, still looks on the weak side, so we really need to see those numbers improve before we can see an extension of the very strong rally we've had."

For now, copper will likely trade in a range between $9,800 and $10,200, with the possibility of some more liquidation of speculative bullish positions held by funds, Hansen added.

The most-traded July copper contract on the Shanghai Futures Exchange gained 0.9% during day-time trade to 81,250 yuan ($11,212.77) per ton.

The rally by copper, up 17% this year, has dampened physical consumption in China where inventories have climbed.

Operation rates of copper cable and wire producers slid 5.5% month on month to 67.9%, less than expected, a survey by Shanghai Metals Market (SMM) showed.

LME tin jumped 2.4% in official business to $32,075 a ton after chipmaker Nvidia rallied to record highs on Wednesday, overtaking Apple to become the world's second most valuable company.

"Basis tin's relation to the chip industry and it having been the first metal to achieve its price peak this year, it's worth monitoring," Al Munro at broker Marex said in a note.

The bulk of tin is used for solder in the electronics sector.

Among other metals, LME aluminium climbed 0.8% to $2,643.50 a ton, nickel added 0.4% to $18,360, zinc advanced 1.4% to $2,905 and lead rose 0.3% to $2,236.

($1 = 7.2462 Chinese yuan renminbi)

(Reporting by Eric Onstad; additional reporting by Siyi Liu in Beijing; editing by Jason Neely and David Evans)