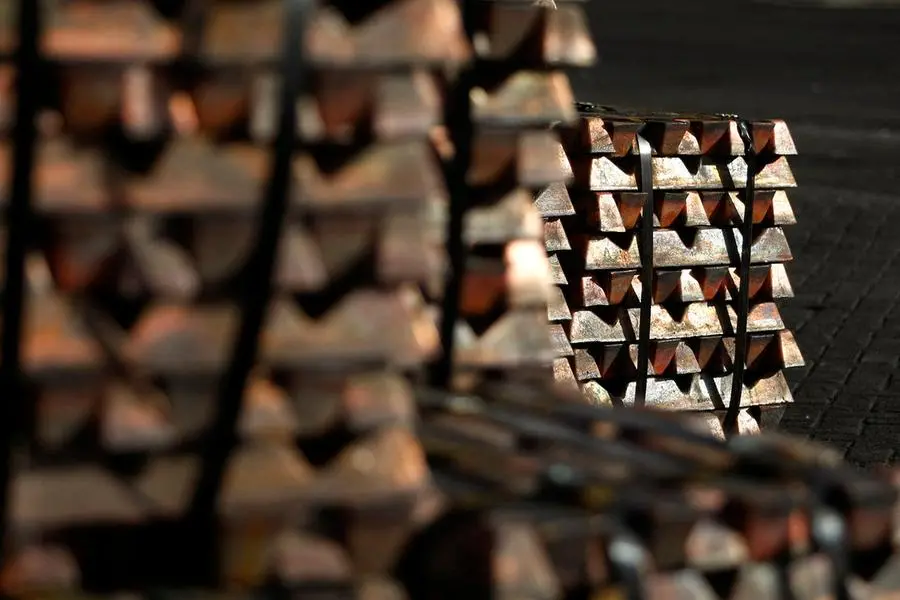

PHOTO

Copper and aluminium prices extended losses on Thursday, pressured by rising inventories, lacklustre demand in China and a strong dollar.

Three-month copper on the London Metal Exchange was down 0.5% at $9,218 a metric ton by 0945 GMT after sliding by 2% in the previous session.

Copper inventories in LME-registered warehouses jumped by 8,700 tons to 322,950 tons, LME data showed on Thursday, the highest for about five years and double levels in mid-June.

Most of the recent inflows have been into Asian LME warehouses amid heavy exports from China, analysts say.

"We could see some more deliveries into LME stocks, even into September," said Amelia Xiao Fu, head of commodity market strategy at Bank of China International.

An arbitrage window that encouraged Chinese exports has closed, but the flows were continuing due to delays in permitting and other shipping issues, she added.

LME copper had rebounded by about 9% since touching a 4-1/2 month low on Aug. 5. It reached $9,453 on Tuesday before retreating on Wednesday.

"The upside is limited until we see a more meaningful pick-up in Chinese demand. The data in the property market still remains sluggish and other types of fixed-asset investment have seen only a moderate pick-up," Fu added.

The most traded October copper contract on the Shanghai Futures Exchange (SHFE) was down 1.1% at 74,200 yuan ($10,434.68) a ton.

Miner BHP downgraded its forecast for China's copper growth to 1-2% this year, it said on Tuesday, pointing to an expected sharp contraction in housing completions this year.

LME aluminium dropped 1.2% to $2,467 a ton, partly pressured by concern about excess supplies as inventories climb in SHFE-approved warehouses.

SHFE aluminium stocks have gained 36% over the past three months.

Among other metals, LME nickel shed 0.4% to $16,955 a ton, zinc dipped 0.1% to $2,877.50, lead eased by 1.4% to $2,055 and tin was down 0.7% at $32,375.

($1 = 7.1109 Chinese yuan renminbi)

(Reporting by Eric Onstad Additional reporting by Siyi Liu in Beijing Editing by David Goodman)