PHOTO

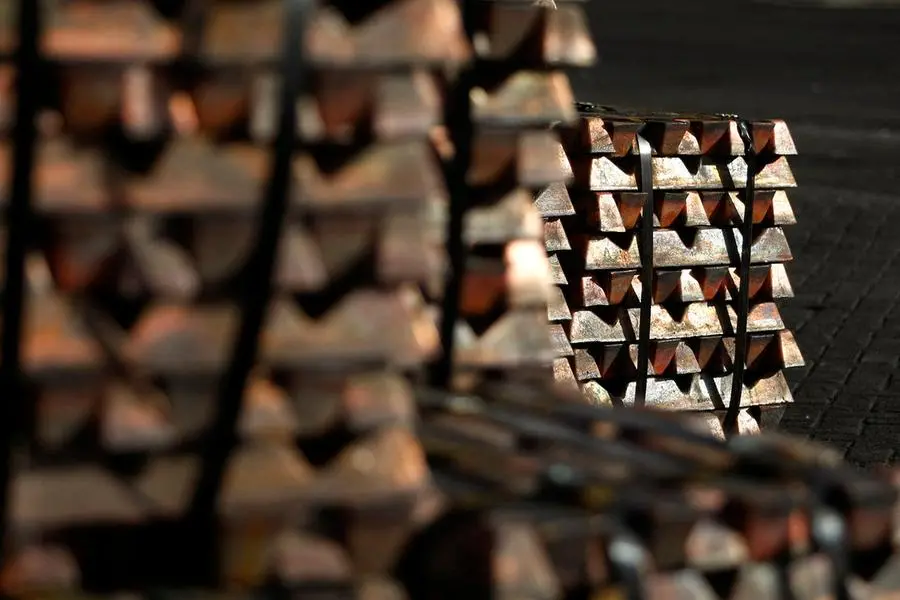

Copper prices slipped to their lowest in three-and-a-half months on Wednesday, hurt by rising inventory and selling by commodity trading funds.

Three-month copper on the London Metal Exchange (LME) was up 0.1% at $9,176.5 per metric ton as at 1023 GMT, after dipping to $9,105 per metric ton to its lowest since April 3.

Computer-driven funds, known as managed futures or commodity trading advisors (CTAs), continued selling copper and pressuring prices, said Robert Montefusco, a commodities broker at Sucden Financial.

"Continued copper inflows to LME was also surprising," he added.

Copper inventory in warehouses monitored by LME rose to a 34-week high of 236,700 tonnes, exchange data showed. It has soared 28% since the start of July.

Rising copper stocks typically signal a weak consumption appetite.

Among other metals, aluminium was up 0.8% at $2,315, lead dropped 0.3% to $2,053, nickel lost 0.4% to $15,950, zinc added 0.6% at $2,704, and tin jumped 2% to $30,025.

(Reporting by Julian Luk in London; Editing by Sonia Cheema)