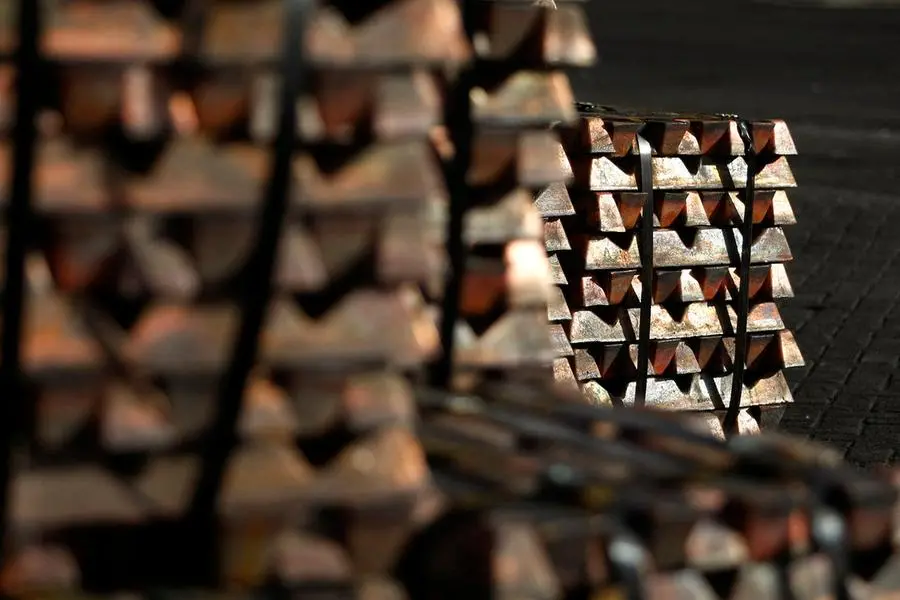

PHOTO

Copper prices edged higher on Wednesday as a slide in the dollar countered worries about weak demand in China and rising inventories.

Three-month copper on the London Metal Exchange (LME) was up 0.2% at $9,681 a metric ton in official open-outcry trading after a 1.5% drop on Tuesday.

Copper was little changed earlier in the session but moved into positive territory after the dollar index tumbled to a four-month low, with other metals also gaining ground.

The dollar move was largely because of a surge in the yen that traders suspected was the result of yet another intervention from Japanese authorities.

A slide in the dollar makes commodities priced in the U.S. currency less expensive for buyers using other currencies.

"Metals are getting support from gyrations in the currency market, which are helping to weaken the dollar," said WisdomTree commodity strategist Nitesh Shah

The gains may be fleeting, however, because there are still concerns about lacklustre demand in top metals consumer China, he added.

Investors were awaiting policy news from the ruling Communist Party's "Third plenum", which is due to end on Thursday, after weak economic data from the world's second-largest economy.

"All the (stimulus) measures so far have been around the fringes. The Chinese government needs to engage in more domestic policy support," Shah said.

The most traded August copper contract on the Shanghai Futures Exchange slid 1% to 78,560 yuan a ton.

Also weighing on copper prices have been rising inventories, highlighting excess supply in the market. LME stocks have nearly doubled since the start of June, climbing to their highest since September 2021.

Lead was the biggest gainer on the LME, advancing 1.4% in official activity to $2,215 a ton after data on Wednesday showed that available, or on-warrant, LME inventories slid by 18,675 tons to a one-month low.

Among other metals, LME aluminium added 0.5% to $2,418 a ton, zinc dipped 0.3% to $2,876.50, nickel rose 0.3% to $16,635 and tin was up 0.5% at $33,340.

(Reporting by Eric Onstad Editing by David Goodman)